Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

- Page(s):

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

It is a fundamental misconception regarding TT to think in terms of shorting on a Sell and SS day and going long on Buy Day.

In fact as Richbois has explained, we expect rallies on Sell day to sell into, ie. to exit long positions and then get into shorts on SS day again on rallies.

OTOH on Buy day a decline is expected to get into Longs.

However this is the ideal cycle which usually is seen in sideways market, in trending markets, the cycle is not so ideal and Taylors had rules to govern trading in that environment.

Hence the study of his book is a must, but it is not an easy read.

The best explanations have been provided by WHY? on the following link at Traders Lab, in response to countless questions. here ignore all else (with the exception of posts by Richbois and Frank)

http://www.traderslaboratory.com/forums/f110/taylor-trading-technique-2623.html

In fact as Richbois has explained, we expect rallies on Sell day to sell into, ie. to exit long positions and then get into shorts on SS day again on rallies.

OTOH on Buy day a decline is expected to get into Longs.

However this is the ideal cycle which usually is seen in sideways market, in trending markets, the cycle is not so ideal and Taylors had rules to govern trading in that environment.

Hence the study of his book is a must, but it is not an easy read.

The best explanations have been provided by WHY? on the following link at Traders Lab, in response to countless questions. here ignore all else (with the exception of posts by Richbois and Frank)

http://www.traderslaboratory.com/forums/f110/taylor-trading-technique-2623.html

Sometime back made notes from posts by WHY?

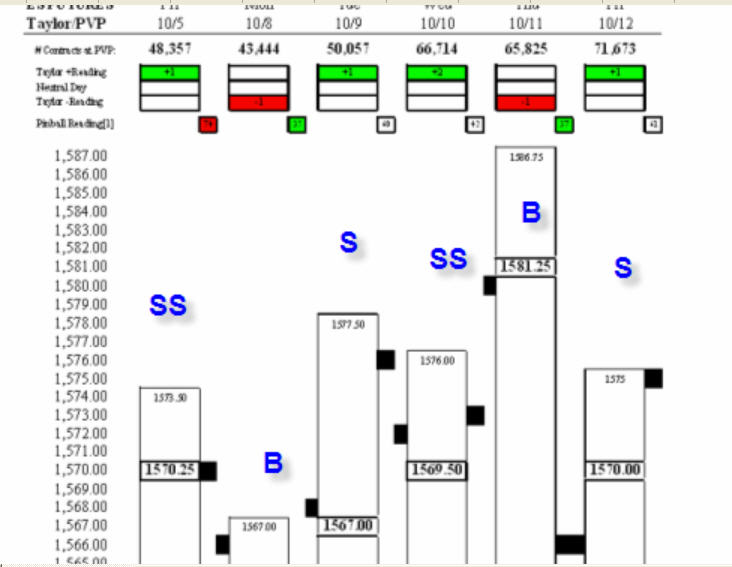

No, 10-11-07 was a BUY day. Taylor was basically a swing trader. However, his system can be used for daytrading (in a limited sense), swing trading, and trend trading. However, the way it is used in daytrading is that you only try to find the main trend for the day and ride that trend. On the buy day, you might be able to capture two moves, or trends. You are allowed to short and to go long under certain conditions on the buy day. On the sell day under certain conditions you can go long but the sell day is mostly reserved for selling longs acquired on the previous day (buy day). The Short sell day (ss day) is only for selling short. No longs on that day.. His system is an EOD system. It is not about trading many intraday cross currents on 2min charts. However, Taylor was about catching that one or two main trends of the day. Lets look at the action on and near 10-11-07

We see that 10-11-07 was a BUY day. On a buy day, per Taylor rules, if the high is made first I am allowed to short it. Then AFTER the high is made IF it trades down and makes its low, and does so early in the session, (by 11:00 or at latest 12:00) then I can go long too.. If the low is made after 12:00 then one cannot take a long position simply because it may close weak, or near its low. You don't want to carry a long overnight with a weak close on a buy day if you can help it. Remember, most longs purchased on a buy are held overnight and one would try to sell them the next session of the cycle (sell day). There is one exception to this. If you go long on a buy day before noon and then it heads up fast and hard, then sell out on the peak because the next day prices could drop. In such a case you wouldn't want to hold the long overnight. It could continue on up the next day but the odds favor it heading back down after such a forceful rise. So what happened on 10-11?

First, on 10-10 -07 to me we had been in an uptrend and that the velocity had picked up. Also, we had a high close on 10-10-07. In addition, the previous buy day 10-8-07 made what Taylor terms an HB or higher bottom. That is, the low on 10-8-07 was higher than the low of the previous session. According to Taylor HB's are usually profitable therefore a bit bullish. Also the close on the SS day 10-10-07 was higher than the close on the previous day too 10-09-07 (a sell day). All this indicates strength.

Taking all this into account, I would be looking for a penetration 10-10-07's high on 10-11-07 and I would expect it early in the session. I am armed with my potential high points but the final factor is the tape. That makes the decision for my entry. The market opens on 10-11-07. It immediately begins trading up. It breaks thru my first high, second high, third high, and fourth high. I have no choice but to wait for the rise to slack off. However, please note the pattern is "right" for shorting a buy day. It traded up early and in Taylors lingo penetrated the high of the previous day (10-10-07 an SS day). Now, note my strategy is to go short because it fits the pattern. Remember, on the close of 10-10-07 , I was already anticipating the pattern by the high close, uptrend, and increasing velocity and the other things mentioned above. So, I watch the tape on 10-11-07. It starts to tank out and I short at 1584. It trades on up to 1586 but I am not stopped out. Then the decline begins shortly after 1:00 p.m. and is in full swing by 1:30. It is a steep decline. I know I must cover the same day as Taylors rules require that I do, especially, on such a fast decline. I also know that this is my ONLY play for the day in ES. I CANNOT go long because here we are in the afternoon (it is past 12:00) on a fast decline and most probably will end up with a weak close. So, my long play is scratched. I know this. It has also broken south of all the fib levels, so this is a weak market. I don't want to be caught long in it. Taylors rules don't allow a long position to be taken here, even though it is down, and one might think it will rise. But to go long in this weak market is dangerous. So, I pay close attention to the tape and try to capture as much of the decline as I can. By 2:30 to just before 3:00 it is trading low enough. I am out of the short at 1559 close to 3:00. I captured 25 pts. That is a big slice out of the days range. Do that on two or three cars and you made some dinero. Why mess around going in/out 10 times that day when what Taylor taught is to catch the main trend? Now, if after

I shorted that early high, then it traded down, and made the low, and did all that before noon, I would have covered my short, and gone long and would probably hold that long overnight, UNLESS it rallied hard off that low before closing on

10-11-07. If it rallied hard I would sell my long and be flat by the end of the day. IN such a case I would have made two plays that day. A short and a long. If on the other hand, it worked it way back up slowly after I went long, and closed say in the middle of the range on 10-11-07, I would hold that long overnight and try to sell it on the next day 11-12-07 (which is a sell day in the cycle). I prefer, and Taylor would also to see the long play within the 1 to 2 hours of the open. It is best to never push the rules past 1:00. The odds are greatly against you after this hour.

Yet some good money was made by sticking to the rules and making this

To sum up: Here is a day that is less than the ideal pattern. trade the way Taylor would have made it...i.e. capture as much of the main trend of the day that you can. And don't get caught in the many cross currents of the day. Know what you are anticipating. Look for it and correlate that with the actual tape. Always look to capture a goodly slice of the main trend.

Remember, the ideal pattern on a buy day is to FIRST trade down, make its low, trade up and close high. One would buy on or near that ideal pattern's low and hold that long overnight to close on shortly after the open on the next day (sell day). In the above case we have a less than ideal pattern that fetched some good money for us by following Taylors rules. To trade Taylor you do not need charts (but you can use them if you like). You really just need the rules and know how to apply them in the context of the cycle and the open, high, low, close. I do think Taylor could be enhanced with an understanding of Price/vol relationships ie. Wyckoff.

I would not know how to apply Taylor intraday on the many cross currents and I do not know IF it can even be done. That would be in effect saying that the "smart money" is also using mini swing low/swing high cycles intraday that can be understood by applying Taylor concepts to them. I think that would be taking things a bit further than what Taylor intended.. But reading the many intraday cycles up and down and applying Taylor to them ...well ..I have my doubts that it would work but it would be interesting to see if it would. Taylors method dealt with price manipulation from a longer time frame than say a 15 minute chart..etc.

So, 10 – 12, Friday = Sell Day

10 - 15 = SS day

10 - 16 = Buy day

10 - 17 = Sell day

Lets say for conversation that 10-17 WAS a BUY. It wasn't, but to answer your question, lets say it was. Taylor would have made a short play and possibly a long play. The gap up would have been the opportunity for shorting, once the tape indicated a slowing down. Taylor allowed shorting on a buy day. He also would allow going long on a buy day. By 12:30 it had dropped enough that had 10-17 been a buy day I would have probably looked at going long after covering my short. I know that is pressing the rules, but with the rather fast steep decline and it still a few hours from the close, I would have taken my chances. I prefer, and Taylor would also to see the long play within the 1 to 2 hours of the open. It is best to never push the rules past 1:00. The odds are greatly against you after this hour.

What really happened:

10-17 was a sell day. You can't go long on a sell day UNLESS a BV is made. You also don't short on a sell day. So, it would have been pushing the outer limits of rules to take the long BV play but a BV did take place by 12:30. One could have entered a long position at around 1538 with a stop loss at 1532 or so (tightest stoploss you would use). It traded lower after that but not enough to take you out of your position. Then it headed back up. On a BV the idea is to sell your long position the SAME day on any penetration of the PREVIOUS day's (10-16) low which was 1545.20. So, on this sell day 10-17 one would have taken the long BV opportunity and shortly been out of the market the same day capturing 7 to 16 pts depending on when you took your exit.

--------------------------------------------------------------------------------------------------------

Question: What Taylor does on the 'day after' -- when a buy day ends up trading High first

I answered that already in a previous post but you short it and hope to also go long, all before noon.

Question:

or the day after a sell day when the sell short day trades low first, high last

You do absolutely nothing. You pass. Why, you wait for the next day (buy day) for a good shorting opportunity. Never go long a short sell day. Why? you might get caught in the wrong trend. You might get lucky and get away with it but there will be a day you get hammered. It could trade down on the SS day, close weak or near the low, and never trade back up. That would indicate a weak market and an upcoming BU on the next day (a buying day) and you are better to go long on that buying day instead of taking the chance on the previous SS day. Maybe a quote from Mr taylor will help clarify. p30 "Now, we go back to the close of the Short sell day and we find that is was a flat closing, then from this indication we expect a lower opening on the buying day and so far this would cause the low to be made FIRST (on the next day i.e. the buying day) and is a stronger indication when made early in the session (on the buying day) that a rally would start from this low (on the buying day) and hold the gains for a strong closing, which in turn indicates an up opening (on the sell day) and a penetration of the selling day objective- the buy day high" . There you have it! Mr Taylors reasons for not going long on a SS day. It could close weak. His reason for not going short on an SS day high made last is because it is best to short it on a buy day high made first (next day since the trend is up).

Taylor said and I quote "one of the fundamentals of speculation-to be able to protect your capital and be in a position to act on a more favorable opportunity when it comes along" p63

He also said "Never make a trade unless it favors your play" p11 Another one... "he must not and cannot ignore the prices printed on the tape"... here is a good one..... "you can believe the tape at all times, learn to read it and believe in nothing else for short term trading"...and ..."the real heart reading the tape is to be able to detect concentrated buying and selling and to the determine the trend of the prices"p12

Here is a Taylor quote that cracks me up "The intent has been to keep the method as simple as possible". Now that is funny! On the other hand, it is hard to make something simple. Ask any teacher.

I might say this: Taylors system is a comprehensive system that "clocks" price movement itself (without use of indicators) and then determines probable future price (or anticipates...) based upon those calculations. However, it is my belief that knowing how to read the tape greatly enhances Taylors method. Tape reading is the final thing that determines entry and exit prices. I would recommend reading any books on tape reading. I have long ceased to look at chart patterns. (they make work for some but I can't get it right...I hate candlesticks).. I have trained semi-literate people to use Taylor in about 3 weeks using my software. The basics, that is. Enough to get them up and trading. I am talking here about people that have never bought or sold stock and didn't even really know what stocks were. I had to use examples with them like going to the market to buy oranges or tomatoes. And supply/demand in the markets where vegetables are bought and sold daily. Trying to explain shorting to them was fun! I say this to say that you don't have to be highly educated to trade like Taylor. Granted the average person would struggle with his book but his concepts really aren't that complicated. He just words things, in hard to understand ways. It took me quite a while to get my dad to understand how you make money when something goes down in price---------------------------------------------

However, the rules do matter for all day including the buy day also because "how" it does whatever it does, is important and the rules can help you there.***** Also, the rules for each day, in themselves, help to anticipate the next day. For instance, never buy a low close on a SS day helps you to anticipate a BU on the next day.

******Also, buying a HB( on a buying day) helps you to anticipate bullish prices as being most likely ahead for the next few days because an HB is usually profitable.

******Buying on a BV helps one to see that the market is weak and may continue that weakness and it may take two or three sessions before it is back to making penetrations of the buy day high on the sell days and of the sell day highs on the SS days, so you would think in terms of adjusting your strategies to reflect or anticipate the next day. Maybe this makes sense?? Anyway, it all works together. The rules are important for each day. It is not "just" that the price was made first or last but it is also "how" the price was made that helps you to anticipate and what that tells you about the next sessions or next few sessions. Page 15, and page 89 in the book should answer your question. Taylors method was his manner of tracking the markets and staying on the right side of the trend. He developed the rules to help him do this. There may be ways to modify his system without hurting the underlying integrity of it. That is, playing around with the days and seeing what happens. All I know is that Taylors way is as good, if not better, than the other modifications I have seen of his method and as good as my messing around with the days.

No, 10-11-07 was a BUY day. Taylor was basically a swing trader. However, his system can be used for daytrading (in a limited sense), swing trading, and trend trading. However, the way it is used in daytrading is that you only try to find the main trend for the day and ride that trend. On the buy day, you might be able to capture two moves, or trends. You are allowed to short and to go long under certain conditions on the buy day. On the sell day under certain conditions you can go long but the sell day is mostly reserved for selling longs acquired on the previous day (buy day). The Short sell day (ss day) is only for selling short. No longs on that day.. His system is an EOD system. It is not about trading many intraday cross currents on 2min charts. However, Taylor was about catching that one or two main trends of the day. Lets look at the action on and near 10-11-07

We see that 10-11-07 was a BUY day. On a buy day, per Taylor rules, if the high is made first I am allowed to short it. Then AFTER the high is made IF it trades down and makes its low, and does so early in the session, (by 11:00 or at latest 12:00) then I can go long too.. If the low is made after 12:00 then one cannot take a long position simply because it may close weak, or near its low. You don't want to carry a long overnight with a weak close on a buy day if you can help it. Remember, most longs purchased on a buy are held overnight and one would try to sell them the next session of the cycle (sell day). There is one exception to this. If you go long on a buy day before noon and then it heads up fast and hard, then sell out on the peak because the next day prices could drop. In such a case you wouldn't want to hold the long overnight. It could continue on up the next day but the odds favor it heading back down after such a forceful rise. So what happened on 10-11?

First, on 10-10 -07 to me we had been in an uptrend and that the velocity had picked up. Also, we had a high close on 10-10-07. In addition, the previous buy day 10-8-07 made what Taylor terms an HB or higher bottom. That is, the low on 10-8-07 was higher than the low of the previous session. According to Taylor HB's are usually profitable therefore a bit bullish. Also the close on the SS day 10-10-07 was higher than the close on the previous day too 10-09-07 (a sell day). All this indicates strength.

Taking all this into account, I would be looking for a penetration 10-10-07's high on 10-11-07 and I would expect it early in the session. I am armed with my potential high points but the final factor is the tape. That makes the decision for my entry. The market opens on 10-11-07. It immediately begins trading up. It breaks thru my first high, second high, third high, and fourth high. I have no choice but to wait for the rise to slack off. However, please note the pattern is "right" for shorting a buy day. It traded up early and in Taylors lingo penetrated the high of the previous day (10-10-07 an SS day). Now, note my strategy is to go short because it fits the pattern. Remember, on the close of 10-10-07 , I was already anticipating the pattern by the high close, uptrend, and increasing velocity and the other things mentioned above. So, I watch the tape on 10-11-07. It starts to tank out and I short at 1584. It trades on up to 1586 but I am not stopped out. Then the decline begins shortly after 1:00 p.m. and is in full swing by 1:30. It is a steep decline. I know I must cover the same day as Taylors rules require that I do, especially, on such a fast decline. I also know that this is my ONLY play for the day in ES. I CANNOT go long because here we are in the afternoon (it is past 12:00) on a fast decline and most probably will end up with a weak close. So, my long play is scratched. I know this. It has also broken south of all the fib levels, so this is a weak market. I don't want to be caught long in it. Taylors rules don't allow a long position to be taken here, even though it is down, and one might think it will rise. But to go long in this weak market is dangerous. So, I pay close attention to the tape and try to capture as much of the decline as I can. By 2:30 to just before 3:00 it is trading low enough. I am out of the short at 1559 close to 3:00. I captured 25 pts. That is a big slice out of the days range. Do that on two or three cars and you made some dinero. Why mess around going in/out 10 times that day when what Taylor taught is to catch the main trend? Now, if after

I shorted that early high, then it traded down, and made the low, and did all that before noon, I would have covered my short, and gone long and would probably hold that long overnight, UNLESS it rallied hard off that low before closing on

10-11-07. If it rallied hard I would sell my long and be flat by the end of the day. IN such a case I would have made two plays that day. A short and a long. If on the other hand, it worked it way back up slowly after I went long, and closed say in the middle of the range on 10-11-07, I would hold that long overnight and try to sell it on the next day 11-12-07 (which is a sell day in the cycle). I prefer, and Taylor would also to see the long play within the 1 to 2 hours of the open. It is best to never push the rules past 1:00. The odds are greatly against you after this hour.

Yet some good money was made by sticking to the rules and making this

To sum up: Here is a day that is less than the ideal pattern. trade the way Taylor would have made it...i.e. capture as much of the main trend of the day that you can. And don't get caught in the many cross currents of the day. Know what you are anticipating. Look for it and correlate that with the actual tape. Always look to capture a goodly slice of the main trend.

Remember, the ideal pattern on a buy day is to FIRST trade down, make its low, trade up and close high. One would buy on or near that ideal pattern's low and hold that long overnight to close on shortly after the open on the next day (sell day). In the above case we have a less than ideal pattern that fetched some good money for us by following Taylors rules. To trade Taylor you do not need charts (but you can use them if you like). You really just need the rules and know how to apply them in the context of the cycle and the open, high, low, close. I do think Taylor could be enhanced with an understanding of Price/vol relationships ie. Wyckoff.

I would not know how to apply Taylor intraday on the many cross currents and I do not know IF it can even be done. That would be in effect saying that the "smart money" is also using mini swing low/swing high cycles intraday that can be understood by applying Taylor concepts to them. I think that would be taking things a bit further than what Taylor intended.. But reading the many intraday cycles up and down and applying Taylor to them ...well ..I have my doubts that it would work but it would be interesting to see if it would. Taylors method dealt with price manipulation from a longer time frame than say a 15 minute chart..etc.

So, 10 – 12, Friday = Sell Day

10 - 15 = SS day

10 - 16 = Buy day

10 - 17 = Sell day

Lets say for conversation that 10-17 WAS a BUY. It wasn't, but to answer your question, lets say it was. Taylor would have made a short play and possibly a long play. The gap up would have been the opportunity for shorting, once the tape indicated a slowing down. Taylor allowed shorting on a buy day. He also would allow going long on a buy day. By 12:30 it had dropped enough that had 10-17 been a buy day I would have probably looked at going long after covering my short. I know that is pressing the rules, but with the rather fast steep decline and it still a few hours from the close, I would have taken my chances. I prefer, and Taylor would also to see the long play within the 1 to 2 hours of the open. It is best to never push the rules past 1:00. The odds are greatly against you after this hour.

What really happened:

10-17 was a sell day. You can't go long on a sell day UNLESS a BV is made. You also don't short on a sell day. So, it would have been pushing the outer limits of rules to take the long BV play but a BV did take place by 12:30. One could have entered a long position at around 1538 with a stop loss at 1532 or so (tightest stoploss you would use). It traded lower after that but not enough to take you out of your position. Then it headed back up. On a BV the idea is to sell your long position the SAME day on any penetration of the PREVIOUS day's (10-16) low which was 1545.20. So, on this sell day 10-17 one would have taken the long BV opportunity and shortly been out of the market the same day capturing 7 to 16 pts depending on when you took your exit.

--------------------------------------------------------------------------------------------------------

Question: What Taylor does on the 'day after' -- when a buy day ends up trading High first

I answered that already in a previous post but you short it and hope to also go long, all before noon.

Question:

or the day after a sell day when the sell short day trades low first, high last

You do absolutely nothing. You pass. Why, you wait for the next day (buy day) for a good shorting opportunity. Never go long a short sell day. Why? you might get caught in the wrong trend. You might get lucky and get away with it but there will be a day you get hammered. It could trade down on the SS day, close weak or near the low, and never trade back up. That would indicate a weak market and an upcoming BU on the next day (a buying day) and you are better to go long on that buying day instead of taking the chance on the previous SS day. Maybe a quote from Mr taylor will help clarify. p30 "Now, we go back to the close of the Short sell day and we find that is was a flat closing, then from this indication we expect a lower opening on the buying day and so far this would cause the low to be made FIRST (on the next day i.e. the buying day) and is a stronger indication when made early in the session (on the buying day) that a rally would start from this low (on the buying day) and hold the gains for a strong closing, which in turn indicates an up opening (on the sell day) and a penetration of the selling day objective- the buy day high" . There you have it! Mr Taylors reasons for not going long on a SS day. It could close weak. His reason for not going short on an SS day high made last is because it is best to short it on a buy day high made first (next day since the trend is up).

Taylor said and I quote "one of the fundamentals of speculation-to be able to protect your capital and be in a position to act on a more favorable opportunity when it comes along" p63

He also said "Never make a trade unless it favors your play" p11 Another one... "he must not and cannot ignore the prices printed on the tape"... here is a good one..... "you can believe the tape at all times, learn to read it and believe in nothing else for short term trading"...and ..."the real heart reading the tape is to be able to detect concentrated buying and selling and to the determine the trend of the prices"p12

Here is a Taylor quote that cracks me up "The intent has been to keep the method as simple as possible". Now that is funny! On the other hand, it is hard to make something simple. Ask any teacher.

I might say this: Taylors system is a comprehensive system that "clocks" price movement itself (without use of indicators) and then determines probable future price (or anticipates...) based upon those calculations. However, it is my belief that knowing how to read the tape greatly enhances Taylors method. Tape reading is the final thing that determines entry and exit prices. I would recommend reading any books on tape reading. I have long ceased to look at chart patterns. (they make work for some but I can't get it right...I hate candlesticks).. I have trained semi-literate people to use Taylor in about 3 weeks using my software. The basics, that is. Enough to get them up and trading. I am talking here about people that have never bought or sold stock and didn't even really know what stocks were. I had to use examples with them like going to the market to buy oranges or tomatoes. And supply/demand in the markets where vegetables are bought and sold daily. Trying to explain shorting to them was fun! I say this to say that you don't have to be highly educated to trade like Taylor. Granted the average person would struggle with his book but his concepts really aren't that complicated. He just words things, in hard to understand ways. It took me quite a while to get my dad to understand how you make money when something goes down in price---------------------------------------------

However, the rules do matter for all day including the buy day also because "how" it does whatever it does, is important and the rules can help you there.***** Also, the rules for each day, in themselves, help to anticipate the next day. For instance, never buy a low close on a SS day helps you to anticipate a BU on the next day.

******Also, buying a HB( on a buying day) helps you to anticipate bullish prices as being most likely ahead for the next few days because an HB is usually profitable.

******Buying on a BV helps one to see that the market is weak and may continue that weakness and it may take two or three sessions before it is back to making penetrations of the buy day high on the sell days and of the sell day highs on the SS days, so you would think in terms of adjusting your strategies to reflect or anticipate the next day. Maybe this makes sense?? Anyway, it all works together. The rules are important for each day. It is not "just" that the price was made first or last but it is also "how" the price was made that helps you to anticipate and what that tells you about the next sessions or next few sessions. Page 15, and page 89 in the book should answer your question. Taylors method was his manner of tracking the markets and staying on the right side of the trend. He developed the rules to help him do this. There may be ways to modify his system without hurting the underlying integrity of it. That is, playing around with the days and seeing what happens. All I know is that Taylors way is as good, if not better, than the other modifications I have seen of his method and as good as my messing around with the days.

Today was a BUY Day, after initial decline price action dictated long at previous day low.

Originally posted by Durendal

As an example of what I was trying to convey:

Today is SS day. Weakness yesterday's late afternoon indicates the decline started. Rather than overthinking, let's assume a short on yesterday's close at 1063.50, with the intention of catching a decline to the buy day low (tomorrow). By the close today we'll know if we lose or win. The overnight has been higher (1071.50), so no problem in shorting 1063.50 or better. Assume a full day's time risk and see what happens.

Maybe one can refine this later with the use of pivot levels and what not. Just an approach for those that do not wish to monitor a short term 1' or 5' chart with thousand possible entries.

well it can work but we never know if we are going to get the full extent of the decline. Today we got the minimum at 1057.50 so you wud get 6 points of profits but at what risk, your stop had to be more than 8 points away.

For me that is not good risk reward ratio

Originally posted by rigel

Today was a BUY Day, after initial decline price action dictated long at previous day low.

did you copy the whole thread LOL

and yes that was the trade of the day as ES and NQ was at my average decline projection and close to PL

OK guys. Thanks for the info. My count had yesterday as SS day. Obviously I must read more.

RICHBOIS,

Monday being President's day, do you skip the day and designate today as Sell short day or keep the same cycle and consider today as a BUY day.

Ofcourse Europe was trading yesterday and the day panned out as a SS day.

Monday being President's day, do you skip the day and designate today as Sell short day or keep the same cycle and consider today as a BUY day.

Ofcourse Europe was trading yesterday and the day panned out as a SS day.

Originally posted by rigel

RICHBOIS,

Monday being President's day, do you skip the day and designate today as Sell short day or keep the same cycle and consider today as a BUY day.

Ofcourse Europe was trading yesterday and the day panned out as a SS day.

yes Monday was a SS day in the US since it was open for part of the day.

Looks like today maybe a tough Buy day if we open at the current levels and so far Europe didnt get much of a decline

On FTSE daily chart, prices are in shortterm uptrend, broken the downward trend, and breakout of yesterday inside day., hence not much decline this morning

however both short and long trades were there as per Taylor for a BUY day

however both short and long trades were there as per Taylor for a BUY day

Originally posted by rigel

On FTSE daily chart, prices are in shortterm uptrend, broken the downward trend, and breakout of yesterday inside day., hence not much decline this morning

however both short and long trades were there as per Taylor for a BUY day

And so far today the rally is continuing as a Sell day should

- Page(s):

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.