Day Trading with TTT and other tools

Welcome to this new thread, where we can share trading ideas and our thoughts on the Taylor Trading Technique.

Anyone with questions on TTT, this is the place.

Anyone with questions on TTT, this is the place.

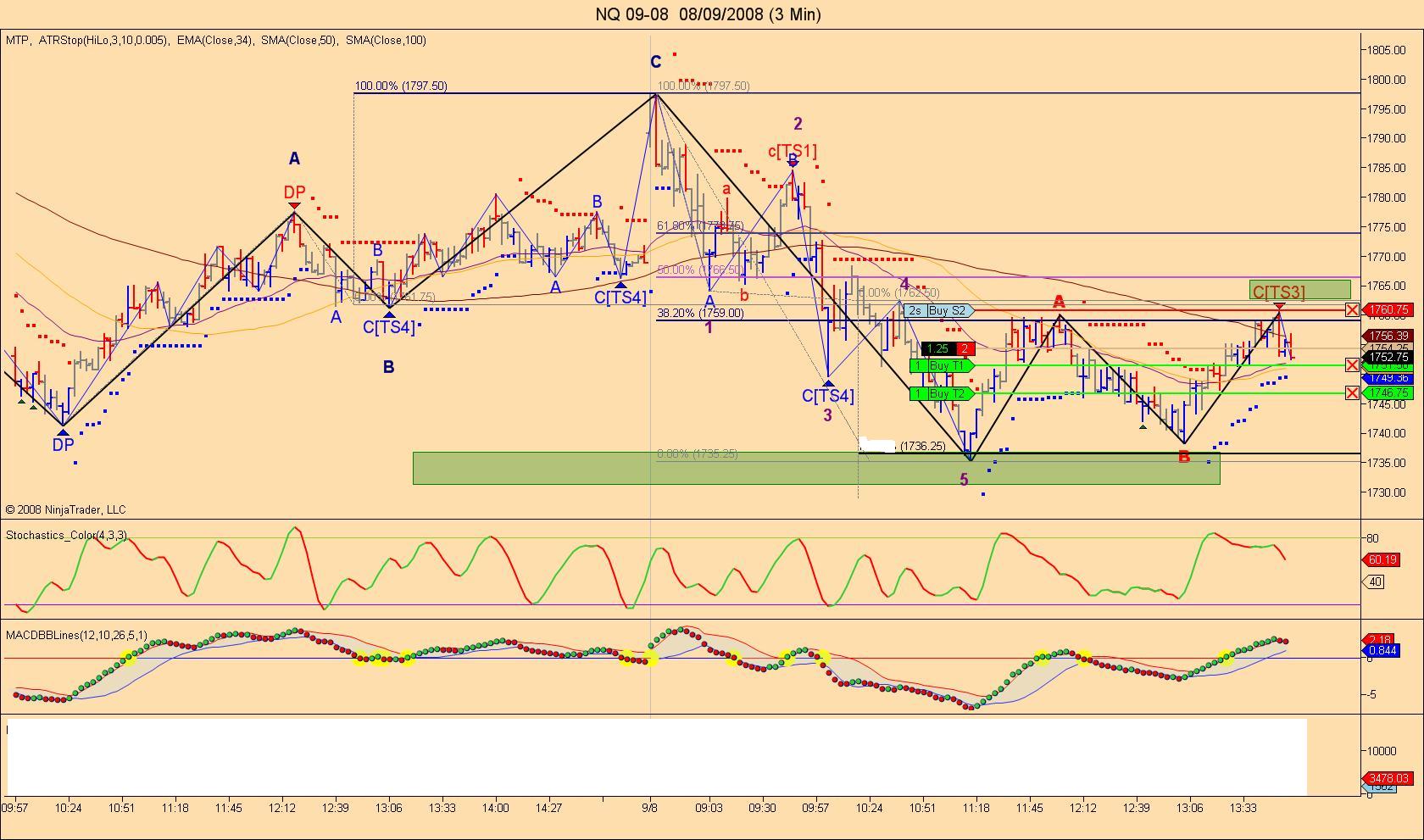

I was only able to sell the NQ and unfortunately forgot to check my box with the number of contract so I only sold 2 instead of 5.

Made money but not enough, that's what happen when you post and daytrade at the same time.

I will post th epic of my trade in a few minutes.

Made money but not enough, that's what happen when you post and daytrade at the same time.

I will post th epic of my trade in a few minutes.

quote:

Originally posted by Larry22

quote:

Originally posted by ddaytrader

If I were a betting man, I'd be selling 1260 ...

hey wait, I guess I am sort of a betting man. Short at 1260 it is

Don't tell me again you're driving with your laptop on your knees and daytrading at the same time as I really can't figure out how you do that.

LOL! Well, I am on my laptop but I'm not driving my truck! Instead, I'm driving my couch watching Thomas the Tank Engine with my my thre year old son.

My usual MO would be to limit out on 1/2 with 10 points at 1250 if we get there and then move my stop to BE on the other 1/2 - given the lateness of the day I'm going to take 1/4 off here at 1255, and I'm lowering my stop from 1260.75 to 1257.25.

quote:

Originally posted by ddaytrader

quote:

Originally posted by Larry22

quote:

Originally posted by ddaytrader

If I were a betting man, I'd be selling 1260 ...

hey wait, I guess I am sort of a betting man. Short at 1260 it is

Don't tell me again you're driving with your laptop on your knees and daytrading at the same time as I really can't figure out how you do that.

LOL! Well, I am on my laptop but I'm not driving my truck! Instead, I'm driving my couch watching Thomas the Tank Engine with my my thre year old son.

My usual MO would be to limit out on 1/2 with 10 points at 1250 if we get there and then move my stop to BE on the other 1/2 - given the lateness of the day I'm going to take 1/4 off here at 1255, and I'm lowering my stop from 1260.75 to 1257.25.

No sooner did I post that than I got stopped out at 1257.25 Result = + 5 points on 1/4 and +2.75 on 3/4, for an average of +3.3125 points per contract traded. I'll take it.

As promised here is a screen shot of my trade I have been filled at my profit target and I am now flat and finally may not regret it after all.

For the moment.

For the moment.

Laurent and Dave thanks for the insights today. Ya'll have a great night.

Jim

Jim

Hi all. Great posts. I hope that more experienced TTT users can post before session how they plan to trade with numbers. That would be very helpfull for new TTT ebook users.

quote:

Originally posted by tomo

Hi all. Great posts. I hope that more experienced TTT users can post before session how they plan to trade with numbers. That would be very helpfull for new TTT ebook users.

Hi tomo what I usually do is try to find Fib projections and retracements that could math with the TTT high or low. Today was a special day as we had a huge gap up that was already over the expected high so I traded accordingly to my longer time frame charts. I did not traded as much as I would have liked as I had problems for more then 30 min before I had to reboot, but overall I'm happy with my trades.

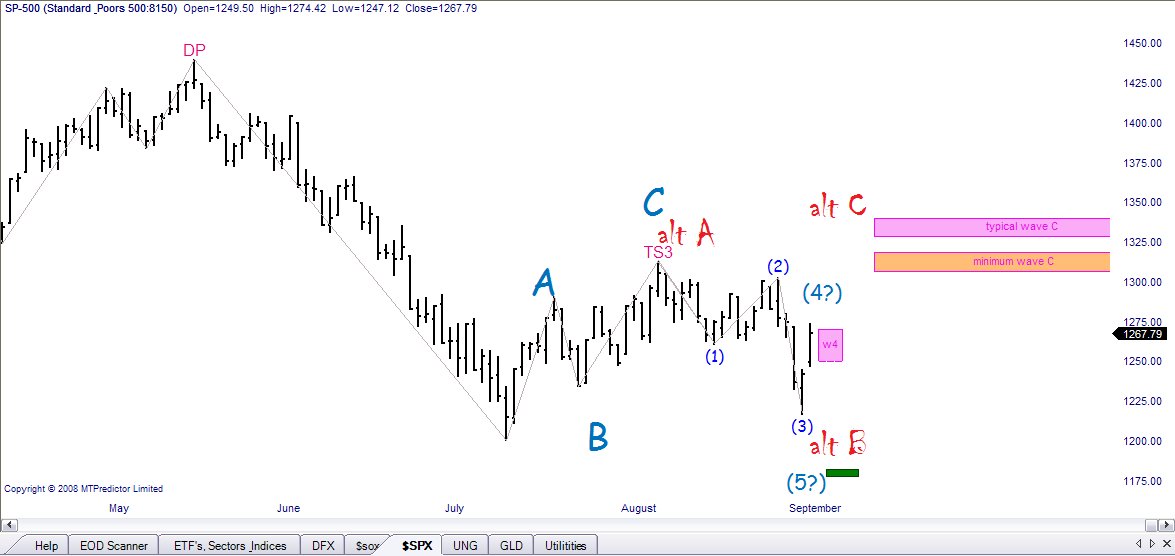

I show two scenarios on the daily SPX, one up, one down (where'd I learn that from ). More accurately, each allow for some sideways backing and filling before resolving in the direction price is going to be taking in the near term.

Looking at the daily $SPX - The immediately bearish count sees the rally off the July low unfolding as an ABC (blue) correction, peaking at 1313 on 8/11 and the price action since being the first 3 waves down of a wave 1 of C. Today's rally peaked a few points above the wave 4 up target, but since the close was within the wave 4 target zone, I cannot invalidate this count. Therefore, we could see a reversal down, or some sideways back and fill for a day or two or three before the wave 5 down to 1178.27-1182.66 (a wave 5 target within a larger 1169-1186 target zone).

The other possibility is that the rally from the July low to the 8/11 high was a Big A (red), with a Big B (red) down ending at 1217, and that we are now in a Big C up. The Big C up (red) has a minimum target of 1306.85-1318.77, though the typical wave C would target 1328.81-1340.10.

Only time and the waves will tell ...

Best Wishes,

ddaytrader

Looking at the daily $SPX - The immediately bearish count sees the rally off the July low unfolding as an ABC (blue) correction, peaking at 1313 on 8/11 and the price action since being the first 3 waves down of a wave 1 of C. Today's rally peaked a few points above the wave 4 up target, but since the close was within the wave 4 target zone, I cannot invalidate this count. Therefore, we could see a reversal down, or some sideways back and fill for a day or two or three before the wave 5 down to 1178.27-1182.66 (a wave 5 target within a larger 1169-1186 target zone).

The other possibility is that the rally from the July low to the 8/11 high was a Big A (red), with a Big B (red) down ending at 1217, and that we are now in a Big C up. The Big C up (red) has a minimum target of 1306.85-1318.77, though the typical wave C would target 1328.81-1340.10.

Only time and the waves will tell ...

Best Wishes,

ddaytrader

Hi Laurent and ddaytrader!

Great stuff here.

Being naturally curious, how did you guys get started day trading? If you don't mind me asking.

Thanks.

Kevin

Great stuff here.

Being naturally curious, how did you guys get started day trading? If you don't mind me asking.

Thanks.

Kevin

quote:

Originally posted by mucis

Hi Laurent and ddaytrader!

Great stuff here.

Being naturally curious, how did you guys get started day trading? If you don't mind me asking.

Thanks.

Kevin

It was either that or Chief Burger Flipper at MickeyDee's - which would have chosen?

- Page(s):

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

I hope all you TTT traders had a good 2014 and I wish you all a better 2015

Richard

Richard

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.