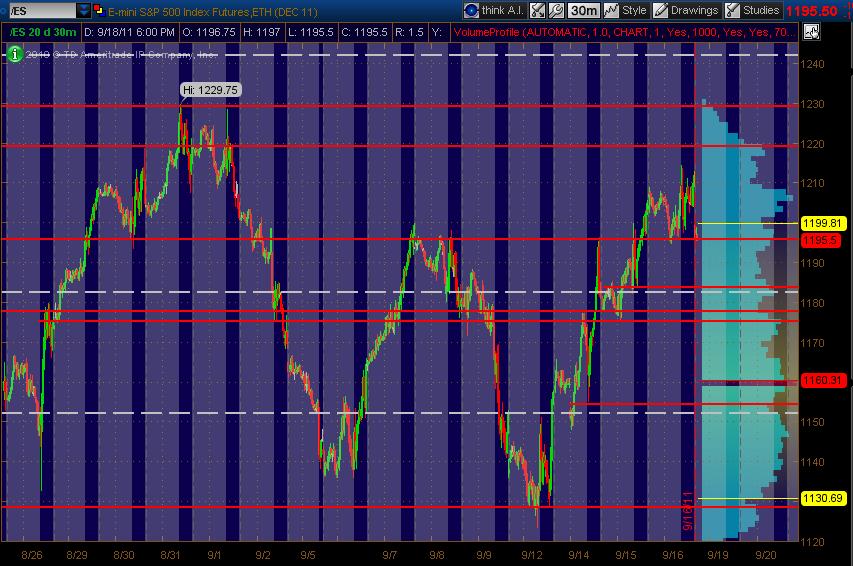

ES Monday 9-19-11

Here's my ES 30min Monkey Map of PASR levels as Red with White dashed lines as Wkly Pivots ... and Volume Profile of the past 20 days on the right vertical axis. The Gray background areas show overnight (non RTH) areas. Have a Fib cluster in and around 1183 as well (though not drawn in). Hope this is helpful.

The issue now is that we have a ledge between 86.25 and 87.75.. If we go back into that ledge, the buy looks less attractive to me unless I can get 86.25/86.50 with a tight stop..

Good call Al, how many points have took from the market already?

Good call Al, how many points have took from the market already?

Final target filled + 4 pts HOME RUN !

Don't count the points, count only the timing of the entry

How many contracts are you trading?

That is very confidential, besides what difference does it make?, it is all in the excution and the precision. Only have one point of stop loss.

I am watching in awe. Even if u did have a failure, i dont think anyone expects a 100% hit ratio

True, I usually trade 3 if I think there is a potential 4-5 point range so I can scale out.. 1-2 when I scalp for less.. If I think there is a potential big move, I'll trade up to 5-6 to hold..

I have to tell you I'm pretty impressed myself.. I never knew you had this scalp prowess in you...ha

The Russell is giving me a sell signal... , we might head lower from here

GUARANTEED Trade, called ahead of time and in real time, the Open was reached as expected...remember this trade from I B Close to Open...

Id go broke trying to read todays posts and trade. In the morning I look for Bruces levels and see how they mesh with mine. Reading any more here will probably cause a brain fart {for me anyway}. A 1.5 stop in 35 pts ranges which we have been having is suicidal in my opinion. You can get an execution and stop at the same time. Best wishes and good trading RB

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.