anyone trying shorts??

Up here at 845 ES....S&P is holding back this rally today...where the HECK is my plus or (hopefully) minus 8 - 10 range? has everyone gone to 24 hour trading???

I'm not sure if I can recall the last time I saw such a small 30 minute bar....

quote:

Originally posted by BruceM

I'm not sure if I can recall the last time I saw such a small 30 minute bar....

I have two thoughts about that 12:30 candle

(1) the boyz/girlz used all their money making that 10am doji

and were wore out so they took a break by the looks of the

volume on that bar

(2) the only people that were trading on the 12:30 bar

took the advice of CNBC ....LOL

I covered this short at 42.75...I don't like how the YM is trying to lead down today........better shorts will be had on a pop up at an attempt of the gap close fill...also watching to see if we get a 30 and then a 60 minute close above/below that WIMP bar from friday as a directional filter

and so I begin again at 49 even.......may need to run it up a bit more to get the overnight and then the gap..got air at 46 area to target

quote:

Originally posted by CharterJoe

I bought some SPY Apr 86 puts on close today @ 1.75 looking for 1 point, thats about ES 830.

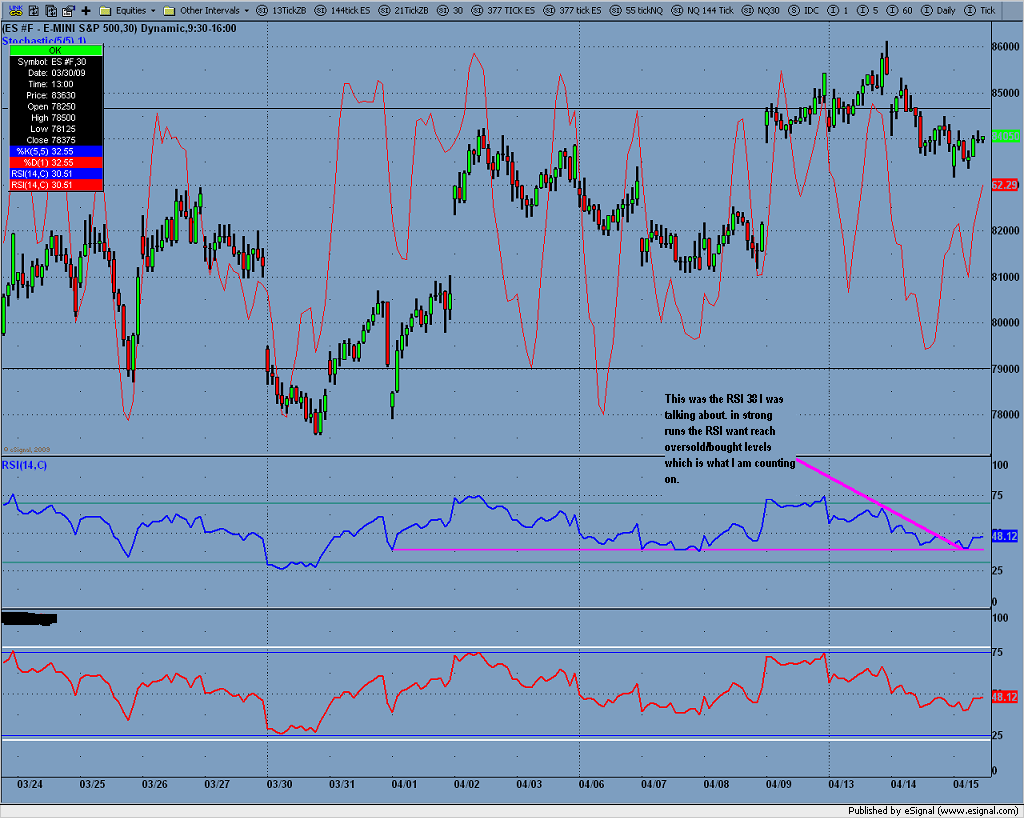

Sold those puts @ +.90 because RSI on the 30 min was finding some support @ the 38 low level which has been a floor on this run we have been having. Now long some calls SPY may 85's at 3.20 I'll add some at ES 820 if need be, ES was at 839 looking for ES 871 that will be about 1 1/2 pts on those calls.

quote:

Originally posted by CharterJoe

Now long some calls SPY may 85's at 3.20 I'll add some at ES 820 if need be, ES was at 839 looking for ES 871 that will be about 1 1/2 pts on those calls.

[/quote]

Note to self; never ever buy OTM options, even if its just one level. ITM would have already resulted in 50 cent. LOL I am to cheap...{edit} well now they are ITM i.e. 85

As a side note to volatility, it'ld be worth looking into the 60 period RSI, Joe. Every swing big or small has divergence play and it reflects more accurately cyclicity.

(& I won't ask what you covered up there. ;)

(& I won't ask what you covered up there. ;)

not the greatest way to put in a top...( three matching 15 minute bars highs) has me monitoring this short very close

We've had our words, Bruce (one more shot). But I agree. I say if we see price above the gap again, we're looking at a wedge and a breakout to the upside. No more than 910 if so, and a failed breakout then. My 2 cents.

- Page(s):

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

Just about perfect - perfectly wrong that is!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.