Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

forum members may be interested to know that rich jim larry dave and myself have been using MTPredictor for a long time now

larry's excelllent charts start with MTP...however, larry then improves the charts with the use of his own labeling and commentary of elliot wave that is superior

if interested in MTP, as a tool, it is linked at rich's site http://www.taylortradingtechnique.net/Affiliates.html

in addition to MTP, another excellent tool that i use is DVTool which can be demo'd from MyPivots

g

larry's excelllent charts start with MTP...however, larry then improves the charts with the use of his own labeling and commentary of elliot wave that is superior

if interested in MTP, as a tool, it is linked at rich's site http://www.taylortradingtechnique.net/Affiliates.html

in addition to MTP, another excellent tool that i use is DVTool which can be demo'd from MyPivots

g

quote:

Originally posted by gio5959

if interested in MTP, as a tool, it is linked at rich's site http://www.taylortradingtechnique.net/Affiliates.html

in addition to MTP, another excellent tool that i use is DVTool which can be demo'd from MyPivots

g

lol

You're too much Gio ... shameless even

quote:

Originally posted by ddaytrader

quote:

Originally posted by gio5959

if interested in MTP, as a tool, it is linked at rich's site http://www.taylortradingtechnique.net/Affiliates.html

in addition to MTP, another excellent tool that i use is DVTool which can be demo'd from MyPivots

g

lol

You're too much Gio ... shameless even

why shameless?

i'm not ashamed to say that the DVTool from MyPivots is the best software investment i've ever made!...in fact, i'm proud to say it's the best software investment i've ever made.

g

Has any seen the news about Fannie and Fredde?

It's blown through tomorrows TTT highs. Everytime (take with a grain of salt) I've seen news like this it is an opprotune time to fade the move.

TS8 isn't providing me data to my charts right now so I can't do anything.

Wondering if anyone had any thoughts?

Good luck,

Jim

It's blown through tomorrows TTT highs. Everytime (take with a grain of salt) I've seen news like this it is an opprotune time to fade the move.

TS8 isn't providing me data to my charts right now so I can't do anything.

Wondering if anyone had any thoughts?

Good luck,

Jim

quote:

Originally posted by jands

Has any seen the news about Fannie and Fredde?

It's blown through tomorrows TTT highs. Everytime (take with a grain of salt) I've seen news like this it is an opprotune time to fade the move.

TS8 isn't providing me data to my charts right now so I can't do anything.

Wondering if anyone had any thoughts?

Good luck,

Jim

Jim

We had a failed positive 3 day rally on Friday. Often when this happens the markets have a tendency to correct it self back to normal. If we don't get back 1245 this will be the first time since January that the 24 hour session will not make a decline.

Also as we know this year when the markets make new lows or get close then the US govt or Federal Reserve make a move to save the day. On Friday the NYSE made a new 2 year low.

I guess Poulson must have lots of stocks in is portfolio

quote:

Originally posted by Richbois

quote:

Originally posted by jands

Has any seen the news about Fannie and Fredde?

It's blown through tomorrows TTT highs. Everytime (take with a grain of salt) I've seen news like this it is an opprotune time to fade the move.

TS8 isn't providing me data to my charts right now so I can't do anything.

Wondering if anyone had any thoughts?

Good luck,

Jim

Jim

We had a failed positive 3 day rally on Friday. Often when this happens the markets have a tendency to correct it self back to normal. If we don't get back 1245 this will be the first time since January that the 24 hour session will not make a decline.

Also as we know this year when the markets make new lows or get close then the US govt or Federal Reserve make a move to save the day. On Friday the NYSE made a new 2 year low.

I guess Poulson must have lots of stocks in is portfolio

If this thing holds this is going to be one SuperSized gap ... anyone happen to know what the largest gap, up or down, in % terms and point terms was?

One other thing - I've been out lurking other forums, and there are scads of folks claiming that they ar egetting short up here in the 1270's, and no one saying he or she is taking the long side. That will be lots of fuel to power this higher. Right now, that gaps does not look like an air pocket so much as it looks like a trampoline.

Indeed,everyone is thinking this is wave 2 up but let's not forget the potential wave 2B that I have posted earlier as we could have completed wave C of a the big ABC completing wave 2B as we clearly made an ABC down and not an impulse wave. Still we could make 5 waves down in the C leg but I was expecting the market to go up to these levels as at minimum this had to be wave 2 of C unfolding. I guess we will only know tomorrow morning if the market is gonna hold at these levels

Anyway I will post a chart tomorrow but I think it was on the 60 min chart the green label with 1 and 2 on the last leg down.

Anyway I will post a chart tomorrow but I think it was on the 60 min chart the green label with 1 and 2 on the last leg down.

quote:

Originally posted by ddaytrader

If this thing holds this is going to be one SuperSized gap ... anyone happen to know what the largest gap, up or down, in % terms and point terms was?

The largest gap I remember of late was on Jan 22, 2008. We had closed on the Friday at 1325 and reopened on the Tuesday at 1265 or down 60 points 4.5%

Hey all, I followed Laurent over here from another site. Seems like an interesting place here....

I am a little confused, I thought everyone knew the government was going to "back stop/take over" FNM and FRE. This is not news... 38 points on ES and 44 points on the NQ because now we know the government really is going to do what everyone knew they were going to do??? What a market!!

Best regards,

Uncle

I am a little confused, I thought everyone knew the government was going to "back stop/take over" FNM and FRE. This is not news... 38 points on ES and 44 points on the NQ because now we know the government really is going to do what everyone knew they were going to do??? What a market!!

Best regards,

Uncle

quote:

Originally posted by Larry22

Indeed,everyone is thinking this is wave 2 up but let's not forget the potential wave 2B that I have posted earlier as we could have completed wave C of a the big ABC completing wave 2B as we clearly made an ABC down and not an impulse wave. Still we could make 5 waves down in the C leg but I was expecting the market to go up to these levels as at minimum this had to be wave 2 of C unfolding. I guess we will only know tomorrow morning if the market is gonna hold at these levels

Anyway I will post a chart tomorrow but I think it was on the 60 min chart the green label with 1 and 2 on the last leg down.

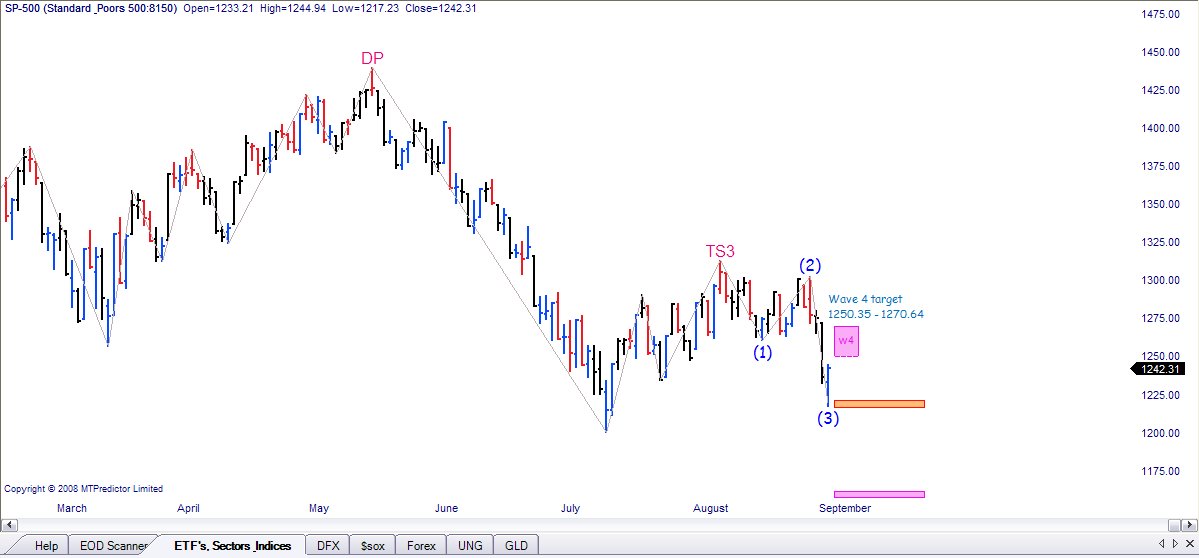

Like Laurent, I don't have a bias one way or the other. We have three waves down, and the wave 3c basically nailed the minimum wave 3 target, so this may be a wave 4 rally before a wave 5 of I of C. I am not nearly as proficient an EW analyst as Laurent. But if this is a wave 4 my target zone is 1250.35-1270.64 on the cash SPX, after which wave 5 down of I down of C down would follow.

If, as Laurent points out as a possibility, 1217 was a big B down, then we are in a Big C up, and I have a minimum target zone of 1307.47-1318.43, though a typical wave C of that degree would take price to 1328.89-1340.34.

If the rally extends much beyond here, then a small wave 4 up is likely not happening, and instead we may be seeing the Big C up Laurent mentions as a possibility if 1217 was a big B down. In fact, if cash opens at the levels the futures are trsding at, then wave 4 will have likely retraced too far into the territotry of wave 1 to keep the downside alive for now. In other words, the Big C up seems most likely to me right now.

Here are my daily charts of the cash SPX showing each scenario:

- Page(s):

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.