Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

- Page(s):

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

quote:

Originally posted by simba

Rich, you say 3 day rally was small, thought 3 day rally was measured from buy day low to ss day high, but here we are talking about it before the end of the SS day. somewhat confusing.

You are correct as to the measurement of the 3 day rally.

When we opened yesterday we had a positive 3 day rally at that point and the markets could have gone down all day and still produce a positive 3 day rally. However based on statistics the average 3 day rally should be greater than the few points we had at the open and therefore long positions could be taken but with extra caution.

thks rich,

guess today is one of those days when all levels get blown away, could be because of this big meeting in London G20 coming out with pledges of injecting cash , at least on paper.

guess today is one of those days when all levels get blown away, could be because of this big meeting in London G20 coming out with pledges of injecting cash , at least on paper.

quote:

Originally posted by simba

thks rich,

guess today is one of those days when all levels get blown away, could be because of this big meeting in London G20 coming out with pledges of injecting cash , at least on paper.

Yes they messed up TTT no decline on a Buy day very rare.

anyone have the win ratio numbers for theTTT?

quote:

Originally posted by maximaken

anyone have the win ratio numbers for theTTT?

I dont think any one can say that TTT has a winning ratio.

The reason is that TTT is not a blackbox system that will tell you buy here sell there.

What TTT does is give you a framework to help you improve your own winning ratio.

I can tell you that some of my customers that had a 60-65% winning ratio before TTT have now improved their ratio to over 85%.

TTT gives you a bias for the day together with potential support and resistance levels. If your trading method is already giving you good results TTT will help you eliminate some of your loosing trades and get more out of your winners. It may also find some trades that you would not have taken.

Today was a Sell day. TTT levels kept markets from going higher during the overnight session and ES reversed and tested the Buy day low. MTP gave us 2 chances to get in at that low. We also had divergence to confirm.

So far this trade is turning out very nice.

We had TTT level at 812.21 which nailed the low we had 50% retracement from the 775.50 lows on 24hr chart at 811.75 and the TS4 88% extension at 813

Nice cluster to enter trade.

We had TTT level at 812.21 which nailed the low we had 50% retracement from the 775.50 lows on 24hr chart at 811.75 and the TS4 88% extension at 813

Nice cluster to enter trade.

Today is a SS day We knew that we had 83% chance of at least getting back above the Buy day Low during the day session. 831.75 was the 50% retracement of the 802.25 low to the 861.25 high. Also we were at the DP zone of the overnight Low. We also had divergence on the Stochastic.

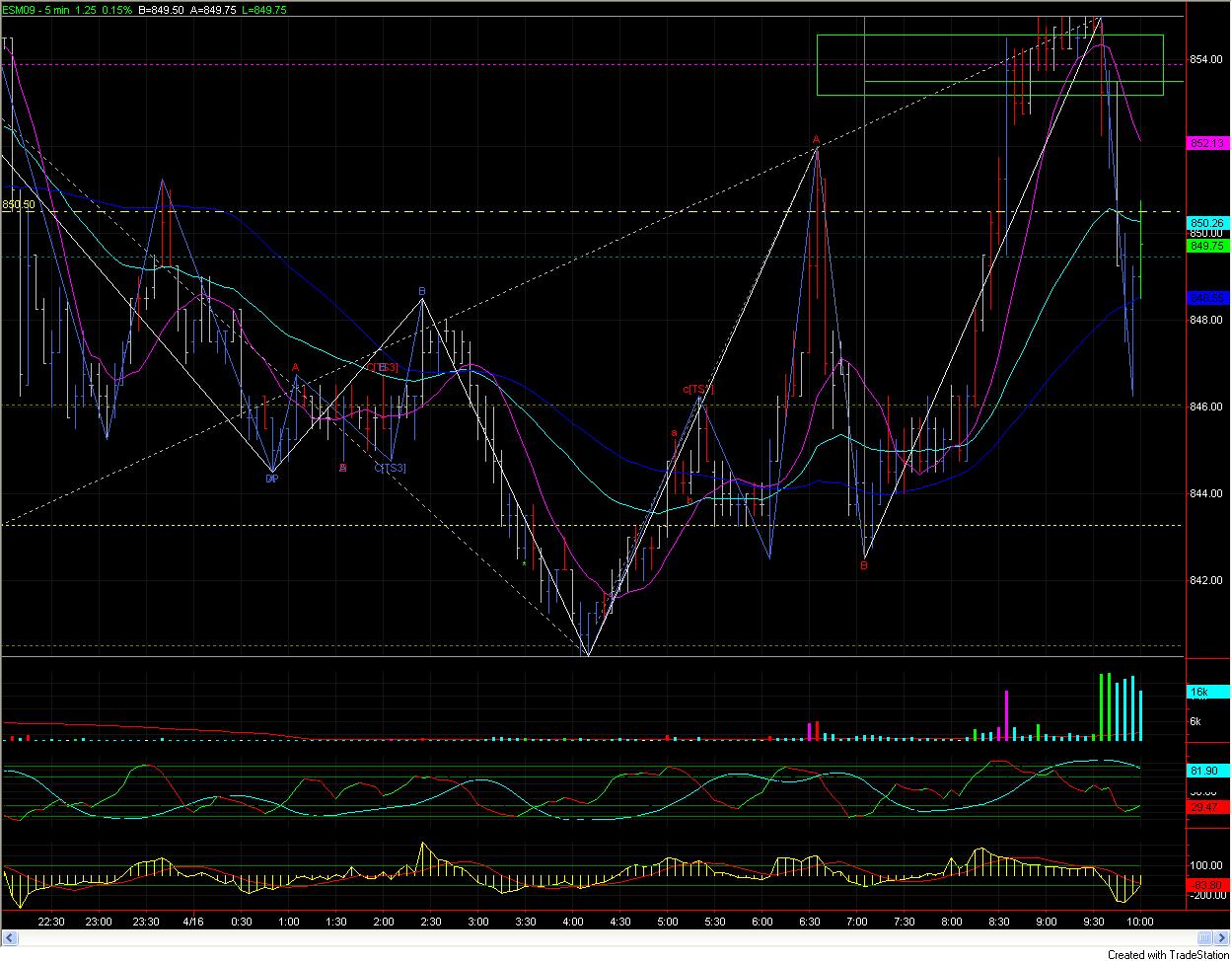

Here is a trade I didn't take even though I had good reason because of the fib cluster and for those of you using MTP there was a DP.

It would have been short from the 854 area.

If I had paid attention to Rich's numbers we had a 95% chance of getting at least a 1 tick decline which would have been 850.25. And knowing that it would have given me enough reason to take the trade.

BTW it was in the premarket session.

Good luck,

It would have been short from the 854 area.

If I had paid attention to Rich's numbers we had a 95% chance of getting at least a 1 tick decline which would have been 850.25. And knowing that it would have given me enough reason to take the trade.

BTW it was in the premarket session.

Good luck,

quote:

Originally posted by jands

Here is a trade I didn't take even though I had good reason because of the fib cluster and for those of you using MTP there was a DP.

It would have been short from the 854 area.

If I had paid attention to Rich's numbers we had a 95% chance of getting at least a 1 tick decline which would have been 850.25. And knowing that it would have given me enough reason to take the trade.

BTW it was in the premarket session.

Good luck,

Jim

As mentioned on page 9 of the Guide to Trading TTT E-Books:

c) If the instrument gaps up at the opening above the Sell Short Day High, the odds are extremely high that this gap will be filled. Therefore Selling Short should be taken into consideration. This has been a rare occurrence in the last year.

So that short was a good one to take

- Page(s):

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.