Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

- Page(s):

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

wish i had bought rich's ttt 895 on the es today

oh well !

oh well !

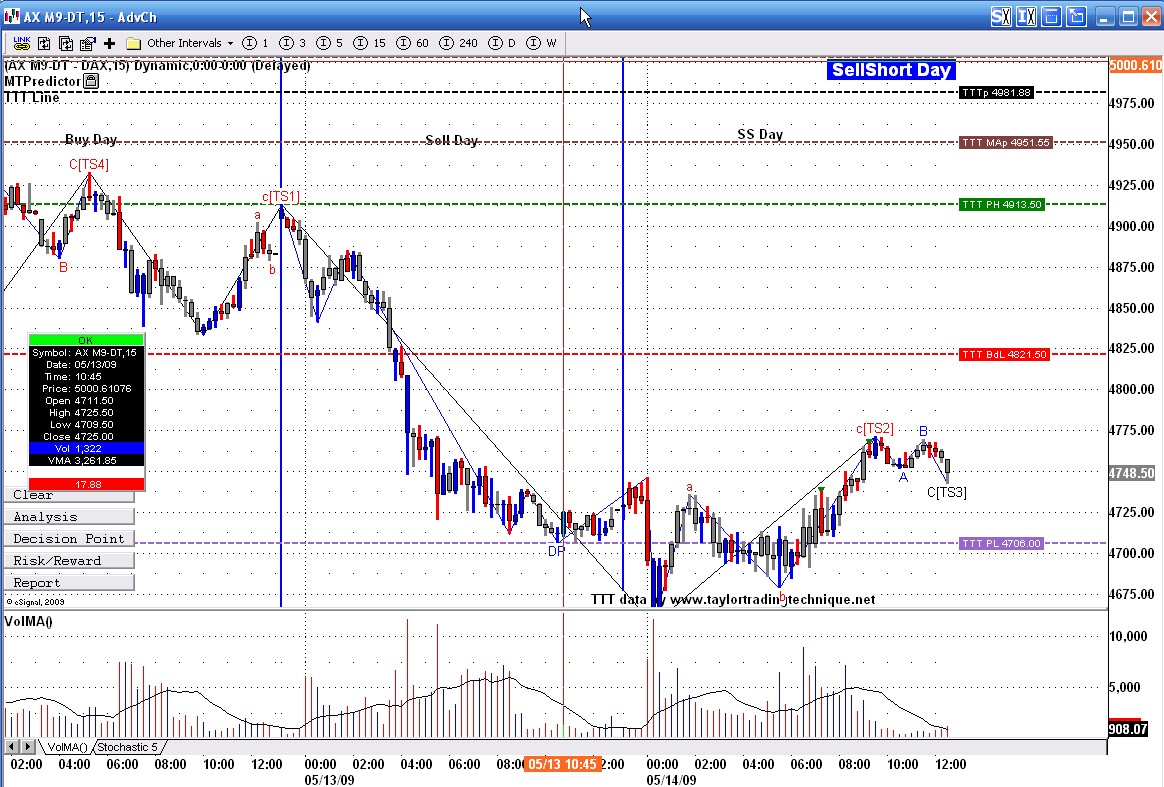

Following up on the DAX

Today was a Sell day.

DAX opened up with a gap which was reversed. It continued droping all day. You will notice that the MA violation line held the drop for a while and then the regular Violation line held.

Now tomorrow will be a SS day. We are way below the Buy day low and have very good odds of getting back to that level.

Although this looks like a tuff hill to climb I would expect at least a good old college try at it.

Today was a Sell day.

DAX opened up with a gap which was reversed. It continued droping all day. You will notice that the MA violation line held the drop for a while and then the regular Violation line held.

Now tomorrow will be a SS day. We are way below the Buy day low and have very good odds of getting back to that level.

Although this looks like a tuff hill to climb I would expect at least a good old college try at it.

Nice posts on the Euro markets, when these Buy Violations take place, does it indicate a turn in the trend to the downside or just a retracement in a rising trend, have you done any analysis on that?

From what I have observed is after BV sometimes it takes 3-4 days of rally for another great short, think in an uptrend and usually on the next Buy day.

From what I have observed is after BV sometimes it takes 3-4 days of rally for another great short, think in an uptrend and usually on the next Buy day.

yesterday rich's ttt said "Tomorrow is SS day. We do have 85% chance of getting at least back to the Buy day lows"

we are there now

awesome job rich !

we are there now

awesome job rich !

very nice looking format!

Well DAX tried to get back to the Buy day low and failed. Like I had mentioned it was a long climb.

US markets all made it back to the Buy day Low and as soon as the last one made it they reversed.

Failed 3 day rallies are normaly a sign the bears are back in charge.

US markets all made it back to the Buy day Low and as soon as the last one made it they reversed.

Failed 3 day rallies are normaly a sign the bears are back in charge.

Hi newbie here, and great job Rich.

How do you initially know which day is the start of the cycle? For example, today in US market, we rallied and closed at 892 on a SS day, which would mean tomorrow's decline will mark buying opportunity. However, it seems from yesterday and today's action that yesterday (wednesday) could've been buy day and today a sell day, which would make tomorrow a SS day with carrying shorts over the weekend. The high's and low's are really helpful, but I really would appreciate if someone could shine some light on how to know the start of a cycle as it could mean drastically different strategies (going short instead of long into the weekend).

Thanks.

How do you initially know which day is the start of the cycle? For example, today in US market, we rallied and closed at 892 on a SS day, which would mean tomorrow's decline will mark buying opportunity. However, it seems from yesterday and today's action that yesterday (wednesday) could've been buy day and today a sell day, which would make tomorrow a SS day with carrying shorts over the weekend. The high's and low's are really helpful, but I really would appreciate if someone could shine some light on how to know the start of a cycle as it could mean drastically different strategies (going short instead of long into the weekend).

Thanks.

quote:

Originally posted by mangakenny

Hi newbie here, and great job Rich.

How do you initially know which day is the start of the cycle? For example, today in US market, we rallied and closed at 892 on a SS day, which would mean tomorrow's decline will mark buying opportunity. However, it seems from yesterday and today's action that yesterday (wednesday) could've been buy day and today a sell day, which would make tomorrow a SS day with carrying shorts over the weekend. The high's and low's are really helpful, but I really would appreciate if someone could shine some light on how to know the start of a cycle as it could mean drastically different strategies (going short instead of long into the weekend).

Thanks.

As per Taylor when you start your trading book you take 10 days of data (Date OHLC) place that on your sheet. then take the lowest low and circle it. That becomes your Buy day. you then fill the rest as per sequence. Once the cycle is established the cycle dont change.

Yes we could have 3 different person starting a book at different dates and we could each have today as a different day of the cycle.

The trick is to learn how to trade each different day as they should.

Having said that I discovered something while creating my first trading book. That is the Positive 3 Day Rally. most of the instruments I follow have an 80-90% ratio. Every so often I run through the 3 possible scenarios to see if the cycle is correct. It is very rare that I find the need for a change.

If you started your book last night then May 1 would have been you Buy day and today would have been a Buy day. So you would have had a Buy day with the low made 1st and would have taken a trade long early today.

In my case the day was a SS day and having opened below the Buy day low I knew that we had great odds of at least getting back to these levels. and we did.

Looking at your idea of tomorrow being a SS day, that means you are expecting the market to drop and so do I. My reason is different then yours because I have a Buy day for tomorrow. On Buy days we need a Decline from the SS day high and having closed near these highs I would be looking for a test of these high and then a decline.

only difference is I would not be allowed to carry short position over the weekend. In your case Taylor would also look at the drop that he got on the SS day before holding that position over the weekend. In my case I am a day trader and never hold positions overnight let alone weekend.

I hope that helped

when these Buy Violations take place, does it indicate a turn in the trend to the downside or just a retracement in a rising trend, have you done any analysis on that?

In this case it has led to failed 3 day rally

In this case it has led to failed 3 day rally

quote:

Originally posted by simba

when these Buy Violations take place, does it indicate a turn in the trend to the downside or just a retracement in a rising trend, have you done any analysis on that?

In this case it has led to failed 3 day rally

I havent done a full analysis on that, however if my memory serves, it at least means a retracement. We havent had a real bull market since I started TTT data back in Jan 2008

- Page(s):

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.