Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

- Page(s):

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

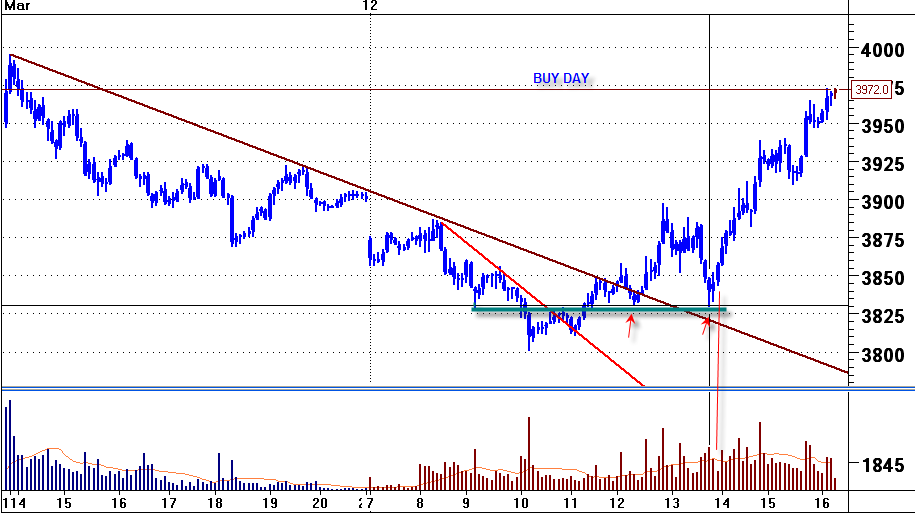

Nice Trade

Well it has indeed turned out to be a Buy day afterall. Shallow decline on ES although prices tests yesterdays low Pre-market.

Rich do you take into account premarket price action in your trading strategy. Markets tend to tip their hands premarket ie. this time failure to penetrate the low.

Rich do you take into account premarket price action in your trading strategy. Markets tend to tip their hands premarket ie. this time failure to penetrate the low.

Hello Everyone,

I appreciate the feedback I received. I got the book today, so as soon as I can read it, I'll give it a go again.

I appreciate the feedback I received. I got the book today, so as soon as I can read it, I'll give it a go again.

quote:

Originally posted by garciaal

Hello Everyone,

I appreciate the feedback I received. I got the book today, so as soon as I can read it, I'll give it a go again.

Good for you. If I may suggest something you may want to just glance through chapter 2-3-4 as for me they must be the most confusing one.

Chapter one explains the concept and 5 to the end is on how to use it.

Good luck

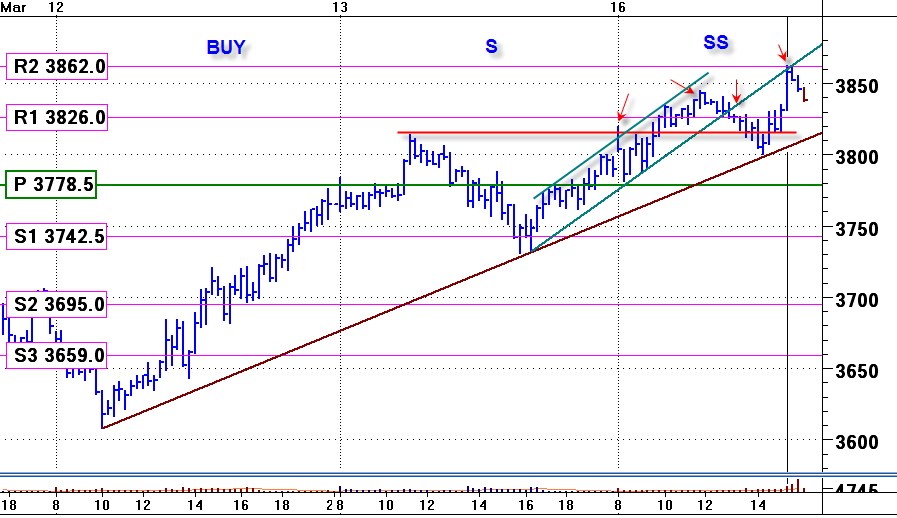

Monday 16th March - Short Sale Day, 90minutes into the market and already a couple of short trading opportunities with reference to daily pivot resistance and also Fridays High.

Would be glad to hear/input from any other traders trading on the European bourses.

Would be glad to hear/input from any other traders trading on the European bourses.

quote:

Originally posted by daxtrader

Monday 16th March - Short Sale Day, 90minutes into the market and already a couple of short trading opportunities with reference to daily pivot resistance and also Fridays High.

Would be glad to hear/input from any other traders trading on the European bourses.

FTSE diverging slightly from Dax and sitting right on its highs now. Have a short order in on breach of past 90 mins trading range but think this is one of these days when we may have to wait for US open

quote:

Originally posted by daxtrader

Well it has indeed turned out to be a Buy day afterall. Shallow decline on ES although prices tests yesterdays low Pre-market.

Rich do you take into account premarket price action in your trading strategy. Markets tend to tip their hands premarket ie. this time failure to penetrate the low.

Sorry Daxtrader I missed to see you asking me a question.

Yes on the US markets we get to see what has happened overnight and very often we will try to test these highs or lows and go from there.

quote:

FTSE diverging slightly from Dax and sitting right on its highs now. Have a short order in on breach of past 90 mins trading range but think this is one of these days when we may have to wait for US open

Thks Richbois, have observed that premarket levels on US markets do influence its behavior on open and also during the session.

Robros, even on Ftse, there were opportunities to short , depending on the timeframe you working from and objective for the trade once you are short. Appears market are in an uptrend coming of the lows, hence the profit targets have to be realistic, in this case first, it would high of the sell day, next would be any uptrend lines you may have plotted on say 15min or 30min charts , thirdly the daily pivots etc.

In the first 90min for example ftse had a 30pt range, if you are fine tuning your entries on smaller timeframe 2min, there is enough room for profit, the end of the move will be dictated by price action which rules over any mechanical considerations

- Page(s):

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.