Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

- Page(s):

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

The Euro bourses have sold off from the open fast,

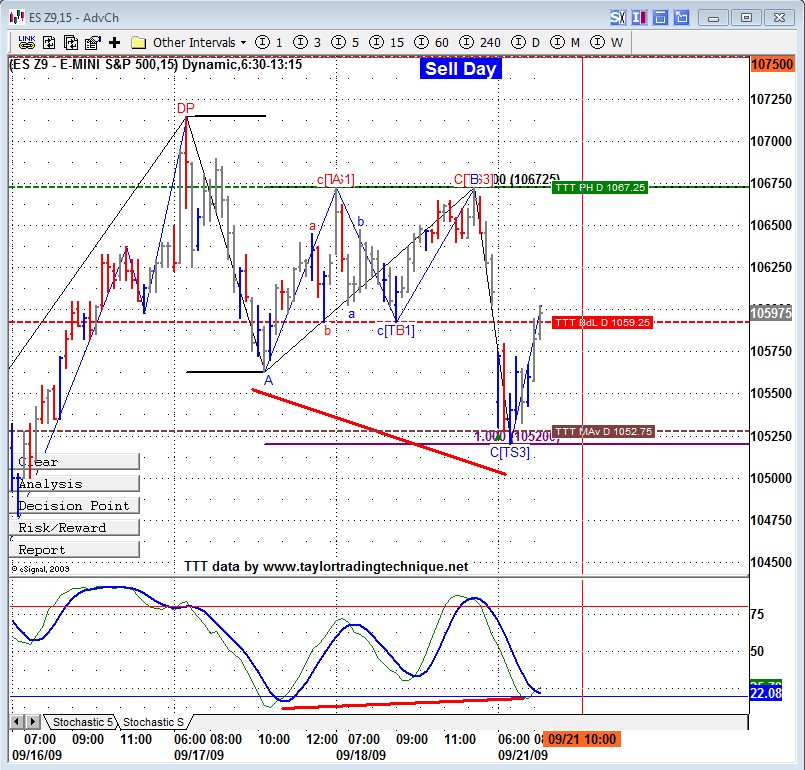

Looks like on S&P, market would open below the Buy Day low today a Sell day providing a long trade opportunity.(not strictly Taylor though)

Looks like on S&P, market would open below the Buy Day low today a Sell day providing a long trade opportunity.(not strictly Taylor though)

Like you said Rigel ES did produce a nice gap down below the Buy day Low and a great opportunity to go long. We also had divergence

ES reached the average violation levels and reversed trying to close the gap and so far got back above the BdL

ES reached the average violation levels and reversed trying to close the gap and so far got back above the BdL

Yes it is amazing how these Taylor's concepts work out each day enabling a trader to get into the right mind set to trade and not have doubts on pulling the trigger. I sure am glad I spent months slogging through the book, now when I revise the chapters with all the notes and highlighted parts, it is a very easy read.(relatively speaking ofcourse:)))

quote:

Originally posted by rigel

Yes it is amazing how these Taylor's concepts work out each day enabling a trader to get into the right mind set to trade and not have doubts on pulling the trigger. I sure am glad I spent months slogging through the book, now when I revise the chapters with all the notes and highlighted parts, it is a very easy read.(relatively speaking ofcourse:)))

Ya relativly speaking

I havent reread the book in so long however having started this service and having to anwser so many questions make it easy to stay focussed on TTT.

BUY DAY, both shorts and longs allowed,

In the morning we had first long and then short opportunities on Euro Indices all before lunch, and in the afternoon (your morning) we have first shorts with a sharp decline prior to longs again before your lunchtime (EST)

Once again hats off to Taylor

In the morning we had first long and then short opportunities on Euro Indices all before lunch, and in the afternoon (your morning) we have first shorts with a sharp decline prior to longs again before your lunchtime (EST)

Once again hats off to Taylor

On Buy day Taylor allowed short only on high made first. So this would not be 'clssic' taylor :) It doesn't mean the move was wrong .. hey money is money :)

quote:

Originally posted by tomo

On Buy day Taylor allowed short only on high made first. So this would not be 'clssic' taylor :) It doesn't mean the move was wrong .. hey money is money :)

Looking at the DAX it did do the high 1st so ok to short till low then reverse.

there was a nice rally even if it came all the way back. but it was a correct play as long as you didnt marry your trade and took the profits.

If it is fast rally on a BUY day before lunch, and if the price action dictates it is o.k to exit, wait for retracement,

However it is also o.k to short but have to again watch if prices are holding to cover in expectation of a rally in the afternoon. I am sure it is all in Taylor.

However it is also o.k to short but have to again watch if prices are holding to cover in expectation of a rally in the afternoon. I am sure it is all in Taylor.

I am not saying one could not short .. just saying that pure Taylor method does not allow to short on Buy Day so late in the session. But today trade would be great .. actually one could think we had a short opp on the open and take few points.

Agreed, no shorts late in the day, but prior to lunch it is o.k as retracements do occur during this period.

Yesterday the late decline was manipulation by smart money related to FOMC news

Today Sell day, great BV longs on Euro bourses, though not strictly Taylor, but Richbois does take those. lets see how US opens.

Yesterday the late decline was manipulation by smart money related to FOMC news

Today Sell day, great BV longs on Euro bourses, though not strictly Taylor, but Richbois does take those. lets see how US opens.

- Page(s):

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.