Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

- Page(s):

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

Originally posted by Richbois

Originally posted by rigel

Well, on exit, did you have a huge smile on your face:)))

HB on ftse and dax this morning on a BUY day.

hard not to have a smile with that kind of trade :)

Hi Richbois,

is it possible for you to post a picture of that trade? As you know, I am an MTP user as well and just never seemed to be able to mesh Taylor and MTP together on a regular basis.( I am more of an MTP standard trader)I am still interested in the ways that you trade the two together. Thanks.

Brian

is it possible for you to post a picture of that trade? As you know, I am an MTP user as well and just never seemed to be able to mesh Taylor and MTP together on a regular basis.( I am more of an MTP standard trader)I am still interested in the ways that you trade the two together. Thanks.

Brian

Originally posted by bks777

Hi Richbois,

is it possible for you to post a picture of that trade? As you know, I am an MTP user as well and just never seemed to be able to mesh Taylor and MTP together on a regular basis.( I am more of an MTP standard trader)I am still interested in the ways that you trade the two together. Thanks.

Brian

Hi Brian

As you probably know, I dont use MTP in the pure conventional way.

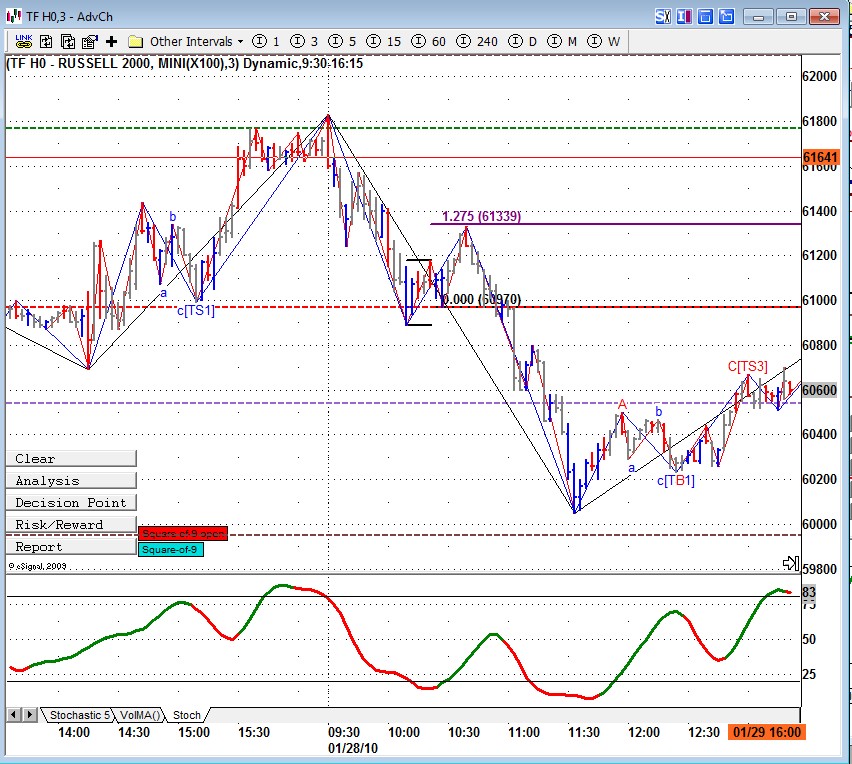

In this case there is no signal on the 3 min chart and there is probably one on the 1 min. However If you look at the minor wave pattern and put your own fib extensions on it, you see a very nice ABC. At this point since we were on a SS day and looking for any excuse to short due to the faliure on the PH, I was not looking for only conventional signal but also any thing that looked good.

I also use range charts where we had a TS2.

Thanks for posting Richbois.

Brian

Brian

Richbois,

SS DAY- my 3day rally projection of 1084 was achieved in the globex session and now the penetration projected price of 1092 has been breached.

Do these match your readings?

As there was no BV, I suppose you would refrain from taking long trades.

SS DAY- my 3day rally projection of 1084 was achieved in the globex session and now the penetration projected price of 1092 has been breached.

Do these match your readings?

As there was no BV, I suppose you would refrain from taking long trades.

Originally posted by rigel

Richbois,

SS DAY- my 3day rally projection of 1084 was achieved in the globex session and now the penetration projected price of 1092 has been breached.

Do these match your readings?

As there was no BV, I suppose you would refrain from taking long trades.

My lower level projection was 1082-6 and a normal projection of 1096-8

I also have penetration levels 1092-95

Today we tested the Sell day high and stayed above so it is a textbook SS day

As I may have mentioned, I only go by one month's data, hence my levels are not as accurate as yours, but I am only using them as guide. The main play of the day is more interest.

We expect rally on SS day, however I will have to re-read Taylor to see where the testing of Sell day high and staying above that is mentioned. Perhaps you know the page numbers or chapter.

When you say textbook SS day, did you take longs?

thought the textbook play was going short on high made first.

We expect rally on SS day, however I will have to re-read Taylor to see where the testing of Sell day high and staying above that is mentioned. Perhaps you know the page numbers or chapter.

When you say textbook SS day, did you take longs?

thought the textbook play was going short on high made first.

Originally posted by rigel

As I may have mentioned, I only go by one month's data, hence my levels are not as accurate as yours, but I am only using them as guide. The main play of the day is more interest.

We expect rally on SS day, however I will have to re-read Taylor to see where the testing of Sell day high and staying above that is mentioned. Perhaps you know the page numbers or chapter.

When you say textbook SS day, did you take longs?

thought the textbook play was going short on high made first.

I havent reread Taylor in long time so I cant quote the page,

I my case I trade TF and noticed at the open that NQ and ES had made the objective so I figured they would go higher in order for TF to get there.

My best trade was at 11.13 EST when we made a nice ABC down close to the PH so I went long on that one.

Fair enough, I take into price action as well to dictate entry, and adopt Taylor that way to todays markets, although it is not strictly Taylor method as per his book.

So when you said textbook SS day, that's somewhat puzzled me as SS day in the book is strictly for shorting, only longs were on BV.

So when you said textbook SS day, that's somewhat puzzled me as SS day in the book is strictly for shorting, only longs were on BV.

Originally posted by rigel

Fair enough, I take into price action as well to dictate entry, and adopt Taylor that way to todays markets, although it is not strictly Taylor method as per his book.

So when you said textbook SS day, that's somewhat puzzled me as SS day in the book is strictly for shorting, only longs were on BV.

maybe i need to read it again but the way i understand the basic part of TTT is we 1st look at the PH and PL for support and resistance than once that is broken we go for the next level. I have since added the BDL into the equation

That is the way I have managed to reduced his 95 page book to just a few pages.

I also changed many of his abreviations and standardised them.

IE: i gave up trying to remember all the code letters for every thing

BDV is Buy Day Violation

BDP is Buy day Penetration

same for each day

He was very hard to understand and I try to make it more simple, atleast for myself

- Page(s):

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.