ES 4-4-2011

Getting the week started off here is a look at last weeks RTH profile.

Obvious zone on this chart is the gap in the middle with virtually zero volume.

Obvious zone on this chart is the gap in the middle with virtually zero volume.

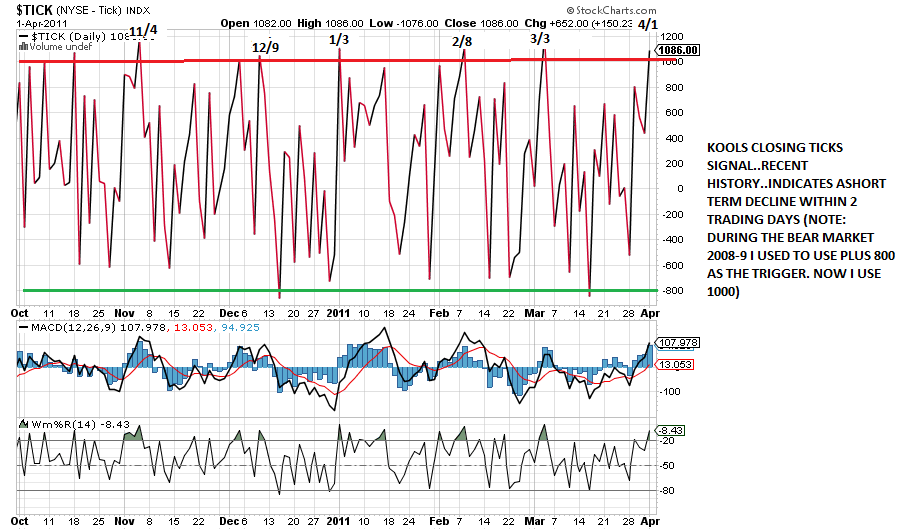

There are at least 6 reliable studies showing odds favor much higher prices over the next 1-3 months.. but the shorter term studies are calling for a short term decline... heres one of my old standbys!...

Nice work, Lorn. Thank you for your insight. August

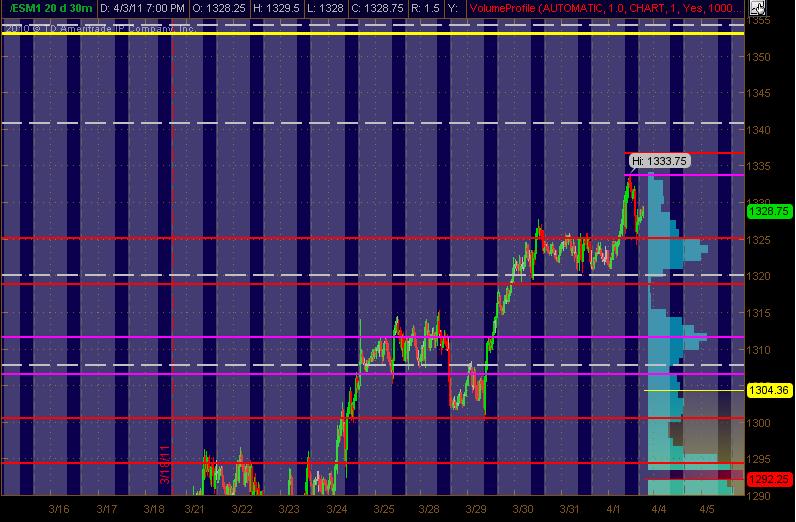

Thought I'd toss in my ES PASR "MAP" for Monday and the week. It's a 30min chart of 20 days with Volume at Price on the right side (vertically) in Light Blue. The Red lines are potential significant S/R zones with Magenta being semi-significant. The White dashed lines are the Weekly Pivots. The Yellow line is what I see as a potential significant Fib Cluster zone above the current market. The Grayed background is "overnight trading" with the Blue background as RTH. Hope this is useful to some folks.

Btw, Lorn's chart where he pointed out that area/vacuum of low low volume is key if we sell down on Monday or during the week. Thanks for a great bit of "goods" there Lorn! And a good variety of perspectives there El Koolio! Thanks all!

Btw, Lorn's chart where he pointed out that area/vacuum of low low volume is key if we sell down on Monday or during the week. Thanks for a great bit of "goods" there Lorn! And a good variety of perspectives there El Koolio! Thanks all!

And for other equity traders out there like this Monkey ... thought I'd post some potential LONG PICKS ... but should be considered only if the overall mkt (ES) is moving up. Looked at 1200+ charts ... and with the market (and lotsa stocks) showing recent hard runs up, and the ES nearing potential signif resistance on the BIGGER time frame ... trade long with caution on these ... if at all.

SOHU

FOSL

PNRA

(the above picks may need a day or few of pullback or consolidation)

BIDU (careful with this minefield, and size accordingly)

DECK

OPEN

HUM

WLP

Energy stocks have been on a rampage showing great setups and follow-thru. Normally don't include any of those since their price has outside factors that can jack with 'em out of the blue and ya end up in sh*! creek in a chicken wire canoe without a paddle. So just a heads up on these three:

HOC

PXD

WLL

As always, hope some find this helpful!

SOHU

FOSL

PNRA

(the above picks may need a day or few of pullback or consolidation)

BIDU (careful with this minefield, and size accordingly)

DECK

OPEN

HUM

WLP

Energy stocks have been on a rampage showing great setups and follow-thru. Normally don't include any of those since their price has outside factors that can jack with 'em out of the blue and ya end up in sh*! creek in a chicken wire canoe without a paddle. So just a heads up on these three:

HOC

PXD

WLL

As always, hope some find this helpful!

And BRUCE ... I don't think you've posted a decent trading idea here since that last concert you attended. I'm still struggling to patch together my synapses after that AC/DC concert here in Dallas around a year ago. Try to post something besides after-the-trade calls ya shill!!

Good work everyone !

Kool: The thing that strikes me about your "High Ticks" chart is the dates you listed for those spike highs. They sure favor the first week of every month going back 6 months. One other point, each spike high doesn't sit and linger above your +1000 high water mark for long before a sharp reversion hits. I notice also the reversion comes in two waves with an intervening mini bounce, like an ABC corrective pattern with "B" being very small in relations to A and C. -400 looks like a safe target for a C completion reading.

Kool: The thing that strikes me about your "High Ticks" chart is the dates you listed for those spike highs. They sure favor the first week of every month going back 6 months. One other point, each spike high doesn't sit and linger above your +1000 high water mark for long before a sharp reversion hits. I notice also the reversion comes in two waves with an intervening mini bounce, like an ABC corrective pattern with "B" being very small in relations to A and C. -400 looks like a safe target for a C completion reading.

My plan here in the O/N session is to get short at 1330.50 or so and use the 1328.75 as a magnet price....No reports scheduled...so mean reversion should work well...we have the 1331.75 number above to lean on if we need to...

that sucks Lorn...the sound is very , very low when I try it on my laptop.....It worked great on my other computer...not sure how to fix that...my apologies

The short story is that I was trying to show how 1328.75 was the original peak volume price and then 1331.75 took over. Then on the way back down we broke through the 28.75 down into our old 1324.50 number but bounced back to retest the 1328.75. Volume as attractors !

I also babbled a bit about the opening range tests. That is the little Red mark on the video. My thoughts were that many just look at the ending volume profile and don't replay it to really get better numbers. The volume surges at the 4 PM cash close throw off the volume profiles many times....Like Friday...

I also babbled a bit about the opening range tests. That is the little Red mark on the video. My thoughts were that many just look at the ending volume profile and don't replay it to really get better numbers. The volume surges at the 4 PM cash close throw off the volume profiles many times....Like Friday...

Glad ya nabbed SOHU ... unfolded well. Considering the market was range bound, most of the stock picks held up well with many also reflecting the ES price activity ... but they performed pretty well overall ... with 1 or 2 semi-lemons. Thanks for the feedback; it's nice to hear back that someone's profited from the picks. Good stuff!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.