ES 3-24-2011

Here is the developing RTH weekly profile. Obviously prices are well above this at the moment. Also on the chart is Paul's Monday Range fib extension where if prices reach the 1.618 extension of Monday's RTH range on either side the probabilities of prices hitting the 2.000 range are extremely high during the rest of the week. In this case to the tick almost!

two more off at 04.25...last two will get stopped at 05.75 or will target 03 print...way too late here...a good end either way to a rough day..but sure would prefer to see 03 print

that was a nice volume divergence into that key area....but a scary time of day for it

flat 05 even...was hoping 4 pm close would be lower..

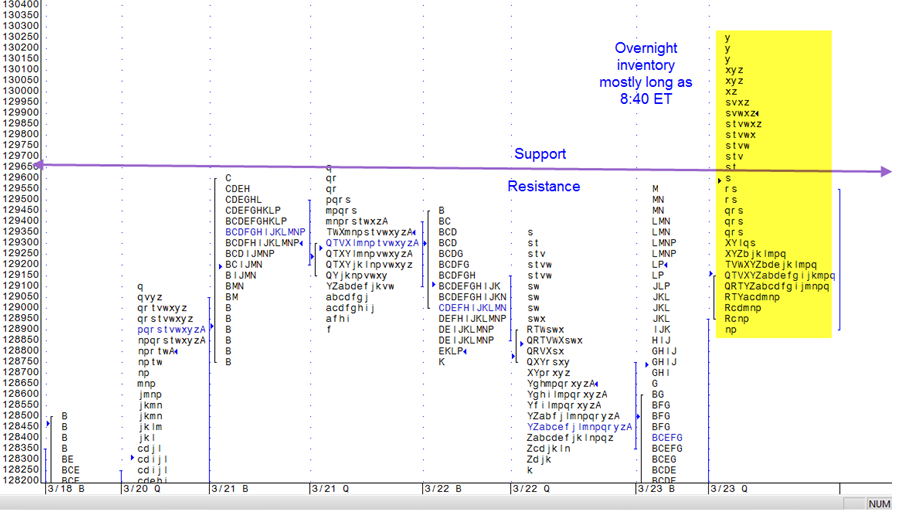

James Dalton: "1. What is resistance going up becomes support once it is surpassed.

2. Overnight inventory is mostly long.

3. Right now we would gap higher, the gap is the reference; failure to fill the gap is positive in the day timeframe.

4. Yesterday’s rally was on poor volume and structure; this increases long side risk. If the market fails to hold the gap and finds acceptance below support, overnight inventory and late longs from yesterday could pressure the market to the downside. "

...SMART MAN!

2. Overnight inventory is mostly long.

3. Right now we would gap higher, the gap is the reference; failure to fill the gap is positive in the day timeframe.

4. Yesterday’s rally was on poor volume and structure; this increases long side risk. If the market fails to hold the gap and finds acceptance below support, overnight inventory and late longs from yesterday could pressure the market to the downside. "

...SMART MAN!

Originally posted by koolbluewhew! tough day indeed! hourly proj hit, but it took all day and sure didnt help me ,as im a big loser today!...licking my wounds tonite..c ya tomorrow gang!

Good morning! All along the recent decline from 1337 to 1241 i harped on the fact that it would likely be a supreme buying opportunity with higher prices due in April...i still believe that. the first phase of the rally(what wave theorists call wave one) is probably nearly over. The 1303 area is considerable resistance ,but i tend to think we top out a little higher..perhaps the triangle apex ? Afterward expect a swift decline for wave 2 of perhaps 38% from 1241 to wherever the high is!.. Heres the hourly picture so far...

Lots of mistakes on my part today but I thought I'd share one that might be most useful to the forum......

I had a good short working from the open as I had the 99 volume number created in the O/N session and the 95.75 volume from yesterday.......I also had a target based on volume at 91.25 ( which never hit today)......now the part I messed up was at the closing range.....I missed covering ANY contracts right there....

I look at the closing one minute range just like I look at the one minute opening range....and should have taken something off there even if it was just one contract out of my last 2 runners..but I was hell bent on getting that 91.25 that I overlooked the closing range..I gave back 4 points by missing that target..

So the moral of the story is to know your closing range...especially on a day that we gap open outside of the previous days range...

Look at todays RTH low and look at yesterday last one minute range of trade....a perfect hit

I had a good short working from the open as I had the 99 volume number created in the O/N session and the 95.75 volume from yesterday.......I also had a target based on volume at 91.25 ( which never hit today)......now the part I messed up was at the closing range.....I missed covering ANY contracts right there....

I look at the closing one minute range just like I look at the one minute opening range....and should have taken something off there even if it was just one contract out of my last 2 runners..but I was hell bent on getting that 91.25 that I overlooked the closing range..I gave back 4 points by missing that target..

So the moral of the story is to know your closing range...especially on a day that we gap open outside of the previous days range...

Look at todays RTH low and look at yesterday last one minute range of trade....a perfect hit

s&p 500 cash high today...1311.34! Thats now a magnet,imho!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.