Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

- Page(s):

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

My mistake, I had input 978 instead of 976 for Monday Buy day in my spreadsheet, as I mentioned previously I do this manually unlike you, only know the basics of Excel.

Still the 3DR average was around 23 and that gave the projected level of 999 after correction from 978 to 976 which the market has hit.

Still the 3DR average was around 23 and that gave the projected level of 999 after correction from 978 to 976 which the market has hit.

26th Aug, Wednesday, back after a small break

Sell day, buy day violation long on ES.

Richbois do you take long only if market opens below BDL or say if opens above and then during the trading day goes below before noon, would you still take a long?

Sell day, buy day violation long on ES.

Richbois do you take long only if market opens below BDL or say if opens above and then during the trading day goes below before noon, would you still take a long?

quote:

Originally posted by rigel

26th Aug, Wednesday, back after a small break

Sell day, buy day violation long on ES.

Richbois do you take long only if market opens below BDL or say if opens above and then during the trading day goes below before noon, would you still take a long?

Both are good to go long on. The reasoning behind that comment is that we know that we have very high odds of a positive 3 day rally and therefor it should get back to the Buy day low at some point by the SS day. So until we make a 3 day rally on the SS day I would be looking for excuse to long if we are below the buy day low

I also feel it is stronger if we are below both Buy day Lows, the Globex and Day session lows

Well today on a SS day the same logic of the 3 day rally is applicable, prices fell below buy day low again, providing a long opportunity once again like yesterday besides the earlier shorting setup.

quote:

Originally posted by rigel

Well today on a SS day the same logic of the 3 day rally is applicable, prices fell below buy day low again, providing a long opportunity once again like yesterday besides the earlier shorting setup.

I didnt look at the European markets but on the US markets, they opened above the Bd Low therefore the Positive 3 day rally clause was Fulfilled.

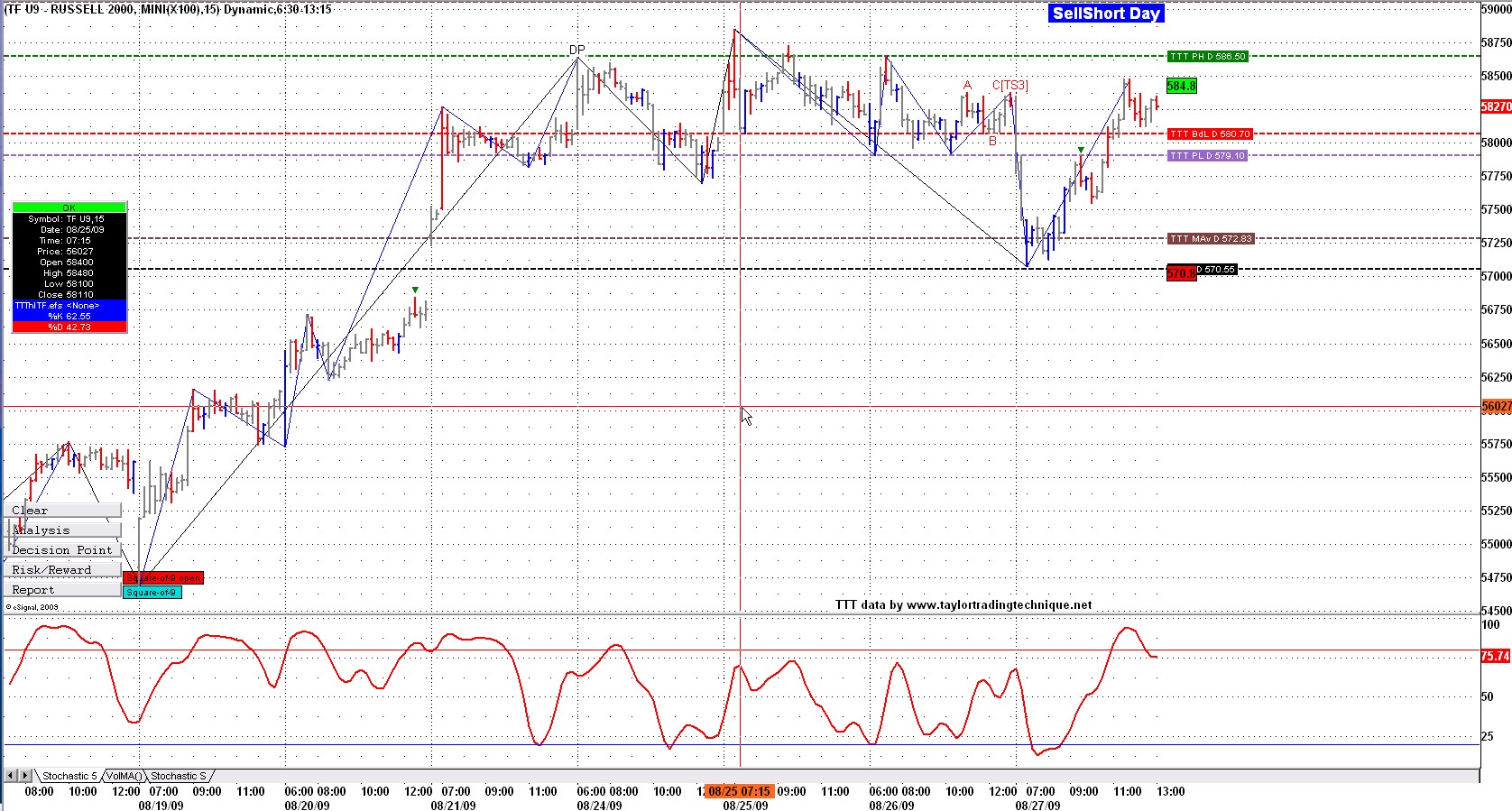

Any longs taken at the lows were not as per Taylor. But if you took these longs your a happy camper now. I know that TF long at the TTT violation levels was pretty rewarding.

would appreciate if you could put a chart of TF, may consider trading that market in future, believe a point is $100, what is the tick worth presume $10.

quote:

Originally posted by rigel

would appreciate if you could put a chart of TF, may consider trading that market in future, believe a point is $100, what is the tick worth presume $10.

yes 10$ / tick 100/ pt

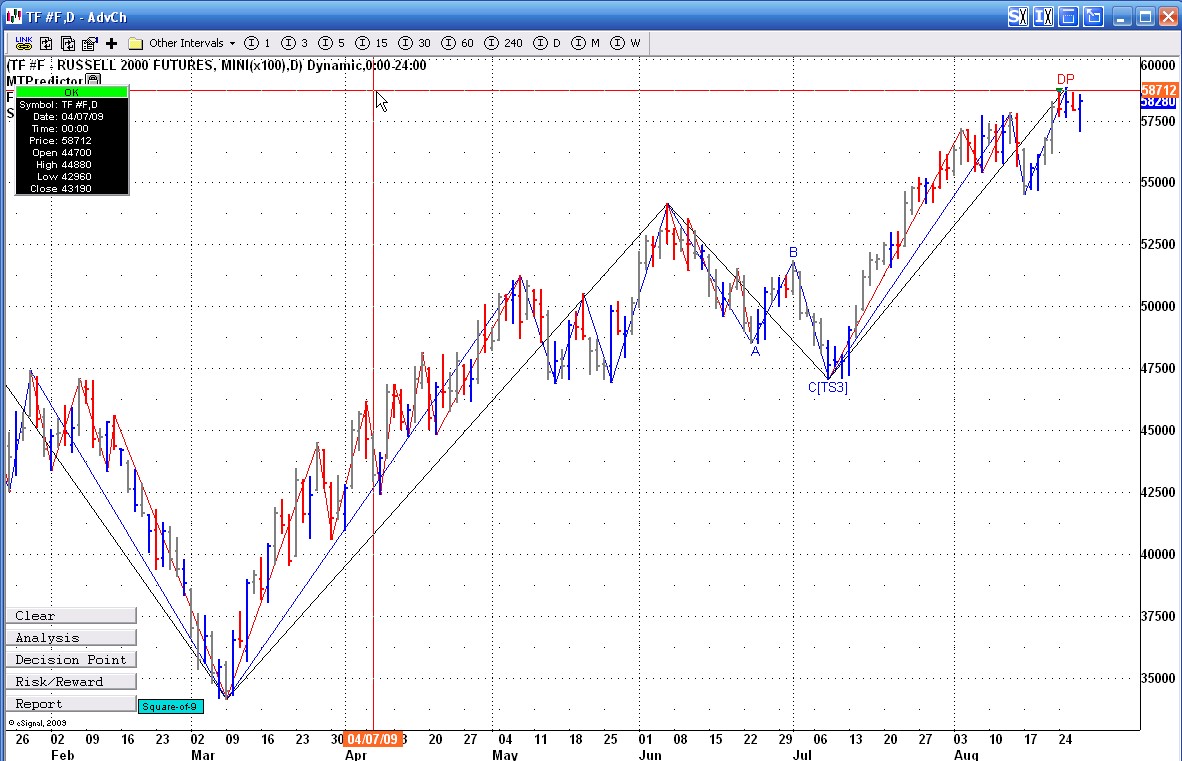

Thanks a bunch for the charts Richbois, will have to get the ICE datafeed and start monitoring this market which has seen considerable rise since March, looks like investment in small company stocks via a mutual fund would have paid off handsomely.

Buy day today, prices reached the 1038 , projected level premarket and reversed.

Projected decline low is 1018

Buy day today, prices reached the 1038 , projected level premarket and reversed.

Projected decline low is 1018

nice call for today rich - you nailed it

- Page(s):

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.