CME Euro FX Futures 6E

Red, sorry ,i was already asleep when you posted!.. I haven't had much time to look at it, but the daily chart indicates 1.3826 coming. Cycles are not very clear.... here's a real short term peak (10 min chart).. id be buying anywhere around the lower prc band...

Well, shuh!

Originally posted by koolblue

Bingo!.. am i a genius ,or what?...lol

lol... at least for one brief moment in time!...

Hey, I'd say you've achieved even more than your '15 minutes of fame', so you are ahead of the game, my friend.

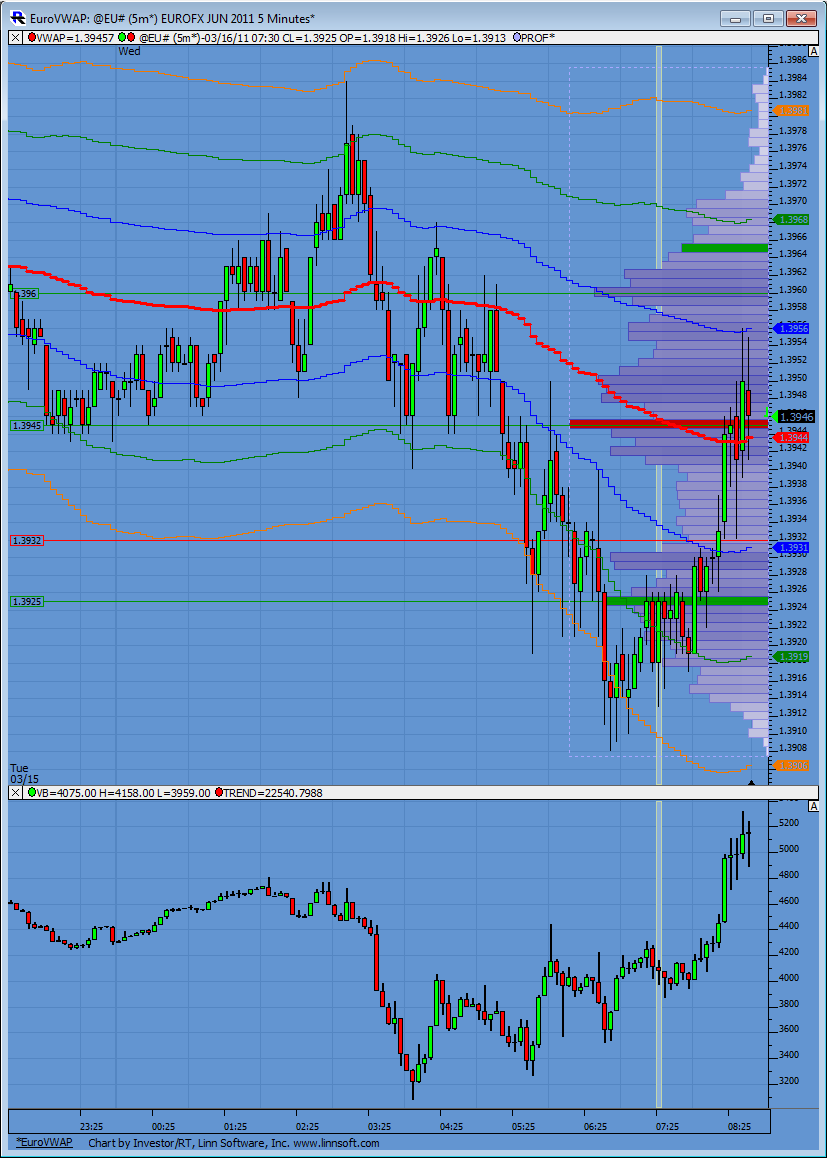

Notice the series of divergences on the CD as prices kept making new lows. Now watching to see if prices find support on VWAP and volume continues to come in.

Well we got 1.3848 .. pretty dam close so far!!!

Originally posted by redsixspeed

Originally posted by redsixspeed

I was looking for 1.386/1.388 .. the post is at this link:

http://www.mypivots.com/board/topic/6372/3/es-short-term-trading-01-27-2011

but I look for the mean so 1.387 is what I wanted .. we got to 1.3856

if we close below 1.3564 I will lose hope of getting to 1.387 at least for now

==================================================================

6e getting close to that 1.387 again .. maby hit it this time ..

I think this area is decision time for more up or the beginning

of a pull back .. a daily close above 1.387 is bullish imho

=====================================================================

The more we stay above 1.387 the "bullisher" <- .. it gets.

on the daily we have a hanging man confirmed with a close below ..

that is bearish .. 6e has moved above that and that is bullish ..

a close above the bear signal would give strength to more up

that is bearish .. 6e has moved above that and that is bullish ..

a close above the bear signal would give strength to more up

Originally posted by redsixspeed

1.387 is a key # for me the next # above that is 1.412 .. I look for

the mean = 1.3995 which is @ 1.400 that some are saying is resistance.

Resistance doesn't mean reversal ..

======================================================================

1.412 ..

- Page(s):

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

At $85 billion/month, it cost Bernanke a little over $1 million for each job created last month. Well done, professor. -Tim Knight

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.