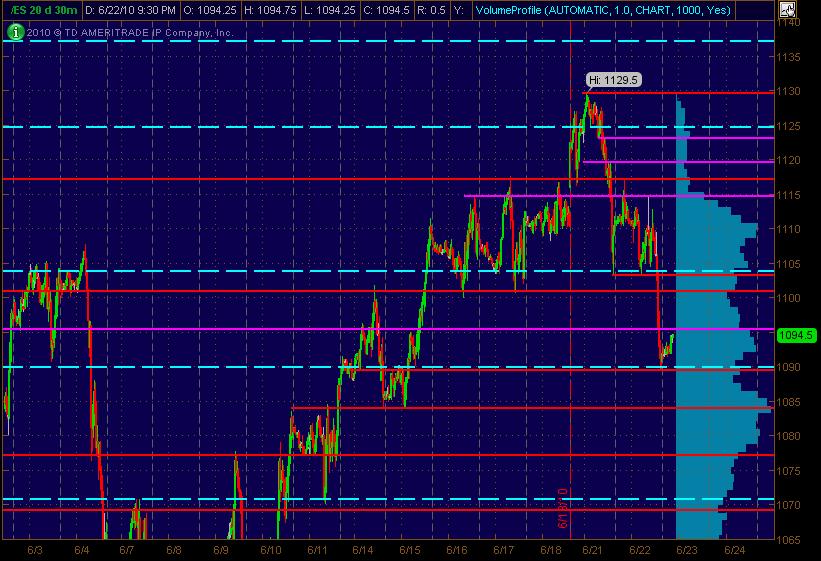

ES Short Term Trading 6-23-10

Here's what I've got as a Price Action S/R "MAP" ... the Red lines are potential significant S/R levels with Magenta semi-significant. The Cyan dashed lines are the Wkly Pivot levels. The Light Blue bars on the right vertical side of the chart represent Volume at Price on this 30-minute, 20 day chart:

Hope this is helpful to all ... and definitely follow MP analysis and your own analysis where things may line up and add significance at price levels for getting off a decent risk/reward trade.

And don't forget ... Wednesday is FOMC day ... stands for F*@K(ng Overall Massive Catastrophe for ____________ (fill in blank with your favorite pet peeve)!

Hope this is helpful to all ... and definitely follow MP analysis and your own analysis where things may line up and add significance at price levels for getting off a decent risk/reward trade.

And don't forget ... Wednesday is FOMC day ... stands for F*@K(ng Overall Massive Catastrophe for ____________ (fill in blank with your favorite pet peeve)!

And stock wise after going thru 1000+ daily charts ... well, most of 'em look pretty sucky ... weak in terms of major moving averages, lack of decent patterns and not many showing decent relative strength LONG. But, if the market does rally, here's the few equities I've got on my radar:

BIDU - would prefer a pullback, but can do without it

NFLX

AAPL - very index direction dependent

CRUS - ummmmm, high risk on this 'un I think

SNDK

VMW

AVB?

VMW?

Again, how the "long picks" perform intraday collectively can provide an overall (and early) tip as to what the overall market is going to do in the short term intraday ... while also tracking the $TICK and other indices intraday. Again, hope this is helpful to both ES (and other index futures traders) as well as any day/swing equity traders hanging around here!

The Klunky Monkey

BIDU - would prefer a pullback, but can do without it

NFLX

AAPL - very index direction dependent

CRUS - ummmmm, high risk on this 'un I think

SNDK

VMW

AVB?

VMW?

Again, how the "long picks" perform intraday collectively can provide an overall (and early) tip as to what the overall market is going to do in the short term intraday ... while also tracking the $TICK and other indices intraday. Again, hope this is helpful to both ES (and other index futures traders) as well as any day/swing equity traders hanging around here!

The Klunky Monkey

waiting for the econ.numbers to come out, then will look to buy 1086 gap fill from last monday (Jun 14)

Originally posted by phileo

waiting for the econ.numbers to come out, then will look to buy 1086 gap fill from last monday (Jun 14)

um... maybe not... bad numbers, wait for the dust to settle first.

Full 3 war just hit Too....certainly not as reliable as price points.

Big volume node at 78 - 81 from composite...hopefully to prop up the market....

Big volume node at 78 - 81 from composite...hopefully to prop up the market....

long 80.50 and hating it

air above so u know why I did that...still don't like fed days...they can just start a trend andf keep going

83.50 is best...have two left for 87 area if lucky

runners will stop at 80.75 ..then I'll try one more long and call it a rap until Fed announcement

that was a minus 1300 $tick into that long term node with air above!!

It will be a surprise to make new lows before testing that 85 area

amazing...the 10 a'm reports created more volume on a one minute spike then the fed announcement...

87 - 89 get top billing from todays trade.......

87 - 89 get top billing from todays trade.......

Originally posted by hari

2:23 bought at 1085

2:31 sold at 1090.50

fastest 5.5 pts ever for me :)

Originally posted by phileo

Euro is in a buying panic!!

TICK at +1400 !!

what the heck did big Ben say ??

fastest 4pts I've made all year

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.