ES Friday 10-11-13

levels I have

ledge at 95.50 is first target now and bracket low test ....tooo slow...that WAS my first target ....cool !!

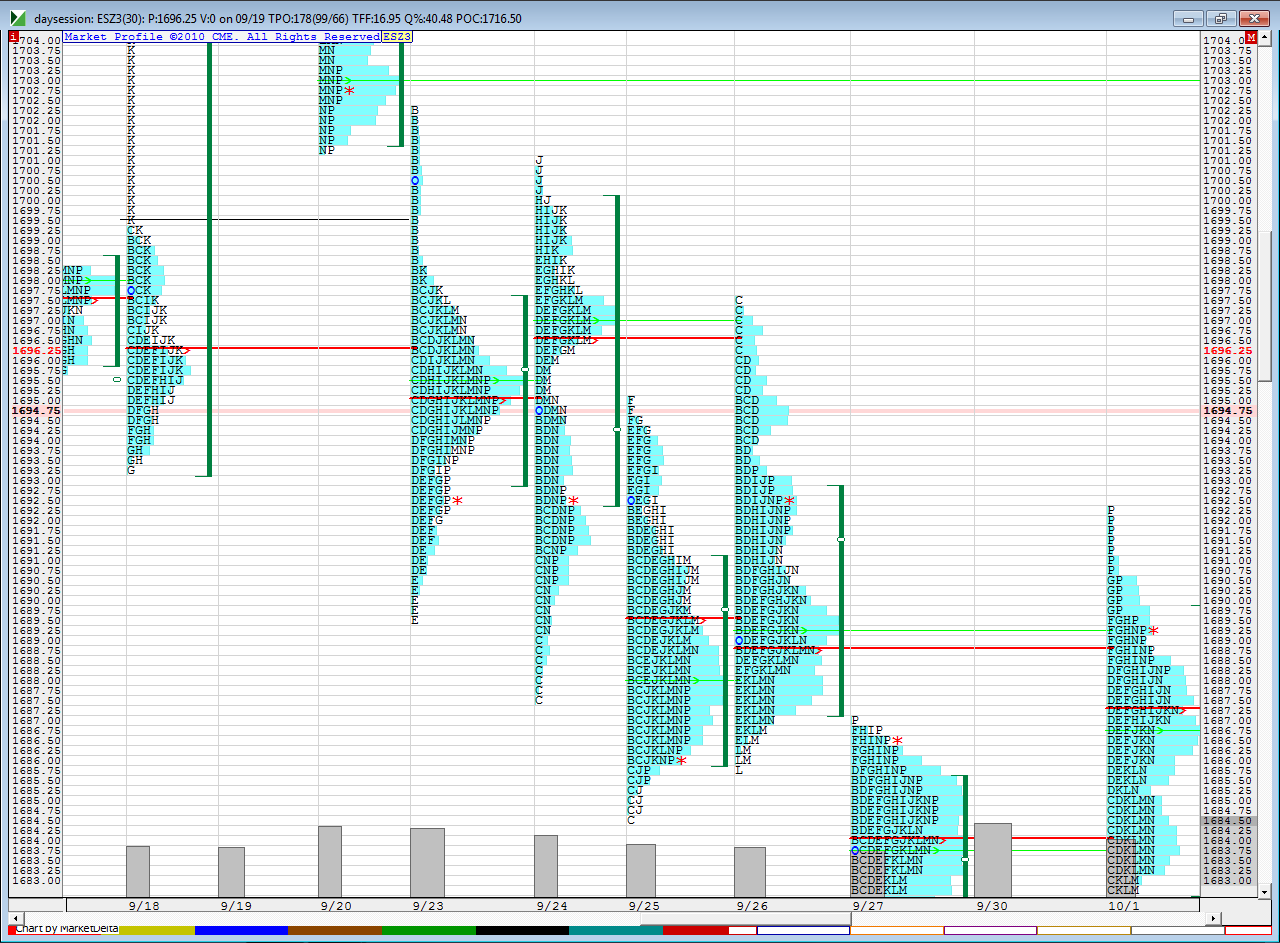

a quick pic as to why that 96-97.50 was important to me...it was a selling tail from 9-26 and a tested VPOC/poc from the 9-24...so that center was still valid and we had rejection that was displayed as a selling tail

best fill for me is 94.75 as that was single prints....will try to hold runners for 93 but will probably be stopped out

can anyone confirm a VPOC flip up to 96.50...? if u r still here...wasn't expecting to trade more today but we need to take advantage of the volatility when it comes our way

91.75 - 92.25 needs to go on our radar even if it doesn't print back today....look where 10-1 high is !!!....so the single prints formed while bracking that high

unfortunately i was stopped on that new high and since i had go pick up my son from pre-k i could not jump back in...

but look at that little zone i had marked on my chart 97.25-98.25...originally i mentioned 95-97.5...well, 95 was the center of the top bell from 9/26, and 97.5 was the top edge of that curve (bruce's selling tail comes from that curve)....but if u observe carefully on 9/24 we had that vpoc and poc at 97.5 that was rejected on 9/26 (bruce just mentioned this on his post, so nothing new here) and 98.25 was the upper edge of that bell curve that had 97.5 as center...u can see also that edge was respected nicely on 9/24 and that a separate balance area was created with 98.25 as lower edge and 1701 as upper edge...sometimes it is tough to foresee where price will stop when lines are so close, so in hindsight my stop should have been above 98.25 on the short, and if we had gone above it then that would have told me we are likely headed for 1701

in any case, i think i am not confusing anyone here

but look at that little zone i had marked on my chart 97.25-98.25...originally i mentioned 95-97.5...well, 95 was the center of the top bell from 9/26, and 97.5 was the top edge of that curve (bruce's selling tail comes from that curve)....but if u observe carefully on 9/24 we had that vpoc and poc at 97.5 that was rejected on 9/26 (bruce just mentioned this on his post, so nothing new here) and 98.25 was the upper edge of that bell curve that had 97.5 as center...u can see also that edge was respected nicely on 9/24 and that a separate balance area was created with 98.25 as lower edge and 1701 as upper edge...sometimes it is tough to foresee where price will stop when lines are so close, so in hindsight my stop should have been above 98.25 on the short, and if we had gone above it then that would have told me we are likely headed for 1701

in any case, i think i am not confusing anyone here

yep vpoc up to 96.5 now...good chance for shorts here if that gets rejected....we could go ta the ibh / single print area left

Originally posted by BruceM

can anyone confirm a VPOC flip up to 96.50...? if u r still here...wasn't expecting to trade more today but we need to take advantage of the volatility when it comes our way

so what does that Vpoc flip to 96.50 tell you Bruce?

well it tells us that all the volume for the day is mostly under the 96.50 now and we have some bigger traders battling it out.....there is a thread on Traders laboratory by a guy named jpearl but the Vpoc flips are not perfect...for me it just confirms another bell curve has formed.....very difficult I find to use them as the market is actually trading live...

it certainly doesn't mean that we can't make new highs and break away still but it implies that most of the volume is UNDER that 96.50 so we want to see if volume on pushes above it is strong...otherwise we will come back down to it.......if we start making new highs you'd want to watch for that concept.....many use it in relation to VWAP and prefer to be short when VWAP is under the VPOC...like we are now.....but the ideal shorts would also need to be below vwap...so we donot have ideal conditions...

bottom line is developing vpoc is hard to figure out !! sorry but I don't have any magic answers.....

above here I see the 1701- 1703 as a zone if the buyers win this over from us

it certainly doesn't mean that we can't make new highs and break away still but it implies that most of the volume is UNDER that 96.50 so we want to see if volume on pushes above it is strong...otherwise we will come back down to it.......if we start making new highs you'd want to watch for that concept.....many use it in relation to VWAP and prefer to be short when VWAP is under the VPOC...like we are now.....but the ideal shorts would also need to be below vwap...so we donot have ideal conditions...

bottom line is developing vpoc is hard to figure out !! sorry but I don't have any magic answers.....

above here I see the 1701- 1703 as a zone if the buyers win this over from us

u2 koolio..c ya

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.