ES 3-24-2011

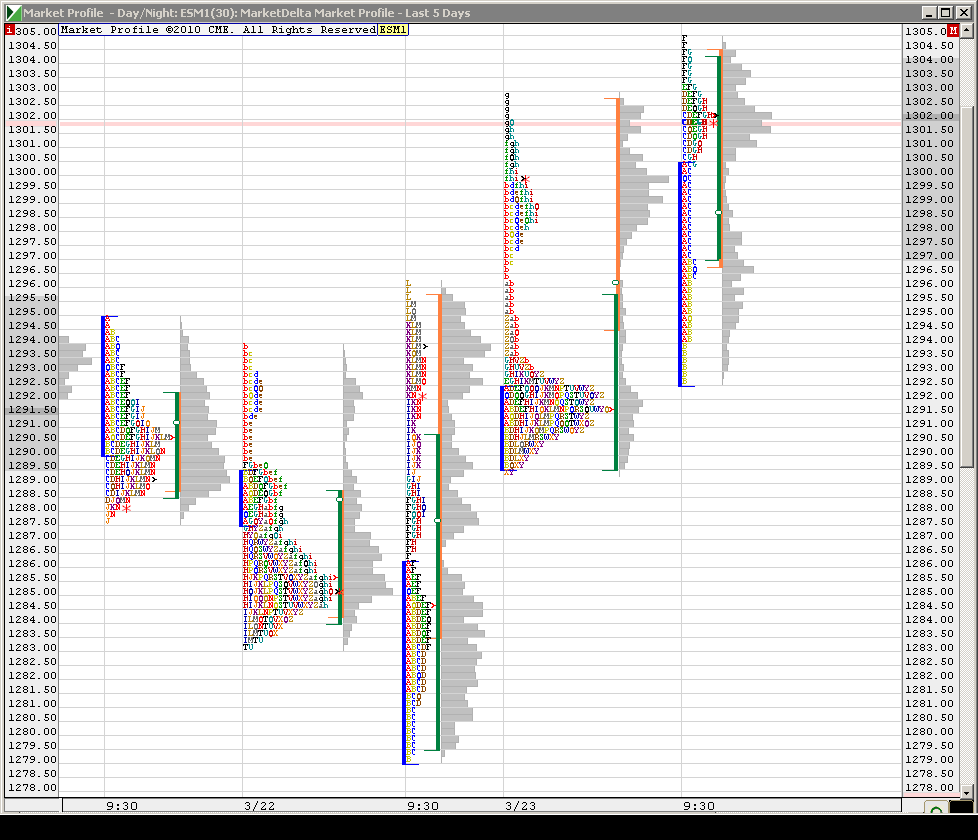

Here is the developing RTH weekly profile. Obviously prices are well above this at the moment. Also on the chart is Paul's Monday Range fib extension where if prices reach the 1.618 extension of Monday's RTH range on either side the probabilities of prices hitting the 2.000 range are extremely high during the rest of the week. In this case to the tick almost!

I find volume from O/N action is immensely important and adds quite a bit to my own trading but I certainly understand its not an absolute necessity.

Originally posted by pt_emini

Originally posted by BruceM

agree about DTN Lorn....I was on the phone with IB for a while yesterday and they assured me that the way I was looking at Cummulative delta it would work but it doesn't seems so....also there is no back fill with IB with cummulative delta so I'd have to run my computers all the time to collect data

I am running zenfire which does not provide any historical backfill either. I start my volume studies around 8:30-9:00 am (Eastern Time) most mornings and have no problem with that at all. Volume overnight (globex session) is so low that many volume studies do not work right anyways.

I agree the overnight volume profile levels are very useful, especially during the first hour or two of the RTH session. The volume profile stuff is constructed from 1 minute volume data (at lest that is the way my volume profile indicator is constructed), so it can be re-built from the historic 1 minute data back fill. Thus, I do not need to keep the computer running all night in order to construct a volume profile from the overnight session.

Originally posted by Lorn

I find volume from O/N action is immensely important and adds quite a bit to my own trading but I certainly understand its not an absolute necessity.

Originally posted by pt_emini

Originally posted by BruceM

agree about DTN Lorn....I was on the phone with IB for a while yesterday and they assured me that the way I was looking at Cummulative delta it would work but it doesn't seems so....also there is no back fill with IB with cummulative delta so I'd have to run my computers all the time to collect data

I am running zenfire which does not provide any historical backfill either. I start my volume studies around 8:30-9:00 am (Eastern Time) most mornings and have no problem with that at all. Volume overnight (globex session) is so low that many volume studies do not work right anyways.

Originally posted by pt_emini

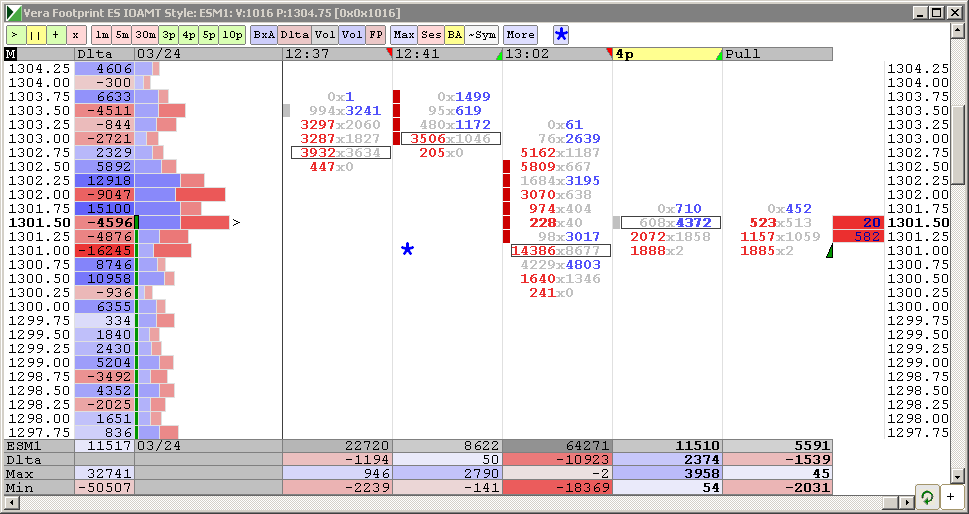

Dipping a toe in on the short side here on this retest of the 1304.50 level

Exited, flat at 1301.00

Great trade ,P.T.! i'll buy 1299.00 ,otherwise i may have to sit today out!

Originally posted by koolblue

Great trade ,P.T.! i'll buy 1299.00 ,otherwise i may have to sit today out!

Thanks Kool, VWAP is sitting at 1299.00

Originally posted by pt_eminiyes i see that! i have it on a 13 min chart at 1298.75...

Originally posted by koolblue

Great trade ,P.T.! i'll buy 1299.00 ,otherwise i may have to sit today out!

Thanks Kool, VWAP is sitting at 1299.00

Re: overnight data. Market Delta allows you to separate O/N and RTH profiles. I find it useful, as market often tests O/N Value Area.

Here is an example. Look where the "open drive" stopped.

Here is an example. Look where the "open drive" stopped.

Lisa - Your Point & Figure Delta charts are just nailing the levels today, very impressive, thank you for sharing them.

s&p 500 cash high today...1311.34! Thats now a magnet,imho!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.