Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

- Page(s):

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

Durendal, As mentioned previously, it is the biggest mistake to take price action of the day and then designate that as a Buy day (if prices rose on that day) and SELL or SS day(if prices dropped all day).

Taylor's rules are quite clear and objective. It will take considerable effort to get your head around it at first:)))

I am afraid there just are no short cuts:

Study the thread on Taylor (80pages),

http://www.traderslaboratory.com/forums/f110/taylor-trading-technique-2623.html

all the clarification you need is there, focus on questions from Hakuna, Bearbull, Monad and responses from WHY?, Frank, Richbois, ignore all else especially posts by those who are trying to introduce any variations.

However initial exchanges between dogpile and WHY? are worthwhile, unfortunately despite lengthy clarifications, you will not that dogpile just did not get it:))) as he was constantly trying to fit the days action into the cycle.

Taylor's rules are quite clear and objective. It will take considerable effort to get your head around it at first:)))

I am afraid there just are no short cuts:

Study the thread on Taylor (80pages),

http://www.traderslaboratory.com/forums/f110/taylor-trading-technique-2623.html

all the clarification you need is there, focus on questions from Hakuna, Bearbull, Monad and responses from WHY?, Frank, Richbois, ignore all else especially posts by those who are trying to introduce any variations.

However initial exchanges between dogpile and WHY? are worthwhile, unfortunately despite lengthy clarifications, you will not that dogpile just did not get it:))) as he was constantly trying to fit the days action into the cycle.

Originally posted by rigel

Durendal, As mentioned previously, it is the biggest mistake to take price action of the day and then designate that as a Buy day (if prices rose on that day) and SELL or SS day(if prices dropped all day).

Taylor's rules are quite clear and objective. It will take considerable effort to get your head around it at first:)))

I am afraid there just are no short cuts:

Study the thread on Taylor (80pages),

http://www.traderslaboratory.com/forums/f110/taylor-trading-technique-2623.html

all the clarification you need is there, focus on questions from Hakuna, Bearbull, Monad and responses from WHY?, Frank, Richbois, ignore all else especially posts by those who are trying to introduce any variations.

However initial exchanges between dogpile and WHY? are worthwhile, unfortunately despite lengthy clarifications, you will note that dogpile just did not get it:))) as he was constantly trying to fit the days action into the cycle.

SOME QUOTES BY WHY?

"Post 101 “Keep it simple guys Taylor didn't need all that nor did he have the computer. He just sought to capture the main trend each day. He woudn't have known what you guys talking about.”

Post 306 “Of course, the key in Taylor is how do you start the count and do you allow re-cycling and if so, how do you determine when to re-cycle and how long does the re-cycling last. Of course, these are keys that I won't be revealing. However, I might say this; if my explanation confuses you then simply learn Taylor well...follow his rules...keep his sequence...and I think you will be pleased with the results providing you are disciplined and can trade on facts and on what the market is doing and not on emotions. Taylor, I like to say, devised a system to "clock" price movement in the markets and it is a pretty good system in my books with a high win rate (at least for me) if one can understand it and follow it...especially the rules. Read the book and study it 50 or more times over the course of a couple of years. I have many trading books. If I were forced to keep one it would be Taylor, no if, ands, or buts about it!!”

]

"Post 101 “Keep it simple guys Taylor didn't need all that nor did he have the computer. He just sought to capture the main trend each day. He woudn't have known what you guys talking about.”

Post 306 “Of course, the key in Taylor is how do you start the count and do you allow re-cycling and if so, how do you determine when to re-cycle and how long does the re-cycling last. Of course, these are keys that I won't be revealing. However, I might say this; if my explanation confuses you then simply learn Taylor well...follow his rules...keep his sequence...and I think you will be pleased with the results providing you are disciplined and can trade on facts and on what the market is doing and not on emotions. Taylor, I like to say, devised a system to "clock" price movement in the markets and it is a pretty good system in my books with a high win rate (at least for me) if one can understand it and follow it...especially the rules. Read the book and study it 50 or more times over the course of a couple of years. I have many trading books. If I were forced to keep one it would be Taylor, no if, ands, or buts about it!!”

]

Originally posted by rigel

SOME QUOTES BY WHY?

"Read the book and study it 50 or more times over the course of a couple of years. I have many trading books. If I were forced to keep one it would be Taylor, no if, ands, or buts about it”

I had to re read the 1st 4 chapters more than 100 times just to start my trading book. Than read the rest of the book many times just to understand the stuff that is written between the lines

There is lots of good stuff on that thread and as a matter of fact I copied lots of Frank's quotes in my book (with his permission of course) and he was using market profile to mix with Taylor which i had to take out as I was trying to explain Taylor not MP

We all have a different tool box and what I can see is that TTT toll must be part of it

Have a great weekend all

Good stuff guys thanks a lot.

So...in a sell day like today: Do you expect a rally or a break of yesterday's lows first?

Originally posted by Durendal

So...in a sell day like today: Do you expect a rally or a break of yesterday's lows first?

if today was a Sell day I would anticipate a test of yesterday's lows before the rally would start. That was done once overnight and may happen again during day session.

However today is a Buy day. The same scenario may happen because most of the Decline happened yesterday on the SS day

Thanks Richbois. It seems I can't even count to 3!

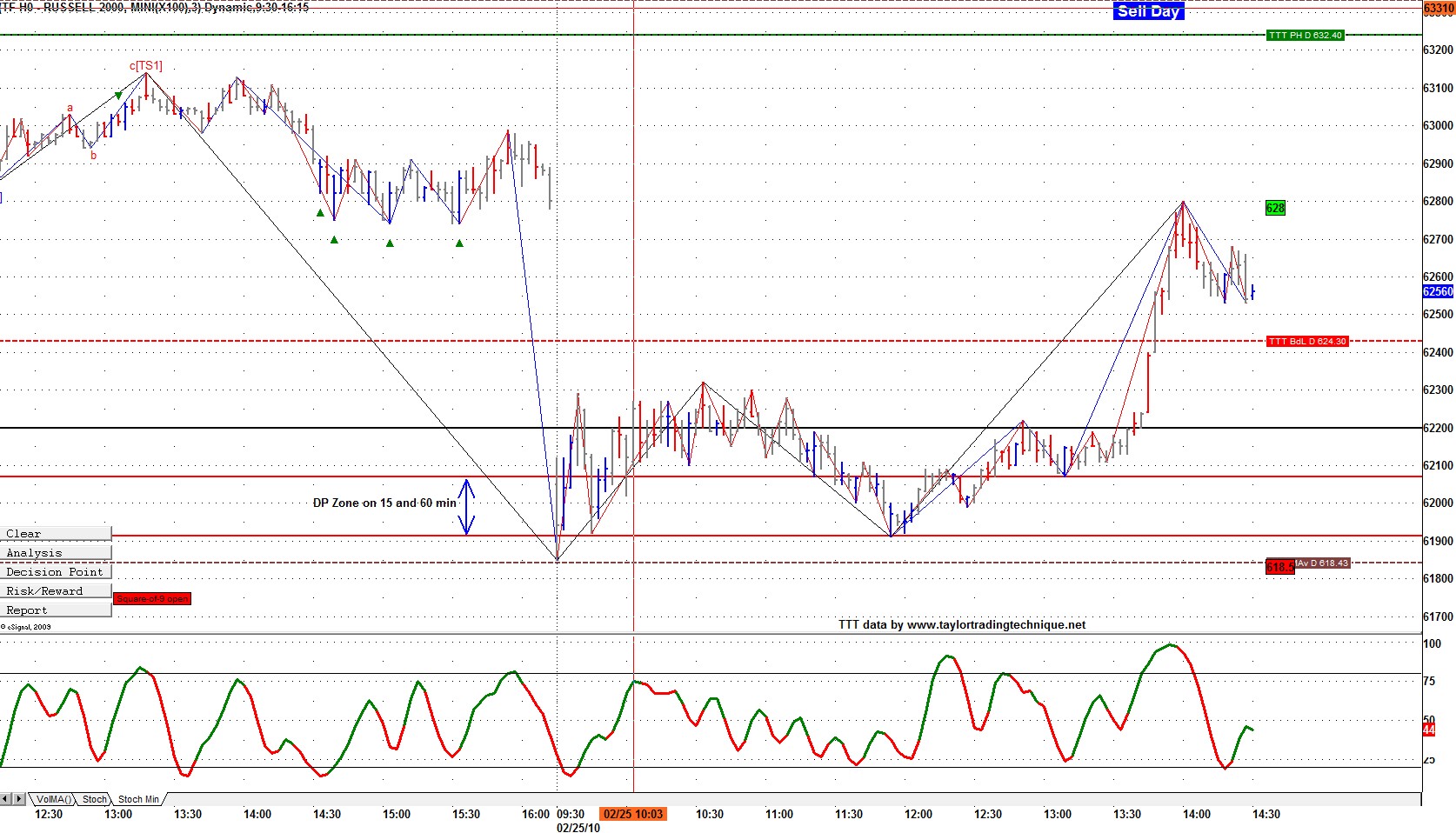

Today was a nice Sell day we opened below the Buy day Low and we know we have good odds of at least getting back above that level.

TF open in the DP zone and hit the TTT MAv right on the button.

Nice long that was

TF open in the DP zone and hit the TTT MAv right on the button.

Nice long that was

Nice trade Richbois.

What/how do you use the stochastic for?

What/how do you use the stochastic for?

- Page(s):

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.