Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

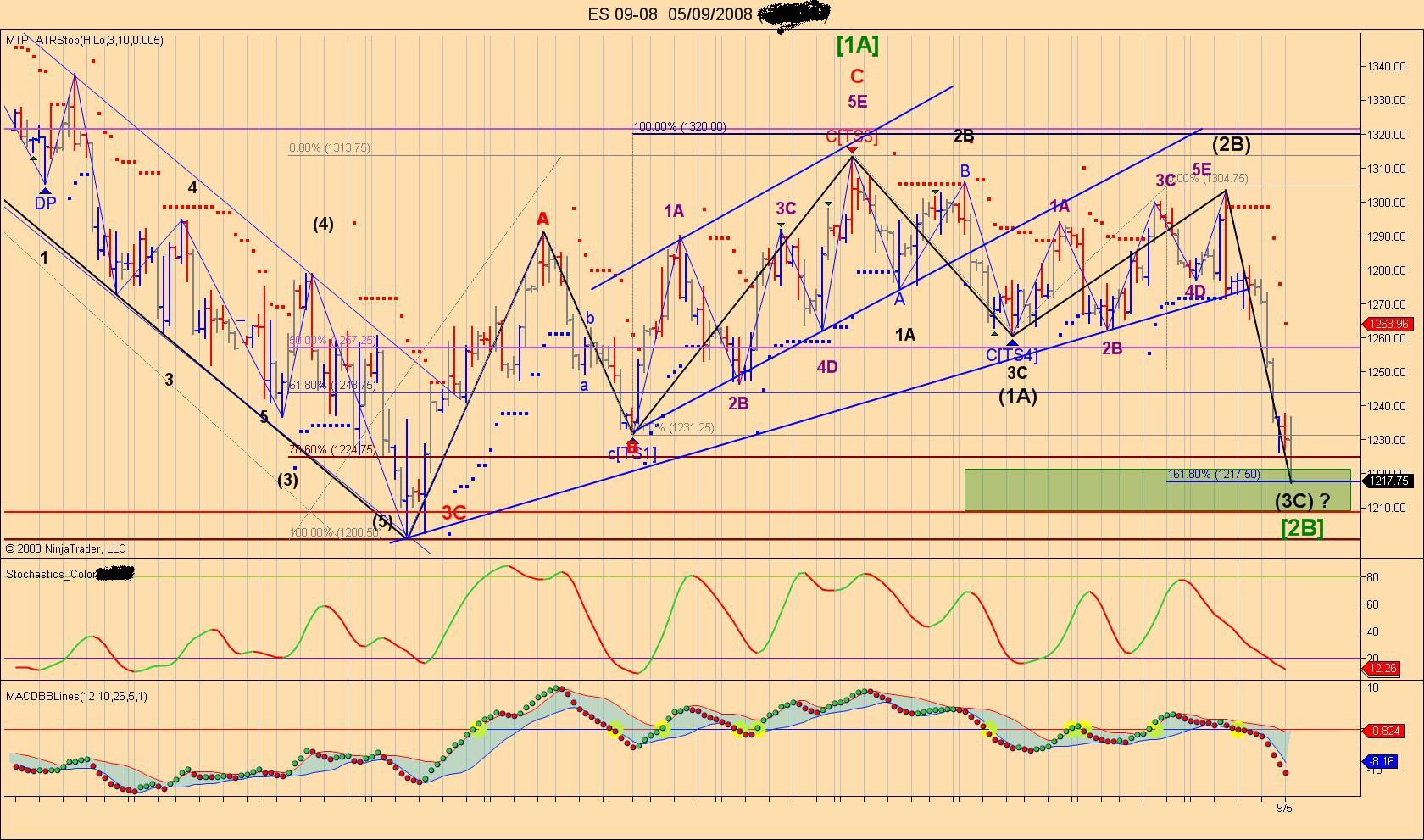

Great trade ddaytrader, you nailed the low. I had possible support at 1217.50 as this was 1.62% of wave (1A) and (2B) (black label.

So it would seems that this provided a good support for the end of wave 3, too bad I sold all my lots earlier but I had a birthday party to prepare.

I will try to upload the chart later on if I figure out how to .

So it would seems that this provided a good support for the end of wave 3, too bad I sold all my lots earlier but I had a birthday party to prepare.

I will try to upload the chart later on if I figure out how to .

quote:

margie,

are you starting to get the hang of it using rich's ttt and the other tools mentioned, to trade?

jim , ddaytrader and rich are very experienced traders, dont hesistate to ask them questions directly - im sure they will help

g

Just so you know who I really am, I am an experienced daytrader, but alas not a good one. I've only become profitable this year on a consistent basis and I am still working very hard at putting all this information, techniques, etc. together, which many of these regular posters have done, and helped me do (whether they know it or not)!

I just want you to know who I really am and that I am learning as well.

Good luck and thank you for your complement.

Jim

Finally I was able to find how to upload as the window was too small for me to see the browse window.

[file]ES_09-08__05_09_2008.jpg,2685,,0[/file]

[file]ES_09-08__05_09_2008.jpg,2685,,0[/file]

quote:

Originally posted by Larry22

Finally I was able to find how to upload as the window was too small for me to see the browse window.

quote:

Originally posted by Larry22

Great trade ddaytrader, you nailed the low. I had possible support at 1217.50 as this was 1.62% of wave (1A) and (2B) (black label.

So it would seems that this provided a good support for the end of wave 3, too bad I sold all my lots earlier but I had a birthday party to prepare.

I will try to upload the chart later on if I figure out how to .

Thanks Larry22 ... TTT had me looking for long trades today, and you of course know what I look for in terms of set-ups. And, since you know that, you probably know where I took my last profits: here's a hint, think the square root of .786

I don't know if I will have left money on the table, but anytime I can go +10.75 points profit/traded contract I'm happy.

By the way, your charts are excellent!

quote:

Originally posted by Richbois

quote:

Originally posted by OD2

Unless there's a surprise rate cut, don't expect to see 1265.25 tomorrow.

I don't necessarily disagree with you, but based on the statistics that is what I get.

Maybe the news tomorrow will change the attitude of the markets.

We are in a bear market and we also have 12-14% odds of getting a failed positive 3 Day rally.

If we don't make it all the way to 1265 I believe the market will still give it a try.

Time will tell

OD2

i think rich posted a very good observation - that the market would give it a try to reach 1265 - cause it sure did try

i hope you got on board and made some loot

have a good weekend

gio

quote:

OD2

i think rich posted a very good observation - that the market would give it a try to reach 1265 - cause it sure did try

i hope you got on board and made some loot

have a good weekend

gio

Did OD2 ever tell us what exactly he thought the market was going to do today?

First, I want to say that I am a friend of Rich's and I am a subscriber to his eBook.

Secondly, I want to state that I have no interest, financial or otherwise, in Rich's service. My only interest in his service is that he continues to offer it.

Today, TTT set my expectations for a lower low and then a rally, preferably to a price at, above, or just below the Buy Day low. The fact that price didn't reach that level is not a failure by TTT. The fact that the ES traded to a lower low than that projected by the averages over time is not a failure by TTT.

TTT gave any trader who uses it properly the "heads up" that a tradbale rally was likely to form during the day, and that such a rally would be more likely to occur than a tradable decline.

Using a set up that I have been using for years based on Fibs, Support/Resistance and momentum observations, I was twice able to go long. The first trade yielded 10 points profit on 1/2 of the position, and -2 points on 1/2 of the position. The second trade yielded +10 points on 1/2 of the position and +24.75 pints on 1/2 of the position. TTT did not provide me with the set-ups. TTT did not tell me "when" or at what price to go long (though, on some days, a TTT projection coincides with an important fib level or Support/Resistance level, and thus confirms a level as one from which a tradable move may commence).

TTT helps you find the rhythm of the markets, and, if you study it and learn it and understand that it is a method, not a system, it will help you determine whether you should be looking more for long trades or short trades on a particular day.

Best Wishes,

ddaytrader

Secondly, I want to state that I have no interest, financial or otherwise, in Rich's service. My only interest in his service is that he continues to offer it.

Today, TTT set my expectations for a lower low and then a rally, preferably to a price at, above, or just below the Buy Day low. The fact that price didn't reach that level is not a failure by TTT. The fact that the ES traded to a lower low than that projected by the averages over time is not a failure by TTT.

TTT gave any trader who uses it properly the "heads up" that a tradbale rally was likely to form during the day, and that such a rally would be more likely to occur than a tradable decline.

Using a set up that I have been using for years based on Fibs, Support/Resistance and momentum observations, I was twice able to go long. The first trade yielded 10 points profit on 1/2 of the position, and -2 points on 1/2 of the position. The second trade yielded +10 points on 1/2 of the position and +24.75 pints on 1/2 of the position. TTT did not provide me with the set-ups. TTT did not tell me "when" or at what price to go long (though, on some days, a TTT projection coincides with an important fib level or Support/Resistance level, and thus confirms a level as one from which a tradable move may commence).

TTT helps you find the rhythm of the markets, and, if you study it and learn it and understand that it is a method, not a system, it will help you determine whether you should be looking more for long trades or short trades on a particular day.

Best Wishes,

ddaytrader

quote:

Originally posted by ddaytrader

First, I want to say that I am a friend of Rich's and I am a subscriber to his eBook.

Secondly, I want to state that I have no interest, financial or otherwise, in Rich's service. My only interest in his service is that he continues to offer it.

Today, TTT set my expectations for a lower low and then a rally, preferably to a price at, above, or just below the Buy Day low. The fact that price didn't reach that level is not a failure by TTT. The fact that the ES traded to a lower low than that projected by the averages over time is not a failure by TTT.

TTT gave any trader who uses it properly the "heads up" that a tradbale rally was likely to form during the day, and that such a rally would be more likely to occur than a tradable decline.

Using a set up that I have been using for years based on Fibs, Support/Resistance and momentum observations, I was twice able to go long. The first trade yielded 10 points profit on 1/2 of the position, and -2 points on 1/2 of the position. The second trade yielded +10 points on 1/2 of the position and +24.75 pints on 1/2 of the position. TTT did not provide me with the set-ups. TTT did not tell me "when" or at what price to go long (though, on some days, a TTT projection coincides with an important fib level or Support/Resistance level, and thus confirms a level as one from which a tradable move may commence).

TTT helps you find the rhythm of the markets, and, if you study it and learn it and understand that it is a method, not a system, it will help you determine whether you should be looking more for long trades or short trades on a particular day.

Best Wishes,

ddaytrader

I agree with your opinion of TTT. You are able to put things into words very well. Congradulations on a good day.

I hope it is ok to talk about stocks in this thread.

Using TTT I was able to buy Potash on the Canadian market yesterday at 157.00. I bought at that level since the stock was below the Buy day low and POT has a 91% positive 3 day rally. I got the rally today and was able to exit my position at 169.64, the mid range between the 2 predicted numbers. Thank you Rich for your Book as it gives me piece of mind and lowers the stress in my trading.

Yanya

Using TTT I was able to buy Potash on the Canadian market yesterday at 157.00. I bought at that level since the stock was below the Buy day low and POT has a 91% positive 3 day rally. I got the rally today and was able to exit my position at 169.64, the mid range between the 2 predicted numbers. Thank you Rich for your Book as it gives me piece of mind and lowers the stress in my trading.

Yanya

- Page(s):

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.