Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I agree with stocksster, good luck in the competition and keep us up-to-date on your progress here. I'm sure that was your intention anyway.

Thank you for the wishes :) ... wrt automating, I have grown the strong belief that trading is a statistical game (duh ?), I lack the financial & advanced proba/stats education to be a quant, as a result I am stuck in this PA niche for the moment, but trying to tackle it through the law of large numbers.

I really wish I could develop a true scalping system (10+ trades / day / instrument), this is the best way of using that law. Unfortunately, I really have no idea wrt scalping ... if anyone wants to help me reach this goal, I am more than willing to share the result.

My World-Cup account was funded by the end of Monday, and I migrated my trading of config#1 from IB to Dorman on Tuesday - this was as simple as stop the strategy, reconfigure it to use the Dorman account instead of the IB account, and restart it.

Last week I finally accepted to migrate my 2 separate IB accounts to a consolidated one, which essentially means I am forced to trade both IB account from the same computer (I had deferred on this as much as possible, since my trading of 2 systems in Ensign required me to trade each system on a separate computer). The bright side of it is that I finally got the IBController installed (I never bothered trying it while I was running 2 instances of TWS), which automatically keeps my TWS alive throughout the week. This is a lot of relief from a pure operations standpoint, and I can go back to emerg and not miss a trade the next day like it happened on Oct-10 (or just, be out of Internet access / power and unable to connect to my trading VM).

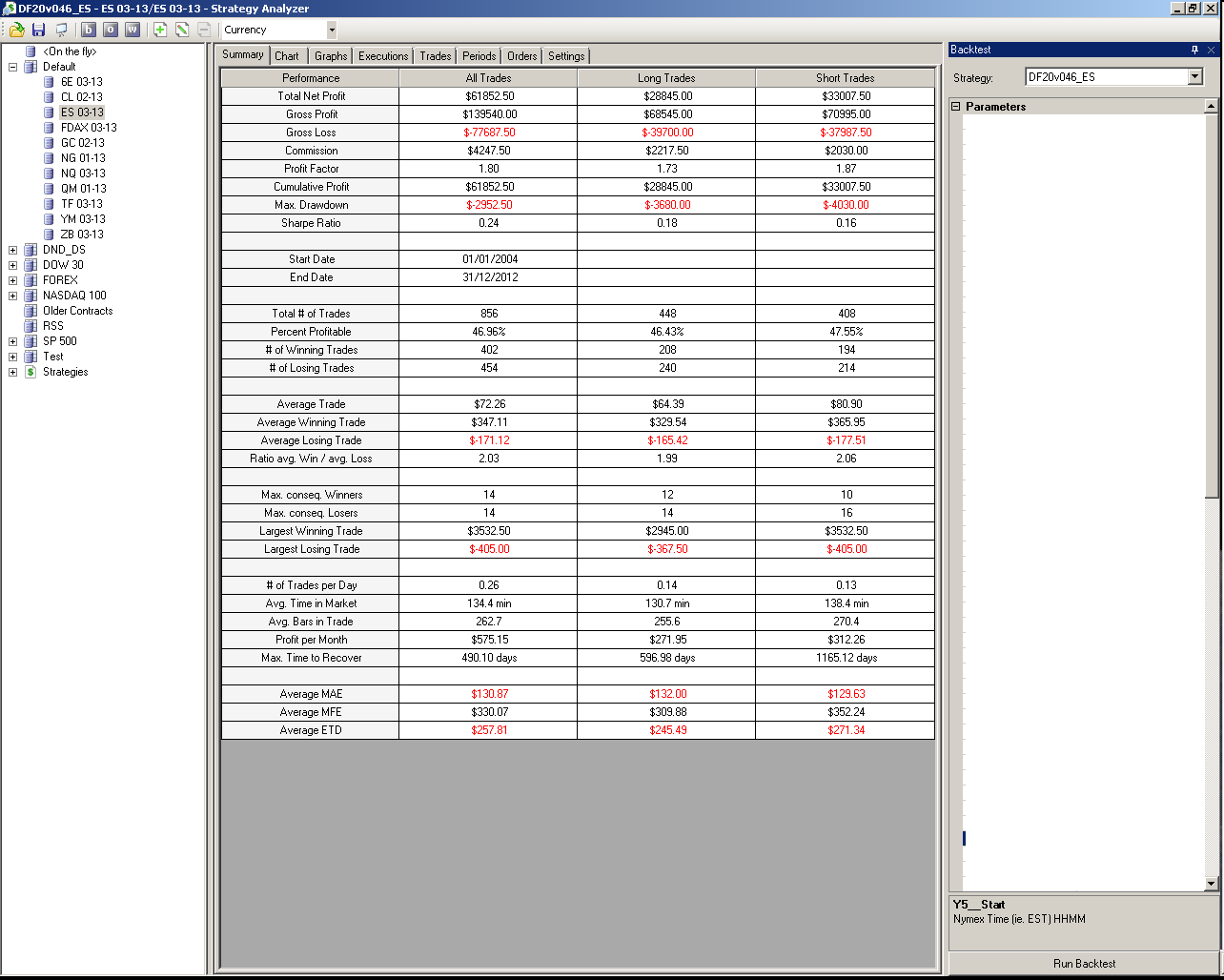

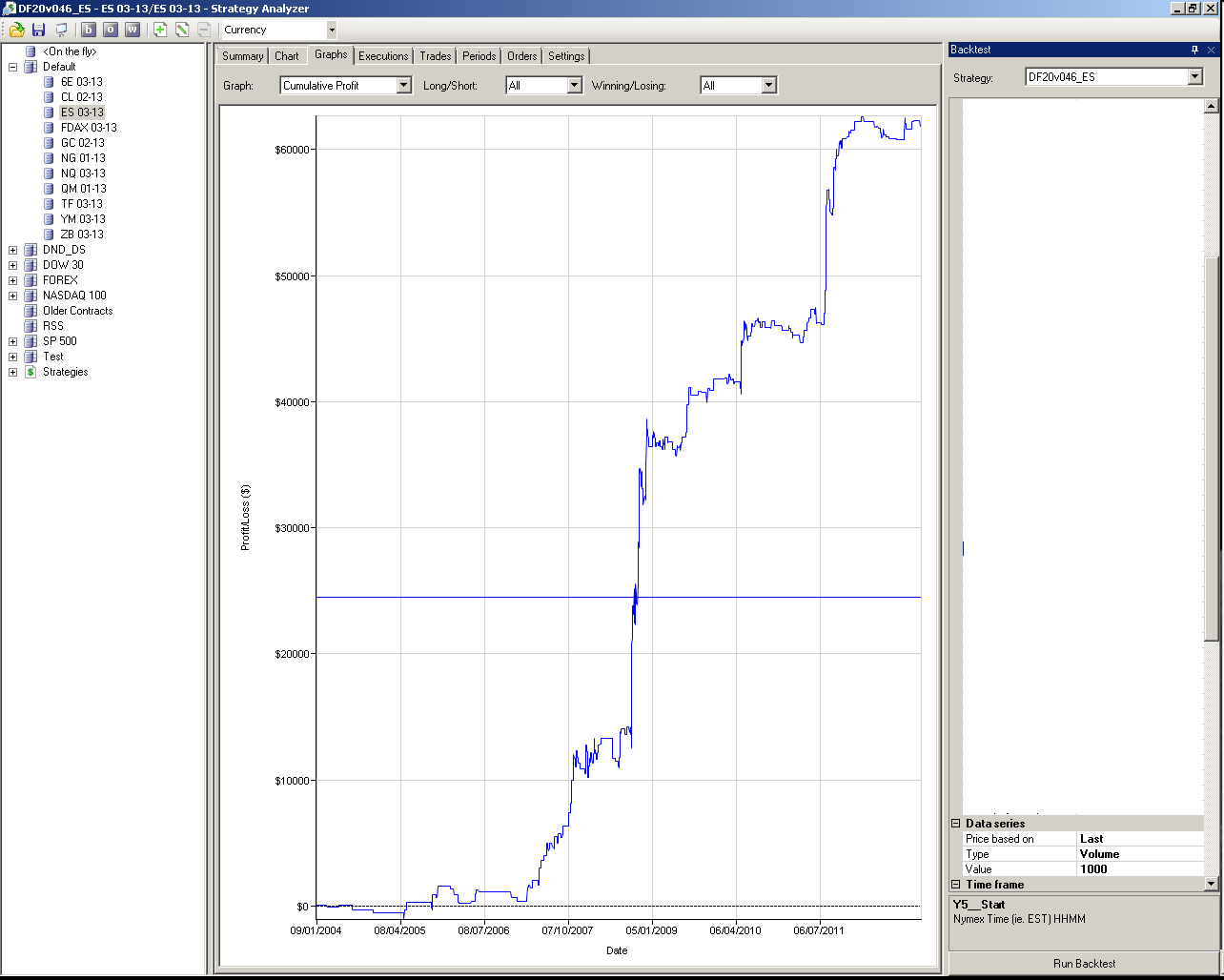

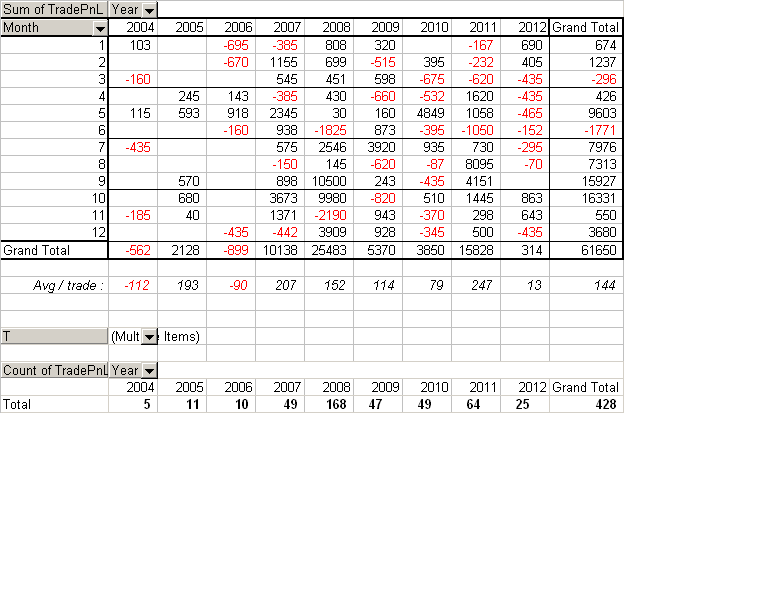

Not a lot of things on the R&D front ... I finished configuring the reversal system for ES, it isn't bad, but IMO it requires too much noise filtering, and the number of trades on 9 years (2004..2012) is ridiculously small : 428 trades, P&L 61,500 for 2 contracts, max DD -2960, P/F 1.81.

Trading results for the week:

- Config#1 : 1 win ; net +460. I pay $15 / round-trip on this world-cup account, clearly not meant for scalpers!

- Config #2 : 1 BE ; net -10. Same setup, 1-t heat on #1, "lucky fill" on #2, stop got moved to BE once the setup became void, and that was it.

Have a great week-end

Last week I finally accepted to migrate my 2 separate IB accounts to a consolidated one, which essentially means I am forced to trade both IB account from the same computer (I had deferred on this as much as possible, since my trading of 2 systems in Ensign required me to trade each system on a separate computer). The bright side of it is that I finally got the IBController installed (I never bothered trying it while I was running 2 instances of TWS), which automatically keeps my TWS alive throughout the week. This is a lot of relief from a pure operations standpoint, and I can go back to emerg and not miss a trade the next day like it happened on Oct-10 (or just, be out of Internet access / power and unable to connect to my trading VM).

Not a lot of things on the R&D front ... I finished configuring the reversal system for ES, it isn't bad, but IMO it requires too much noise filtering, and the number of trades on 9 years (2004..2012) is ridiculously small : 428 trades, P&L 61,500 for 2 contracts, max DD -2960, P/F 1.81.

Trading results for the week:

- Config#1 : 1 win ; net +460. I pay $15 / round-trip on this world-cup account, clearly not meant for scalpers!

- Config #2 : 1 BE ; net -10. Same setup, 1-t heat on #1, "lucky fill" on #2, stop got moved to BE once the setup became void, and that was it.

Have a great week-end

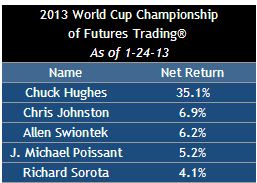

If you guys want to check-it out tonight, I am currently #2 with that trade from yesterday.

http://www.worldcupadvisor.com/worldcupchampionships/default_nwcc3.aspx

Absolutely NO trades this week :( ... only had 2 setups on Monday, missed in both cases.

Not a whole lot on the R&D front, I am getting back in the system under development, did mostly testing of various trend-modeling parameters.

Have a great week-end!

I thought this week would be a remake of last, but I had this morning a short that ended as follows:

- config#1 : target-1 lucky fill (extreme low of the move) ; stopped on runner. Net +20

- config#2 : both targets filled. Net +300

- config#3 : 1 contract filled before setup voided, immediate stop. Net -15.

I disappeared from the World-Cup top 5, and to be honest the current (Chuck Hughes) #1 rocks!

On the R&D front, I am taking some time away from the system in development to look at other things ... using the DF20 reversal system trend-identification mechanism, I try to "follow-the-trend". Not sure I will get this to work ever, what I have at this time with very little work on it has about 3500 trades (6 years) for a total P&L of 265k (about $76 avg / trade, after slippage & commissions). BUT only 1.25 P/F, about 56% win-rate, and avgW/avgL 0.98. Max DD on 6 years -19,000, max Win +15k, max Loss -5k. Not sure yet if this is genius or raw stupidity :)

BTW, those figures are just trading 1 contract. That system generates asynchronous entries & exit or reverse signals, so allowing it to trade multiple contracts can increase the number of entries by about 30%, with an almost linear increase in the P&L. And there are 2 other entry signals that could be used, as well as add-ons ... letting it go crazy (for the fun) yield a total P&L of 1,900,000 on the 6 years, with -153,000 max DD (actually barely noticeable on the P&L curve). Up to 56 contracts traded, and total 27833 entries (55.8% win-rate, P/F 1.25). Serious inquiries only :)

The other thing I am doing (this afternoon, really), is trying to fine-tune my reversal system for the current low-volatility conditions, without taking the risk of being badly hammered when volatility comes back. But there isn't much to play with, so this will be quickly over.

Have a great week-end!

Just so I understand this correctly, Chuck Hughes has a net 35.1% return since 1/1/2013?

Originally posted by day trading

Just so I understand this correctly, Chuck Hughes has a net 35.1% return since 1/1/2013?

Yep ... and that's paying $15 per contract per round-turn.

Again, NO trade this week :(

Some nice progress on the R&D front on the "follow-the-trend" system. Basic version trading 1 contract : P&L ~425k for 3300 trades on 6 years, max DD -21k, P/F 1.39, avg/trade 128. Allowing the system to trade up to 5 contracts (that is, when already long and another long signal comes, add 1 contract up to max position size of 5 contracts), P&L ~908k for 6400 entries (still 3300 exits, of course), max DD -52K, P/F 1.43, avg/trade 142 (all assuming 1-t slippage on entries, same on exits, and $5 commission per round-trip).

This system is quite a departure from the usual intraday trading, and brings its own challenges: always-in requires 24/7 operations, the ability to stop/restart a strategy - or Ninja - with a position on, as well as automated rollover of the current position to the next expiry month.

BTW, for 1 contract this system qualifies to the challenge of "making minimum $100 per day per contract", as its worst year in backtest (2010) makes just 26k. Other years range from 42k (2007) to 168k (2008), with 2011/2012 taking #2 & #3 ranks with 76k / 65k. Of course, the average annual DD is around -15k, and honestly this is pretty good, as MonteCarlo simulation gives the mean max.DD on 750 trades (1 year) at -18k, with 6.2k std-dev.

I am starting next week to work on the 2 operations requirement for the system - stop/restart w/ position on, and auto rollover. I will probably also spend some cycles trying to improve further its performance, although I have already turned a fair number of rocks.

Have a great week-end!

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.