ES 03-22-2011

i will take one off at 90.25 if they choose to fill me!...not yet!

one off at 1290.25 plus one handle(now up 8.25!) Now do i bail at 1291.25 or hold for 1294? not sure....

raised my stop to 1288.50 for a no risk trade... while i decide..

Originally posted by koolbluecorrection up 8.00 on the day as my entry was 89.50, not 89.25 (unfortunately)...

one off at 1290.25 plus one handle(now up 8.25!) Now do i bail at 1291.25 or hold for 1294? not sure....

stopped out at 88.50.. loss of one tick total on the trade...watching for possible re-entry...

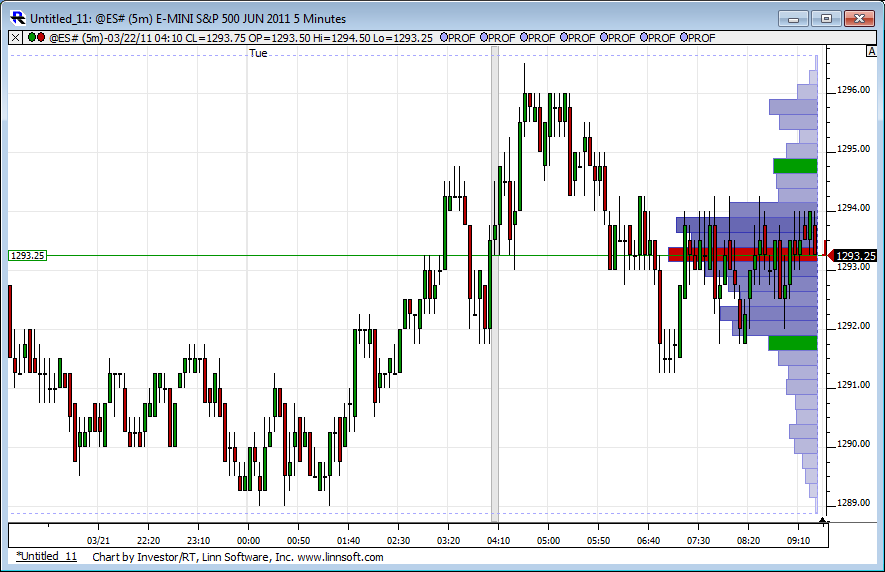

here's a trade I didn't take but could have....it demonstrates some good stuff...the context is that we had the key peak volume ( 1293.75)created at 9:47 A.M EST...YESTERDAY...so that was a key number...

Today the Opening ranege was 1292 - 1293.50 and it had the biggest volume bar of the day so far...

So if you refer to my comments earlier about the IB and how people would try to sell ABOVE the midrange...this is how I would have done it if I liked trades within the IB..

Note also the great test back down to the volume that was created at the lows today.....bring up a one minute chart to see these awesome volume spikes..

so we have that great A - B volume divergence into key zone.....same old story....I'm a broken record but high probability trades when in the correct context..

Today the Opening ranege was 1292 - 1293.50 and it had the biggest volume bar of the day so far...

So if you refer to my comments earlier about the IB and how people would try to sell ABOVE the midrange...this is how I would have done it if I liked trades within the IB..

Note also the great test back down to the volume that was created at the lows today.....bring up a one minute chart to see these awesome volume spikes..

so we have that great A - B volume divergence into key zone.....same old story....I'm a broken record but high probability trades when in the correct context..

man ,i played that last trade way too conservative! still think that was a good buying opp.

Originally posted by koolbluegot to run some errands.. back in a bit!

man ,i played that last trade way too conservative! still think that was a good buying opp.

Originally posted by koolblue

man ,i played that last trade way too conservative! still think that was a good buying opp.

I think you did fine. An hour close in 1287s will bring in sellers, how low? Not sure.

something to think about for those who like to trade in the afternoon...

so far we have spent all the volume and time BELOW the POC of yesterday which happens to be 1293.50.....so VALUE is building LOWER in relation to yesterday and the prices viewed as "Most Fair" - the POC....all the trade is happening below so it is Logical ( not always probable) that the value area will end up being below yesterdays Value area...

so we should think about selling rallies unless we get back over the 1293.50 - 75 if we are to assume that value will CONTINUE to be accepted at lower prices.

You can also look at where your developing POC is forming...is it forming higher or lower than yesterdays...

So I favor the retest of todays lows and further based on LOGIC...it sure doesn't mean it will happen...

so far we have spent all the volume and time BELOW the POC of yesterday which happens to be 1293.50.....so VALUE is building LOWER in relation to yesterday and the prices viewed as "Most Fair" - the POC....all the trade is happening below so it is Logical ( not always probable) that the value area will end up being below yesterdays Value area...

so we should think about selling rallies unless we get back over the 1293.50 - 75 if we are to assume that value will CONTINUE to be accepted at lower prices.

You can also look at where your developing POC is forming...is it forming higher or lower than yesterdays...

So I favor the retest of todays lows and further based on LOGIC...it sure doesn't mean it will happen...

Originally posted by koolbluebingo!(within one tick... this is the important dividing line imho!... if 1283 doesnt hold then down we go, otherwise bulls still have hope here!

once again caution is the watchword! as the charts are mildly negative,but we just had nice pos. divergencies at the last low!...

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.