Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

- Page(s):

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

a person could save him/her self a lot of grief in trying to figure out where the market could be heading if he/she just subcribed to rich's ttt

rich had today, on the es, 699 as low of previous buy day and good odds we would go there or above that level - we hit 699.25 and market sold off

awesome job rich !

rich had today, on the es, 699 as low of previous buy day and good odds we would go there or above that level - we hit 699.25 and market sold off

awesome job rich !

As today is expected to be SS day, would I be right in taking long at the opening to fulfil 3 day positive rally and then go short as prices faltered once the 3day rally criteria was fulfilled.

quote:

Originally posted by simba

As today is expected to be SS day, would I be right in taking long at the opening to fulfil 3 day positive rally and then go short as prices faltered once the 3day rally criteria was fulfilled.

Yes, 700 was also the 50% retracement of the last wave down so that too offered resistance, which helped the reversal. So far only ES made it above the Buy day low, it will be interesting to see if they will give it another go at it for the others to make it.

Rich,

I had subscribed to your nightly email several months back and I could not get my head around the theory. From what I have seen from charts you and others have posted with your new Ninja plugin it seems to be making more sense. I have not read Taylor's book, because from what I have heard others say it is quite confusing ( not written well). I would appreciate anyones feed back. Should I read the book or just go for it with Rich's great info. It still it is fussy what to expect on different days.I'm just trading YM presently. All replies welcome.

Thanks, Al

I had subscribed to your nightly email several months back and I could not get my head around the theory. From what I have seen from charts you and others have posted with your new Ninja plugin it seems to be making more sense. I have not read Taylor's book, because from what I have heard others say it is quite confusing ( not written well). I would appreciate anyones feed back. Should I read the book or just go for it with Rich's great info. It still it is fussy what to expect on different days.I'm just trading YM presently. All replies welcome.

Thanks, Al

quote:

Originally posted by garciaal

Rich,

I had subscribed to your nightly email several months back and I could not get my head around the theory. From what I have seen from charts you and others have posted with your new Ninja plugin it seems to be making more sense. I have not read Taylor's book, because from what I have heard others say it is quite confusing ( not written well). I would appreciate anyones feed back. Should I read the book or just go for it with Rich's great info. It still it is fussy what to expect on different days.I'm just trading YM presently. All replies welcome.

Thanks, Al

Hi Al

I remember you trying TTT but I dont remember if it was before or after I wrote the Guide to Trading TTT E-Books. The Guide is a brief explanation of Taylor's theory combined with explanations on how I apply the principles.

The new Add-On just make it all more visual, as now you can see the support and resistance levels directly on your chart. In the past we had to either draw the lines ourself which took time and concentration to ensure no mistakes slipped in.

Now it take less the 1 minute, on a slow day, to get that done and with no errors, leaving you with only the planning of the next day.

As far as reading Taylor's book, I think it is a good idea to read it. Once you have read the Guide it will make it easier to understand. I would skip chapter 2-3-4 as they are the hardest to understand and relate to how to create your own Trading Book, and I did that work for you with even more features than Taylor did.

Email me if you didnt get the Guide.

You have to study the book to really get to grip with the essential concepts and trading rules IMHO

I would endorse that, the book is essential study, it is not an easy real, infact terrible style of writing, however the real genius of the man comes through once you grasp his methodology designed to exploit the market manipulation that goes on in the market. Then by all means blend it with Fib numbers and TTT levels to enhance your trading.

Rich's great contribution is bringing it all together on a spreadsheet and employing a statistical approach plus the discovery of TVGR and 3 day positive rally effects, these are invaluable.

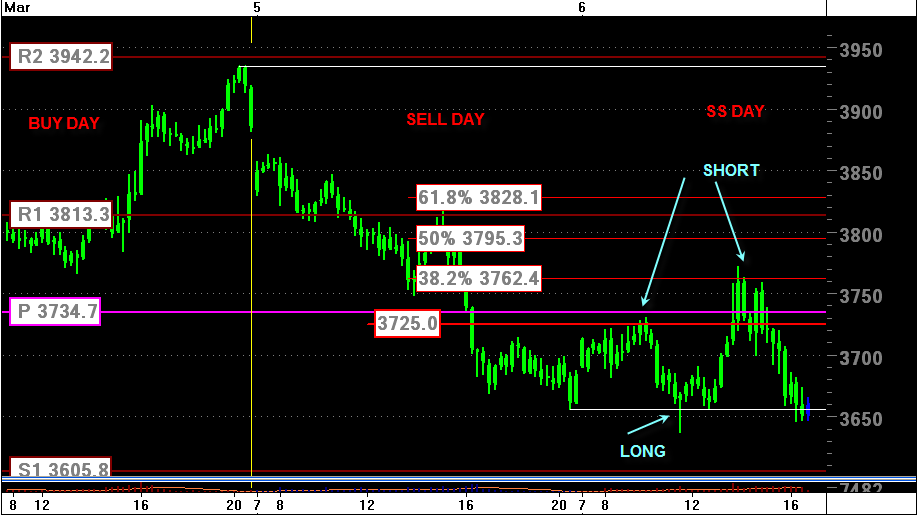

On the Dax we had the Ideal short around 10a.m(London time) and at BUY DAY LOW of 3725 and then again at 3p.m (10a.mEST) at 38.2% fib retracement of previous swing i.e from BUY DAY HIGH to SELL DAY LOW.

There was also a classic price action based long opportunity at 11.30a.m(UK), a perfect bullish dragonfly(15min Chart), ofcourse this is not strictly Taylor as no longs on a SS day.

Rich's great contribution is bringing it all together on a spreadsheet and employing a statistical approach plus the discovery of TVGR and 3 day positive rally effects, these are invaluable.

On the Dax we had the Ideal short around 10a.m(London time) and at BUY DAY LOW of 3725 and then again at 3p.m (10a.mEST) at 38.2% fib retracement of previous swing i.e from BUY DAY HIGH to SELL DAY LOW.

There was also a classic price action based long opportunity at 11.30a.m(UK), a perfect bullish dragonfly(15min Chart), ofcourse this is not strictly Taylor as no longs on a SS day.

quote:

Originally posted by daxtrader

There was also a classic price action based long opportunity at 11.30a.m(UK), a perfect bullish dragonfly(15min Chart), ofcourse this is not strictly Taylor as no longs on a SS day.

I agree that it is not pure Taylor to Long on SS day, however since that trade happened at the open of the US markets and they were below the day session Buy day low, and the DAX is affected by the US markets in the afternoon then we could say that this long was OK based on the Positive 3 day rally theory.

PS DaxTrader you need those TTT lines on your chart

- Page(s):

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.