Dom's notes

Despite having been hammered for posting my sincere feedback re. ATW in the appropriate thread (or may-be, because of ...) I am starting this thread for the benefit of all waanabee traders.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

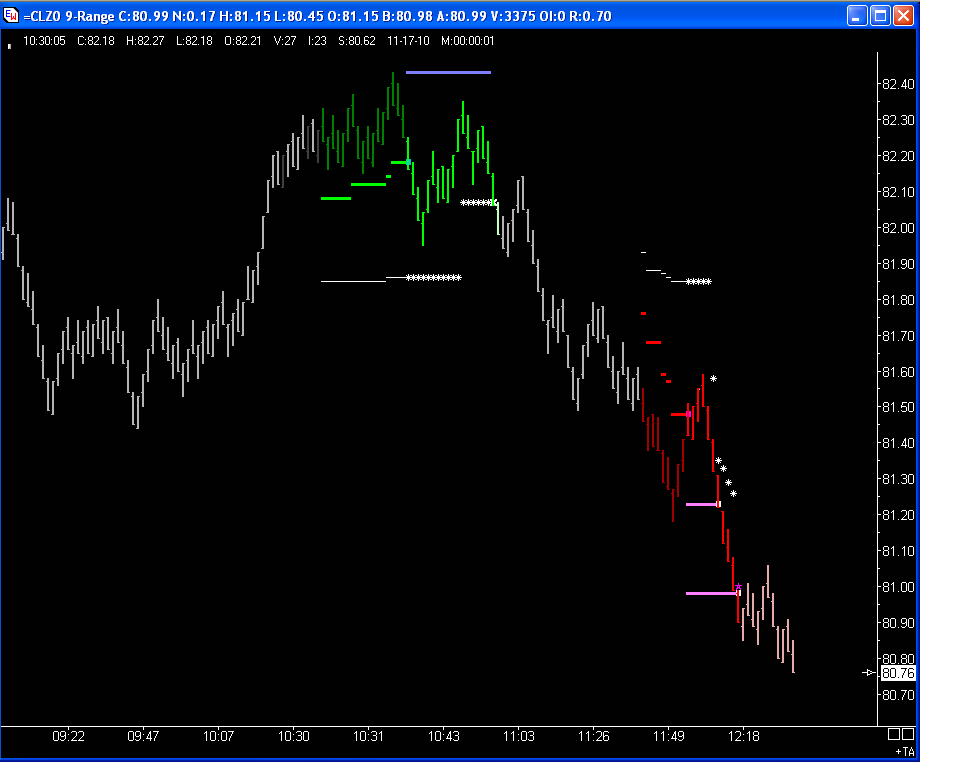

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

I have no intent of sharing my exact trade setups, however I will share as much as I can - the good, the bad & the ugly, and if someone learn something from this then it won't have been a waste of my time.

I have been a student of the market for over 4 years now. I actually started my education with Investools PhD program (which was a lot of money for not much outcome in my case), trading stocks then options, then started to focus on the SPX (directional Calls/Puts then credit spreads), at some point I discovered the futures / ES in particular and that was a "revelation" ... 1/4pt spread vs 2pt spread for the SPX options, I was sold in no-time.

I purchased Todd Mitchell's system (TradingConcepts), which was a lot less money than Investools but no more outcome in my case, at least it triggered my interest in Fibs (back then, retracements only) and I did a lot of research / backtesting using Fibs - but at the end of the day, the real challenge resides in figuring out which fib level will "hold", and to this day I have to admit I have not solved it.

Anyway, I then spent a lot of time in a couple of "free" trading rooms

learning pure price action, the person that was offering his time teaching PA free for several months later offered a paying program, which I took, but I still couldn't make money live. I took another mentor, recommended on a free forum, and despite he being a nice guy (and why wouldn't he be when students are paying), this also was a failure.

I was about to throw the towel when I found ATW, started with the 101A education, added 3 weeks later the mentorship education, and have been studying / backtesting a lot for now a full year. I reached a point where I can "consistently" make fake-money on sim, however the transition to live trading is a real challenge for me, because of fear I pass on many trade setups and I deviate from my trade management rules.

So, that's the background. I trade CL (Crude Oil "big" contract) which is very liquid, has 1 tick spread throughout the European & US session, and is nicely volatile (day range is on average 250-350 ticks, some days even more - like today : 450 ticks). I find CL to have a lot of momentum, it shows very repetitive "patterns" (at least, for the fib user that I am).

I don't use any indicator, I trade price action using a lot of price projection techniques (best book IMO on this topic is Robert C. Miner "Dynamic Trading").

If I have one advice for new traders, it is look for another way of making a living ... but if you are truly in love with the markets, then I believe it is a must to 1) find an excellent education (this is way more than just reading books, and frankly, there is probably no one-stop education shop) and 2) find a mentor to accelerate your learning curve.

Now that this is out of the way, a brief summary of my week :

Tuesday - tried 1 trade early morning, entry hit no fill, that made me mentally sick for the rest of the day, I passed on 2 setups (both wins), the last setup I tried but my entry wasn't even close to be hit.

Wednesday - 2 setups no-fill, then 1 small winner (got out at 1/2 of my target for pseudo-good reasons - really, lack of discipline), and I passed on the last one (another wouldabe winner :( )

Thursday - passed on 5 setups (4 wins / 1 loss), took 1 small winner (1/2 target again, same lack of discipline), and missed the best setup of the day by being away for 5min

Friday - passed on 1 setup (win), no fill on next 2 setups, then I couldn't focus & called it a day.

Bottom-line - only 2 trades this week, I made ~10% of what I should have made if I had the discipline to follow my plan.

Last 2 weeks summary

These last 2 weeks I have been moving ... I managed to keep my system up & trading throughout the move, totally unattended most of the time, but it took me over a week to get the new place in order, and this week I only sat at my trading desk yesterday & today.

Last week's system performance was really bad, with 2 wins / 6 losses (net -90 ticks), this week was a bit better with 4 wins / 3 losses (net +30 ticks), no trades yesterday nor today.

All in all, the current draw-down is now longer than the longest one in backtesting, and marginally deeper too. I still trade the system faithfully and without manual intervention.

I will get back to posting daily summaries next week.

Below is a picture of my trading-desk after the move - same furniture, re-organized.

These last 2 weeks I have been moving ... I managed to keep my system up & trading throughout the move, totally unattended most of the time, but it took me over a week to get the new place in order, and this week I only sat at my trading desk yesterday & today.

Last week's system performance was really bad, with 2 wins / 6 losses (net -90 ticks), this week was a bit better with 4 wins / 3 losses (net +30 ticks), no trades yesterday nor today.

All in all, the current draw-down is now longer than the longest one in backtesting, and marginally deeper too. I still trade the system faithfully and without manual intervention.

I will get back to posting daily summaries next week.

Below is a picture of my trading-desk after the move - same furniture, re-organized.

Nice relaxed and open space.

Cheers!

Cheers!

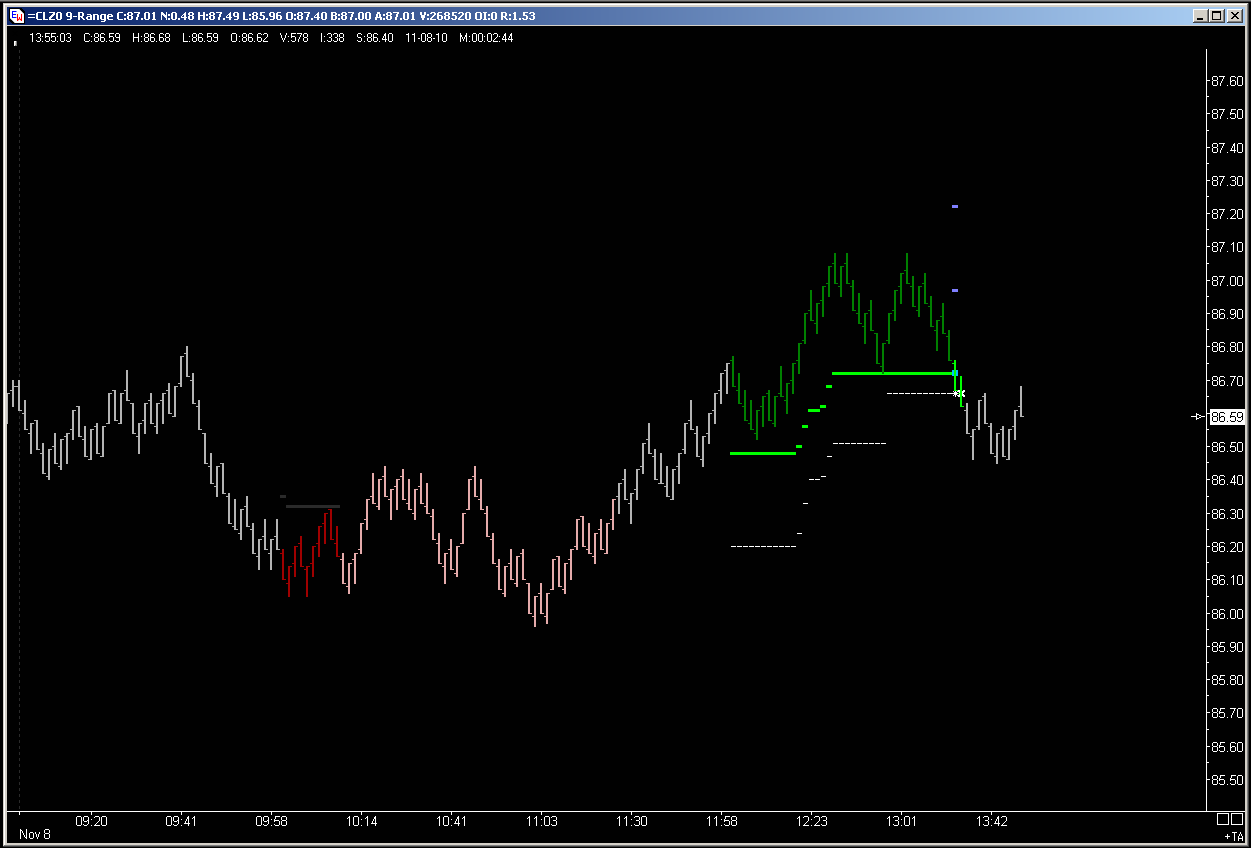

Day's summary:

CL Impulse system : 1 win (+15-t) / 1 loss (-6-t)

I actually got filled on 1st touch of entry LMT, and I bailed w/ 15-t after a stall on 12:53pm 1min bar. I would have easily got the programmed 20-t target in such case if I had stayed put. The loss is the system entry after the DT (I know, that looks like a stupid entry, but backtesting results encourage the current system behavior in this situation).

I have started to work on a bunch of possible changes, based on the last 6 weeks less than stellar results, but so far no breakthrough

CL Impulse system : 1 win (+15-t) / 1 loss (-6-t)

I actually got filled on 1st touch of entry LMT, and I bailed w/ 15-t after a stall on 12:53pm 1min bar. I would have easily got the programmed 20-t target in such case if I had stayed put. The loss is the system entry after the DT (I know, that looks like a stupid entry, but backtesting results encourage the current system behavior in this situation).

I have started to work on a bunch of possible changes, based on the last 6 weeks less than stellar results, but so far no breakthrough

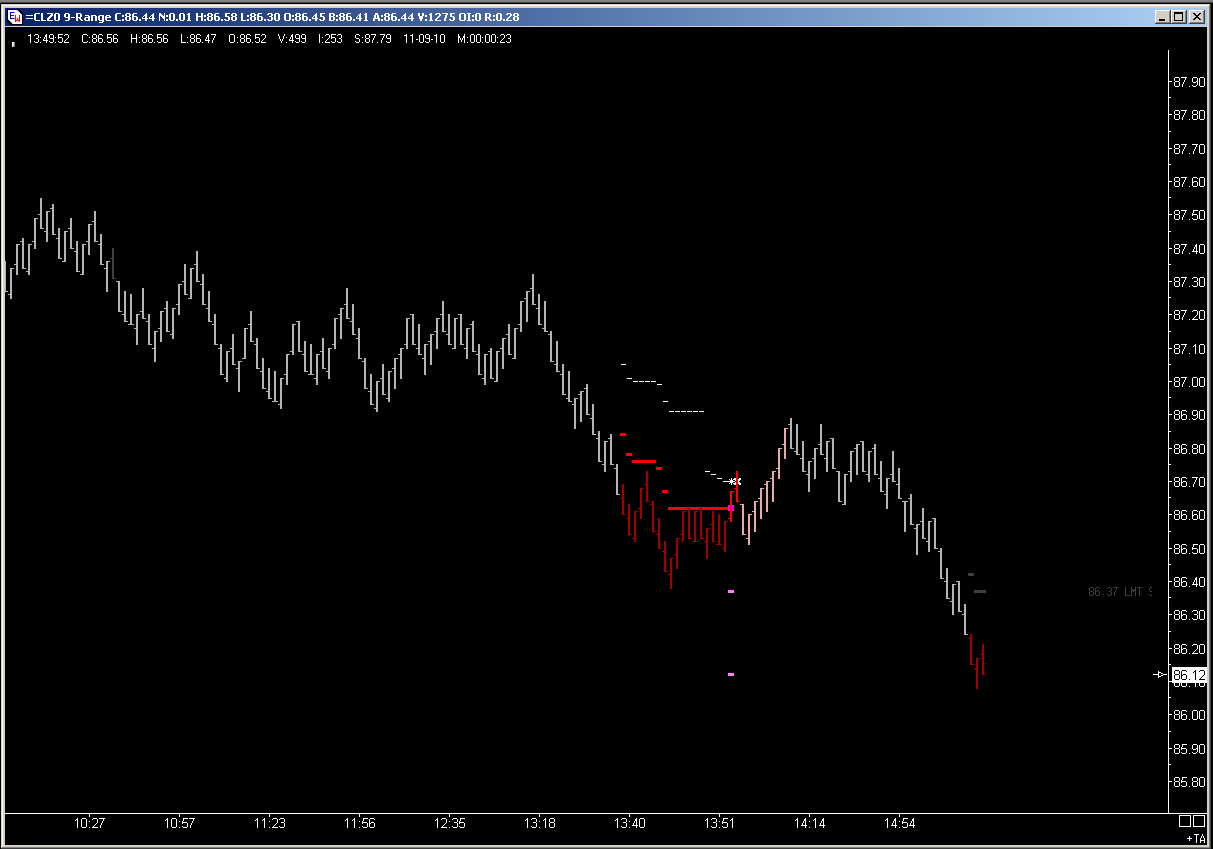

Day's summary

CL Impulse : 1 loss (-4-t)

Most of the day-session in CL was chop in a tight range, finally the breakdown around 1:30pm gave some action. I was filled on 1st touch of entry LMT, and that went as far as 15-ticks green, then it turned around and came back towards the entry price, I bailed with 4-ticks knowing that the system entry was still active - with reduced stop. Too bad, that entry got stopped right away for -8-ticks, giving a combined -4-ticks on this setup.

CL discretionary : 1 win (6-t)

I took this one in the 1:44pm pull-back, "regular" entry based on 2nd down-leg (much easier to see on a 1min chart), more aggressive than the CL Impulse entry at that time. But I bailed-out on the 1st up-tick (literally), missing out on an easy full win for this setup.

I have had numerous crashes on my primary desktop since my move (about twice a day), very weird since various apps were complaining about "not enough storage to complete that action", and the display was visibly messed-up. I had planned yesterday to test the RAM, but didn't do it, so I finally got to that this afternoon. Surprise ! The memory tester was crashing after a few seconds, repeatedly ... I removed the memory sticks, placed them back, then ran a couple passes of MemTest w/o error ... hopefully, this will have cured the crashes, but only time will tell.

CL Impulse : 1 loss (-4-t)

Most of the day-session in CL was chop in a tight range, finally the breakdown around 1:30pm gave some action. I was filled on 1st touch of entry LMT, and that went as far as 15-ticks green, then it turned around and came back towards the entry price, I bailed with 4-ticks knowing that the system entry was still active - with reduced stop. Too bad, that entry got stopped right away for -8-ticks, giving a combined -4-ticks on this setup.

CL discretionary : 1 win (6-t)

I took this one in the 1:44pm pull-back, "regular" entry based on 2nd down-leg (much easier to see on a 1min chart), more aggressive than the CL Impulse entry at that time. But I bailed-out on the 1st up-tick (literally), missing out on an easy full win for this setup.

I have had numerous crashes on my primary desktop since my move (about twice a day), very weird since various apps were complaining about "not enough storage to complete that action", and the display was visibly messed-up. I had planned yesterday to test the RAM, but didn't do it, so I finally got to that this afternoon. Surprise ! The memory tester was crashing after a few seconds, repeatedly ... I removed the memory sticks, placed them back, then ran a couple passes of MemTest w/o error ... hopefully, this will have cured the crashes, but only time will tell.

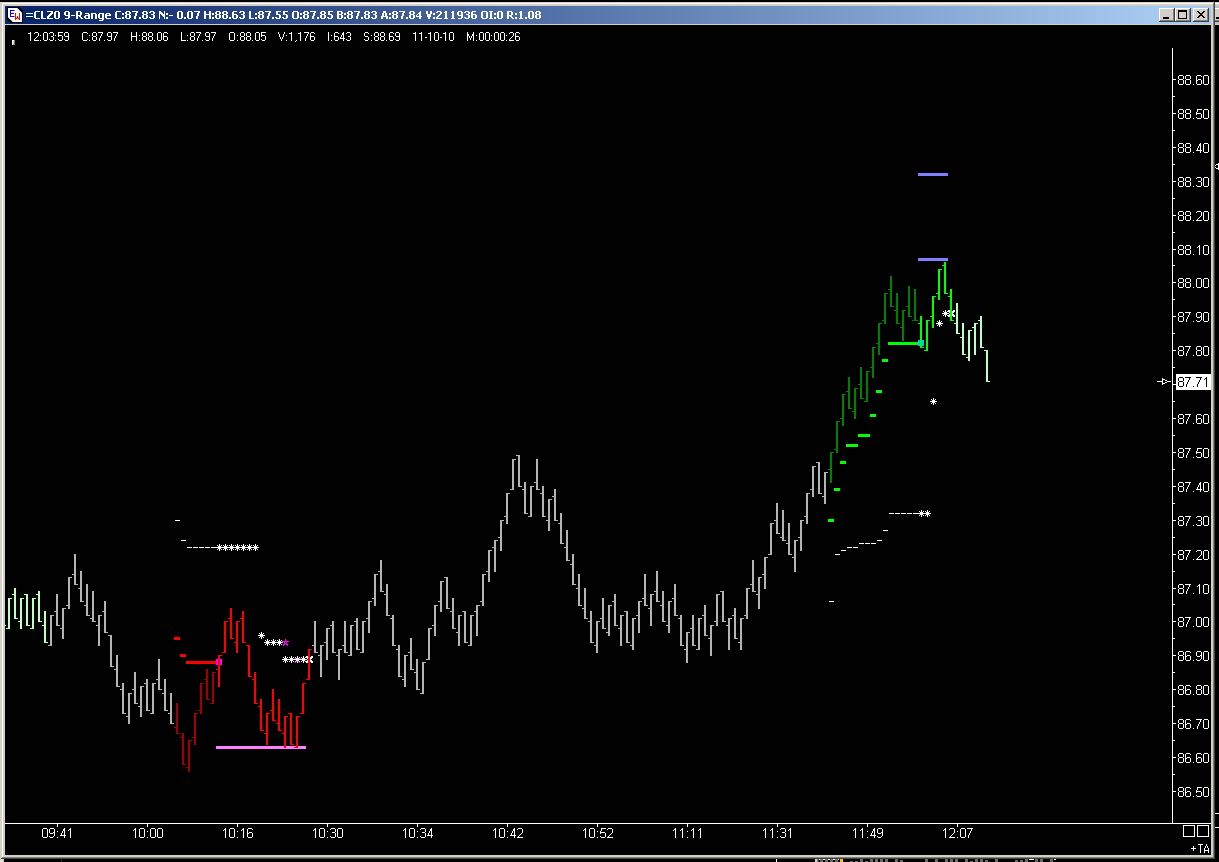

Yesterday's summary

CL Impulse system : 1 BE / 1 (small) win

Despite the chart (based on DTN refresh, historical tick data cannot get better than that), I was filled Short 86.88 at 10:11:28, and took 5 ticks before the system entry. The "regular" trade went up to +25, and because of the pending Petroleum Status report I moved the stop manually to 86.82. That stop was executed at 87.00, a 18-ticks slippage from that level :( Net for this setup : -7 ticks + comms. The 2nd setup did bring +8 ticks before comms, making the day just BE.

I also had a couple of discretionary trades, 1 small loss (-5 ticks) 1 small win (+10 ticks).

I am still trying to fight the crashes on my primary desktop, last night I downgraded Ensign to the August version, which I know for a fact is stable ... the crash manifested just a bit differently, so that cannot be Ensign either ... Googling "not enough storage to process this command" did bring one potentially interesting thing re. Desktop Heap (SessionViewSize, configurable in Windows registry), I did increase that parameter this morning, now waiting for the next crash).

No setup so far today, so that might be my update for today, too...

Thank you to all the veterans ... my original country (France), Europe & the world at large wouldn't be what they are today without you !

CL Impulse system : 1 BE / 1 (small) win

Despite the chart (based on DTN refresh, historical tick data cannot get better than that), I was filled Short 86.88 at 10:11:28, and took 5 ticks before the system entry. The "regular" trade went up to +25, and because of the pending Petroleum Status report I moved the stop manually to 86.82. That stop was executed at 87.00, a 18-ticks slippage from that level :( Net for this setup : -7 ticks + comms. The 2nd setup did bring +8 ticks before comms, making the day just BE.

I also had a couple of discretionary trades, 1 small loss (-5 ticks) 1 small win (+10 ticks).

I am still trying to fight the crashes on my primary desktop, last night I downgraded Ensign to the August version, which I know for a fact is stable ... the crash manifested just a bit differently, so that cannot be Ensign either ... Googling "not enough storage to process this command" did bring one potentially interesting thing re. Desktop Heap (SessionViewSize, configurable in Windows registry), I did increase that parameter this morning, now waiting for the next crash).

No setup so far today, so that might be my update for today, too...

Thank you to all the veterans ... my original country (France), Europe & the world at large wouldn't be what they are today without you !

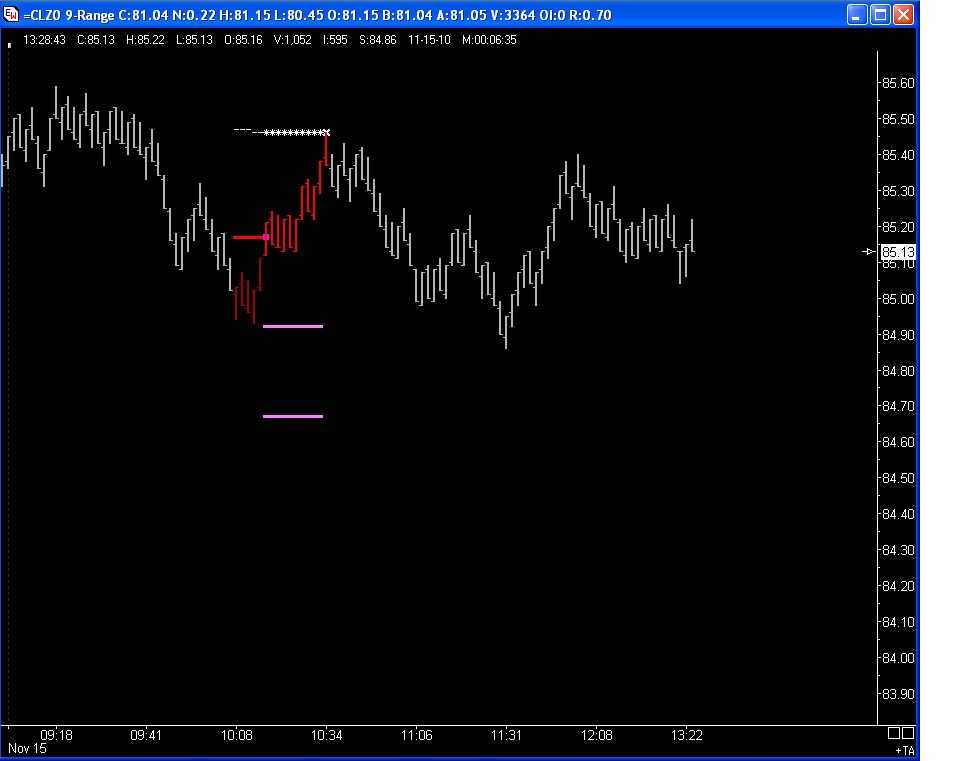

Friday, Monday, Today's summary

Friday : 1 setup ; net +2-ticks as I got filled on 1st touch of entry LMT, took 10-t, then on system entry got a 7-t loser. That particular trade did highlight a bug which had been hiding until now - too bad, it should have been a winner.

1st breakthrough in my fight again PC crashes which started 3 weeks ago ... after removing antivirus + firewall, PC was stable 24h+ (did crash every 12h before that). I decided to reinstall the firewall & see what happened through the week-end & after.

Monday : 1 loser (-28-t)

How frustrating is that ! Stopped at the high tick of the pullback :(

Tuesday : only 1 setup, and was filtered by the system.

After the close, my main PC had been running over 48h without any crash ... I decided to re-install the antivirus

Today :

I found my 2 desktops both crashed overnight ... no doubt, these crashes are coming from the antivirus, which I uninstalled immediately and definitely. Not wanting to let these guys naked, I decided for MS Security Essentials in a matter of minutes.

CL Impulse system : 1 loss (-11-t) / 1 win (+50-t)

I was very exited about the short, despite the DB at overnight low that was an excellent setup ... the pullback lasted way too long to my taste, but then the retest and move to LL was very easy.

Luckily, the PC crashes have been concentrated on my 2 desktops, and my laptop (on which I am running my CL Impulse ATS) has been free of these crashes all along ... I still replaced the antivirus after the close.

Friday : 1 setup ; net +2-ticks as I got filled on 1st touch of entry LMT, took 10-t, then on system entry got a 7-t loser. That particular trade did highlight a bug which had been hiding until now - too bad, it should have been a winner.

1st breakthrough in my fight again PC crashes which started 3 weeks ago ... after removing antivirus + firewall, PC was stable 24h+ (did crash every 12h before that). I decided to reinstall the firewall & see what happened through the week-end & after.

Monday : 1 loser (-28-t)

How frustrating is that ! Stopped at the high tick of the pullback :(

Tuesday : only 1 setup, and was filtered by the system.

After the close, my main PC had been running over 48h without any crash ... I decided to re-install the antivirus

Today :

I found my 2 desktops both crashed overnight ... no doubt, these crashes are coming from the antivirus, which I uninstalled immediately and definitely. Not wanting to let these guys naked, I decided for MS Security Essentials in a matter of minutes.

CL Impulse system : 1 loss (-11-t) / 1 win (+50-t)

I was very exited about the short, despite the DB at overnight low that was an excellent setup ... the pullback lasted way too long to my taste, but then the retest and move to LL was very easy.

Luckily, the PC crashes have been concentrated on my 2 desktops, and my laptop (on which I am running my CL Impulse ATS) has been free of these crashes all along ... I still replaced the antivirus after the close.

Can someone clarify the dollar value of each "cent" in the CL? I've been looking at trading CL as an alternative to trade when the NQ and ES are slow. I'm looking for a .20 profit target on setups and was curious what that comes out to dollar wise. Thanks.

contract multiplier for CL is 1000

so each cent (each tick) amounts to $10 for 1 contract.

Cheers

D.

so each cent (each tick) amounts to $10 for 1 contract.

Cheers

D.

Quick update as I have not been posting much since my move:

- I have had no more PC crashes since I uninstalled Avira Antivir & replaced it by Microsoft Security Essentials. Case closed.

- CL Impulse system: I missed a couple winning trades in the past few weeks because of lost ticks in the datafeed. A week ago I decided to give DT IQ.feed a try, and I am really satisfied with the quality of that feed (not so much by its price). Having an accurate & reliable datafeed is of paramount importance for automated trading systems, because there is no point having a system that performs well on historical data if the system doesn't get live the same information as it will later when backtesting for that same day !

- CL Impulse system performance update: the system has been mostly trading water in the last few weeks - I did spend a lot of time analyzing recent price action (from October), and it is clear that the market has changed a bit from the prior 12 months period ... CL still impulses a lot, but often times with more shallow pullbacks ... also, there has been a relative decrease in volatility, and my predefine targets are less often hit than before (I actually redefined target-1 to 20-ticks, as 25-ticks was clearly no longer appropriate). All in all, the current trading conditions are not favorable for the system.

- CL Impulse R&D update: I have made a number of enhancements and or bug fixes in the last 2 months, making the system "better than ever" ... it however very difficult to remain clear of over-optimization. I have been also spending a lot of time trying to reduce the average initial stop size, but I am finding that trend-trading requires "large" initial stops (and subsequent trailing stops) for good system performance, with the obvious drawback that drawdown periods are steeper & deeper.

- Trading psychology (mine) update: I decided 2 weeks ago to add a 2nd contract to my trading of the CL Impulse system, aiming for target-1 (20-ticks) - before that, I was only trading 1 contract,aiming for target-2 (50-ticks). That change in position size (in a time of poor system performance) did trigger a number of behavior errors in these 2 weeks, with a very significant cost for these errors :( Even though the last 3 trading days have been really bad for the system, I have been back to a calmer state, letting the system trade 100% by itself (that's always the case ... once I get back to letting any system trade alone, it enters a period of poor performance, which in the past always triggered me to override the system again and make additional costly errors ... well, not this time I hope).

I am spending a lot of day-time again on discretionary trading (with pretty good success so far). Interestingly, making the most of my results out of counter-trend trades (all in CL) ... trend-trades suffering from the same initial stop dilemma as in system trading.

One final word re. UPS ... I found one of my PCs improperly shutdown after an overnight power outage (how did I find out ? very easily, it had to check/rebuild the RAID array after reboot). This week-end I re-created a power outage to see the reason why ... I found that a PCIexpress Ethernet NIC driver was preventing the system to enter hibernation mode, hence the PC stayed up until the UPS ran out of battery. I am pretty sure I had done testing of these UPS driven shutdowns when I got the UPS, but I probably did not think of checking that again after adding that NIC ... Updating the driver did fix the issue.

- I have had no more PC crashes since I uninstalled Avira Antivir & replaced it by Microsoft Security Essentials. Case closed.

- CL Impulse system: I missed a couple winning trades in the past few weeks because of lost ticks in the datafeed. A week ago I decided to give DT IQ.feed a try, and I am really satisfied with the quality of that feed (not so much by its price). Having an accurate & reliable datafeed is of paramount importance for automated trading systems, because there is no point having a system that performs well on historical data if the system doesn't get live the same information as it will later when backtesting for that same day !

- CL Impulse system performance update: the system has been mostly trading water in the last few weeks - I did spend a lot of time analyzing recent price action (from October), and it is clear that the market has changed a bit from the prior 12 months period ... CL still impulses a lot, but often times with more shallow pullbacks ... also, there has been a relative decrease in volatility, and my predefine targets are less often hit than before (I actually redefined target-1 to 20-ticks, as 25-ticks was clearly no longer appropriate). All in all, the current trading conditions are not favorable for the system.

- CL Impulse R&D update: I have made a number of enhancements and or bug fixes in the last 2 months, making the system "better than ever" ... it however very difficult to remain clear of over-optimization. I have been also spending a lot of time trying to reduce the average initial stop size, but I am finding that trend-trading requires "large" initial stops (and subsequent trailing stops) for good system performance, with the obvious drawback that drawdown periods are steeper & deeper.

- Trading psychology (mine) update: I decided 2 weeks ago to add a 2nd contract to my trading of the CL Impulse system, aiming for target-1 (20-ticks) - before that, I was only trading 1 contract,aiming for target-2 (50-ticks). That change in position size (in a time of poor system performance) did trigger a number of behavior errors in these 2 weeks, with a very significant cost for these errors :( Even though the last 3 trading days have been really bad for the system, I have been back to a calmer state, letting the system trade 100% by itself (that's always the case ... once I get back to letting any system trade alone, it enters a period of poor performance, which in the past always triggered me to override the system again and make additional costly errors ... well, not this time I hope).

I am spending a lot of day-time again on discretionary trading (with pretty good success so far). Interestingly, making the most of my results out of counter-trend trades (all in CL) ... trend-trades suffering from the same initial stop dilemma as in system trading.

One final word re. UPS ... I found one of my PCs improperly shutdown after an overnight power outage (how did I find out ? very easily, it had to check/rebuild the RAID array after reboot). This week-end I re-created a power outage to see the reason why ... I found that a PCIexpress Ethernet NIC driver was preventing the system to enter hibernation mode, hence the PC stayed up until the UPS ran out of battery. I am pretty sure I had done testing of these UPS driven shutdowns when I got the UPS, but I probably did not think of checking that again after adding that NIC ... Updating the driver did fix the issue.

my 4yo live trading pc has no anti virus or firewall when it shows the sign of sluggish I run a system restore right away. I have nothing but ninja on this machine.

Dom that equity curve looks too good to be true so I'd be scared but hope it trades like that in real time....what became of your trading contest...? how did Chuck Huges do ? He wants me to spend almost 4 k on options recomendations

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.