Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

- Page(s):

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

quote:

Originally posted by simba

A SS day today, the market did not sell off much before buyers stepped in, some 10pt rise from the bottom, fast rally

According to Taylor there would be no long trade

as per TTT, presume long would be o.k if there was buy violation or is it just the penetraton of Sell day low.

We'll Rich did say we test yesterday's highs, based on the average 3 Day Rally.

But only one exception for longing according to Taylor on a Sell Short Day.

Good luck,

quote:

Originally posted by simba

A SS day today, the market did not sell off much before buyers stepped in, some 10pt rise from the bottom, fast rally

According to Taylor there would be no long trade

as per TTT, presume long would be o.k if there was buy violation or is it just the penetraton of Sell day low.

As per Taylor no longs even on the violation of Sell day low.

The only reason that I would consider that long at low is that yes the violation and mainly that we didn't get much of a 3 day rally.

Lets not forget that TTT is a framework and a guideline.

One can take any trade one wants to, however if it is against the rules then extra care should be used. IE: thighter stop and protect profits quicker.

Looks like an ideal SS day

sell short day today - this morning there was a test of sell day high to go short - rich's ttt possible high level for today was hit this morning providing a short entry

fantastic work on your rich's ttt

fantastic work on your rich's ttt

Yes guys so far a great SS day.

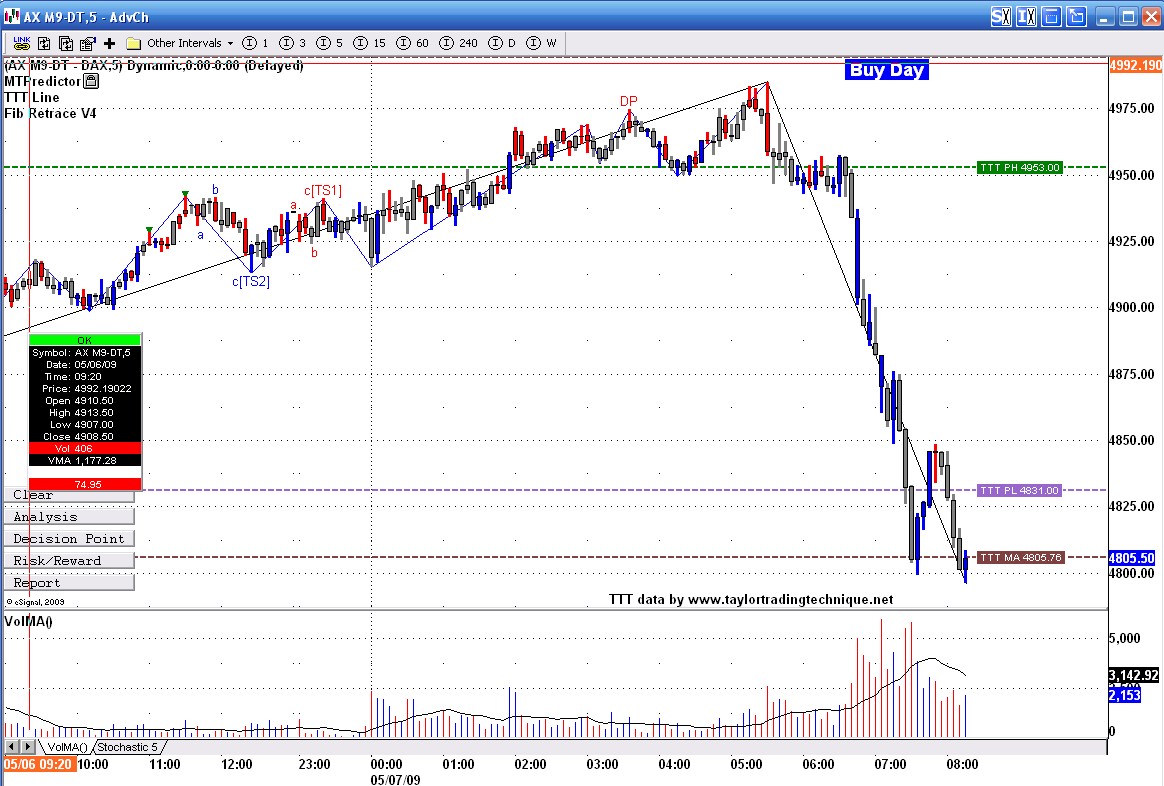

As mentioned in last night's email to subscribers, we still had room to go up to achieve the average 3 day rally. We opened right at the TTT levels for that and had a nice DP from the overnight action.

Nice short so far

As mentioned in last night's email to subscribers, we still had room to go up to achieve the average 3 day rally. We opened right at the TTT levels for that and had a nice DP from the overnight action.

Nice short so far

As this DP was only about a 1:1 R/R ratio and would not show up on charts without this filter turned off, could you elaborate on what other factors would prompt you to take this DP trade with the RR so low? Thanks.

quote:

Originally posted by acuity

As this DP was only about a 1:1 R/R ratio and would not show up on charts without this filter turned off, could you elaborate on what other factors would prompt you to take this DP trade with the RR so low? Thanks.

It was a test and failiure of the overnight high and it was right at TTT so for me it was worth the risk. I also entered the trade at 911.5. I exited at 903 since it was the 50% retracement of last wave up, day session.

I use MTP in a different way than what they teach, that is why I didn't even look at the RR. There also was numerous fibs at that level.

and, short again at rich's second possible high on sell short day

how sweet is that

awesome job rich !!!

how sweet is that

awesome job rich !!!

As the high was placed last yesterday, today a short would be in order on a Buy day

quote:

Originally posted by simba

As the high was placed last yesterday, today a short would be in order on a Buy day

Exactly if we dont get the decline on SS day then it has to come on Buy Day

Gapping up this morning was just an added bonus to help us find an excuse to short since we had 93% chance of atleast getting back below 918 on ES and wow what a move on DAX near 200 points

- Page(s):

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.